Happy Fri-YAY, y’all! It’s July 4th weekend so happy BBQ-ing, boating, golfing, hiking, sparkling and/or whatever you do to celebrate the holiday of independence – such a great time of year.

We are at halftime of the 2021 season, so we will spend a little time reviewing the first half performance. Any good coach will tell you that halftime adjustments are key to long-term success. To make said adjustments, one must critically assess their first half performance to determine what went right, what went wrong, was it you, was it them, was it the weather, the online trolls or who knows? We tend to spend a lot of time doing such things around here, so we will take a look at a few of those.

All-in-all, it was a fantastic first half. Even more impressive given how positive the 2020 season wrapped up. But as we experienced last year, halves can be very different, so the goal is to not blow the lead or choke under the bright lights. Playing from ahead is definitely the spot to be. Sure, every once in a while, it’s fun to stage an epic comeback and build the drama. Queue the workout montage hype video of you chopping wood in the snow, pulling a dogsled and doing endless pull-ups in the barn. You get knocked around early before prevailing as the late hero (again). Over time though that’s just stressful and draining and nobody needs that. Just like nobody needed Rocky V.

It’s all market-based fun and games in these notes, but the posture of “playing from ahead” is really the essence of financial planning, not investing per se. Less glamorous things like proper budgeting, tax management, insurance protection, and goal setting are what really get it done. They provide a steady foundation so when times are good, they can be embraced as a “bonus” as opposed to “needed” or even worse, “required.” We have all worked on and continue to work on that foundation together so here’s to enjoying the good times.

Looking ahead at the second half, it’s still about the same two things – taper tantrum and taxes, blah blah blah. Does the Fed start the taper? If so, how bad is the tantrum? Do we get tax reform? Is it better or worse than anticipated? You get it. These issues will definitely provide some short-term market direction, but the longer they are debated, the more muted the move will be. These are reasons to be cautiously optimistic about the second half. Rates are back at the bottom, job creation is strong and inflation has remained in check. So, if strong returns continue, great. If not, we know it’s not “required.”

For those checking out here, everyone at High Note wishes you an enjoyable 4th of July weekend. We are excited to play the second half of the season with you. All the best.

<<< HIGH NOTE QUICK HITS >>>

You’re Either First or Last

Looking at the winners and losers of the individual stocks we hold in the portfolio is interesting. Here are the leaders in the clubhouse…

Kind of an odd mix here you could say with old tech, new tech, biomed, retail, and banking leading the way. Not a lot of correlation among these names which tells us it’s been more about the individual companies than broader sectors or themes.

The “losers” are also a mix. Given that Amazon and Apple both made monster moves up last year, it’s not surprising to see them chilling out this year. Still, 5.41% and 3.78% returns for half a year isphenomenal so it’s kind of hilarious to see them on the “losers” list.

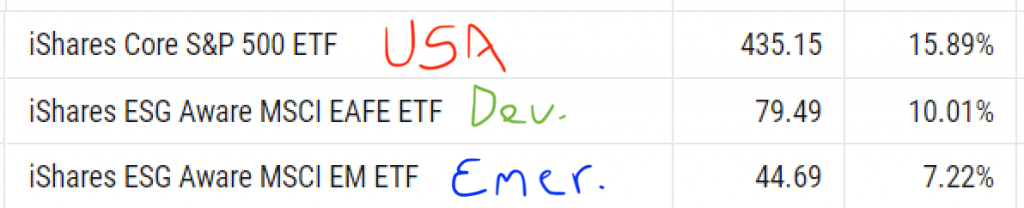

The recovery has somewhat felt like it is only taking place in the U.S., but our international holdings posted strong in May and June to put up solid numbers as well. The middle return is considered “international developed” which is comprised mainly of Europe and Japan. The bottom position is “emerging markets” which include China, India, Brazil, etc.

