Happy Mon-YAY “fools”; Friday was April 1st. There’s enough silliness taking place at the highest levels of governments and corporations worldwide that we decided to spare you the attempt at parody. As you well know, some of the things written here in the past sound more like April Fool’s jokes than reality so we left Friday for the retailers to send funny emails.

If you happened across any financial news in the last two weeks, you certainly heard some version of the word “inversion”. It’s so hot right now that all the talk in the nightclubs and discos is “yield curve inversion”. You just say it, and shazam, everything in global investing is explained. The best part is you don’t even have to know what it means.

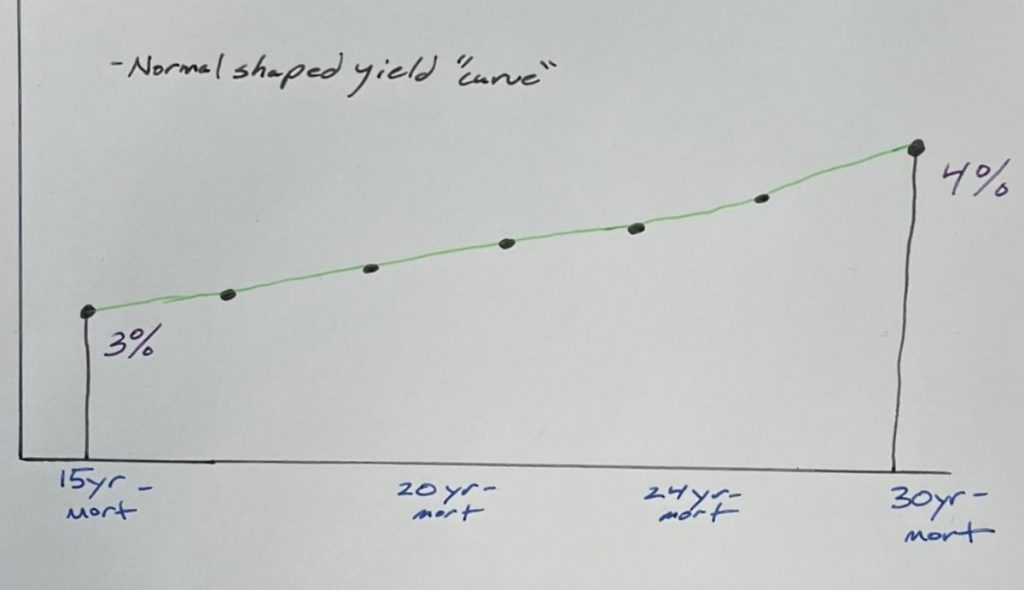

For the few people left not mic-dropping the phrase at dinner parties, we will do an explainer. Before we get to the “inversion” part we need to grasp the concept of the “yield curve”. Mortgage rates are often a nice place to start. Under normal circumstances, a 15-year mortgage has a lower interest rate than a 30- year. Pretty straightforward as when borrowing for a shorter time period we get a discount because the bank gets their money back faster.

Under that principle, if we were to tell the bank we wanted a 23-year mortgage we would…get laughed out of the joint. However, in our hypothetical example here, we can assume the rate would be somewhere between the 15-year and 30- year. Same for a 17-year or a 26-year. So, the years would all have their unique rates. If we then plotted those rates on paper, we would have a line that moves gradually to the up and right. In this vision, it sure sounds like a straight line but the financial term is “curve” (don’t ask). Like this…

So that’s a “normal” yield curve (our attempts to get “verted yield curve” to catch on have been unsuccessful to this point). This normal structure keeps the capitalist world moving. If you want money for longer, it’s going to cost you. Or if you are willing to give the bank your money for longer, they will give you a better rate on a CD. It’s logical and makes sense. Now we break things.

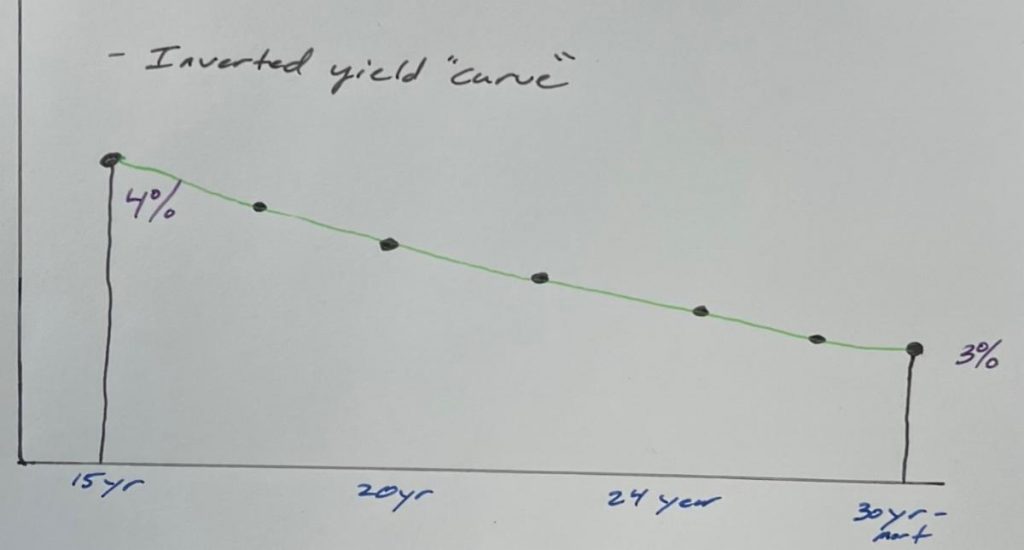

To invert the curve, we make the rate of the 15-year higher than the 30- year. WHAT. That would never happen, right? Well, for mortgages not really but just follow the concept. The 15-year rate is now the highest and it moves down the 30-year. Like this…

To make sense of this inverted world, let’s put on our best formal business attire and put ourselves in the shoes of the lender. In this dynamic, the lender feels like the time is now to make money. They look at the future and they don’t like what they see. They don’t want their money back quickly because they would rather you just keep making payments. They don’t want to have to reinvest the money at year 15 so they will discount the rate to extend it to 30 years. Or put another way, they are going to pay you less interest for a longer CD because they want you to take your money back. Strange world.

What this Jedi-mind-bending-rate-trick just described is recession. Simply put, in a recession, things are worth more today than they will be tomorrow. Whoa.

Okay, let’s end the mind games and bring it back to today. In the world of investing, the go-to yield curve is the 2-yr and 10-year rates (like our 15 and 30- year mortgages). Under normal circumstances, the 2-yr is lower than the 10-year. However, before every recession on record in the US, the yield curve has “inverted” pushing the 2-yr higher than the 10-yr. Which is not the same as saying that every time the yield curve inverts, a recession has followed. Make sense? Anyone even paying attention at this point? If you are, and we don’t blame you if you aren’t, here’s the rub.

The 2-yr/10-yr yield curve is right on the border of inverting (long story when it comes to when we can say with certainty that has inverted). This leads to speculation about a pending recession and that’s a topic that grabs headlines not just because markets can be “blah” in a recession, but it causes fallout for employment, wages and you guessed it, politicians.

Fortunately, recession or not really matters little to us as investors (we don’t have to make 15 or 30-year commitments is one reason). And as we’ve been writing since the middle of last year, there’s been a cooling off in various parts of the market. Whether the official recession label gets applied has little bearing as there is always a path through. However, if the R-word is in the zeitgeist come this fall, the politicians running mid-term elections will wish it was April Fool’s Day.

High Note Quick Hits

Boeing’s Little Black Box

On March 21st a Boeing-made commercial airliner crashed in China. The tragedy resulted in no survivors and the investigative report is still pending. The timing is horribly ironic given that in March, Netflix added a new documentary called, “Downfall: The Case Against Boeing”. The title spoils the ending but it’s worth watching, particularly given the recent loss. The film takes viewers through the events surrounding the 737 MAX crashes of Lion Air and Ethiopian Air in 2018-19. Lots of questions are raised about Boeing’s handling of the incidents but it also raises some eyebrows about the role of the FAA.

The interplay between a dominant manufacturer and a regulating body can always leave one feeling a little…uncomfortable. This is that and then some. The final report out of China will hopefully provide some answers. In the meantime, the doc will catch you up to speed on everything from the last goaround.