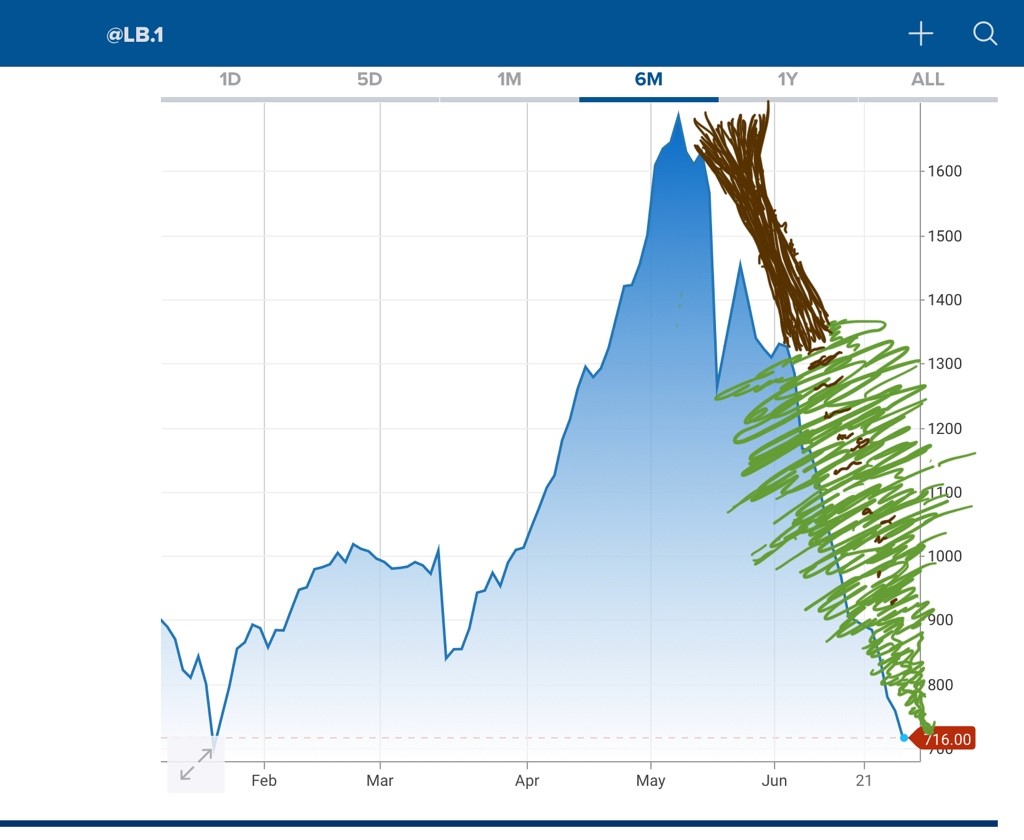

TIM-Burrrrrrrrrr…

Peak lumber prices are so yesterday. After a record-breaking run-up, the commodity is now down 60% from the highs it made in May (down 42% in June alone). The chart looks something like this…

In addition to making for a fun story, the precipitous drop does provide some evidence that the overall inflation concern is, in fact, “transitory”. Well played, Federal Reserve.

The GameStonk Epilogue

The GameStop Reddit Trade (Meme Stock Rebellion?) has continued to be a story throughout the year (if you need a refresher, here). At the epicenter of the mess was the ironically named trading app and broker du jour, Robinhood. After months of investigation, the Financial Industry Regulatory Agency (FINRA) has weighed in, and let’s just say they weren’t impressed. On Thursday, FINRA bombed Sherwood Forest by levying the biggest fine they ever have. Robinhood is ordered to pay $70M in fines and restitution. Is justice served to those who were locked out of selling at the peak? Probably not. It’s a drop in the bucket for the Prince of Thieves. But lessons have certainly been learned. Hedge funds that make a living shorting stocks are treading carefully to avoid the ire of the keyboard warriors. The Reddit crew continues to organize and attack companies that are getting picked on by short-sellers so another similar situation is always on the horizon.

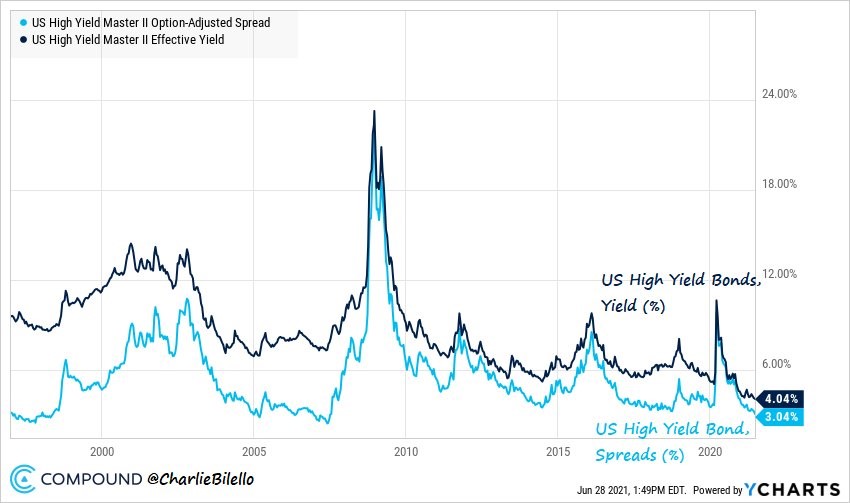

One’s Trash Is Another One’s Lower-Yielding-Higher-Risk Treasure

U.S. high-yield bonds, also known as junk bonds, are basically at all-time lows. Also, the rate difference between quality and junk is close to the bottom (this is known as the spread). Overall, this signals a reduction of risk in the system – as in, investors see very little chance of default on interest payments. This picture adds to the narrative that the setup up for the second half of the year looks promising. That said, just back up on the timeline and you can see things can change dramatically and fast.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.