Happy Satur-YAY, fam! We hope everyone’s June is going well. It’s hard to beat sunny summer days. We’ll spare you the seasonal stock market analogy and get right to it.

The year of market volatility continues in both the stock and bond markets as we reach halftime. All the traditional characteristics of bear markets are present: increased volatility, sharp positive rallies and significant selling pressure almost every day. The discussions of a potential recession are dominating the financial zeitgeist but that’s all speculation. Whether a recession is imminent matters little to us as it is simply defined as two consecutive quarters of negative growth. That’s not helpful. What’s more important is how long it may last and how severe it will be?

Formal definition aside, it certainly feels as though the recession is here as seen by smoking hot inflation, reduced asset prices and interest rates moving up aggressively. Last week, both Elon Musk and JP Morgan CEO, Jamie Dimon, made statements along the same lines. We have started to see corporate rumblings of layoffs and forward guidance pulling back. We expect to hear more of this in the coming months.

This week the Federal Reserve made its biggest move since 1994 by taking interest rates up by 75bps after saying a hike that big was off the table just 30 days prior. Chair Powell also hinted that the unemployment rate is below expectations (read: too low). Clearly, they feel behind the problem and are trying to catch up. We wish them luck with that (read: no chance).

The good news in all this bad news is that most of the prices have already corrected. In this order, the correction has come over the last nine months for stay-at-home stocks >>> cloud-computing stocks >>> NFTs >>> Crypto Pt.1 >>> SPACS (IPOs) >>> private equity >>> NASDAQ >>> FAANG (Facebook, Apple, Amazon, Netflix, Google) and now >>> Crypto Pt.2. What’s left? Well, for the most part, energy and health care have been spared along with a very big piece of the puzzle, residential real estate, so let’s hit that quickly.

The interest rate effect on home prices is far greater than most of what we are hearing, or many would like to admit. We’ve been the “boy who cried wolf” for the last year which – we get it – is annoying. A look at the quick math below paints a better picture than the words ever could:

A $600,000 house with a 3%, 30-year mortgage is roughly $2,000 of principal and interest per month. Take the mortgage rate to 6% and the payment goes to $2,900. Go up to 7% and it’s all the way to $3,200. The extra $1,200 per month or $14,400 per year after-tax is a significant number but if we look at it in a different way, it’s even more jarring. To keep the principal payment around the $2,000 per month mark we started with, we would need to take the price of the house from $600,000 to $385,000. That’s a big, big drop. That means, either the buyer’s payment goes up by 60% or the seller’s price drops by 36% and we all know who can better accommodate the difference (hint: not the buyer).

30-year rates reached close to 6.5% early in the week before dipping down closer to 6% but this is early, early in the game. Based on what we saw from the Fed rate hike and the continued inflation numbers, they will need to go higher and with that, real estate prices must come down. We are starting to see the signs with mortgage applications down, building permits down and real estate companies like Redfin and Compass announcing layoffs. Ideally, the prices will move down in an orderly manner while employment is still very strong. We witnessed the orderly reset in the other asset classes, so the hope is that we will see the same as abrupt changes in housing prices can cause lots of issues. We will be watching this along with everything else.

If there is anything to take away from this, it’s that recession is most likely here, many asset classes have been reset, real estate still needs to happen and then the rebuild can start. We can try to wish it away or take advantage of the opportunities it presents so we’ll focus on the latter. We have a couple more things below but otherwise, that’s it for this week. We appreciate you. Thank you for the support and trust. All the best.

High Note Quick Hits

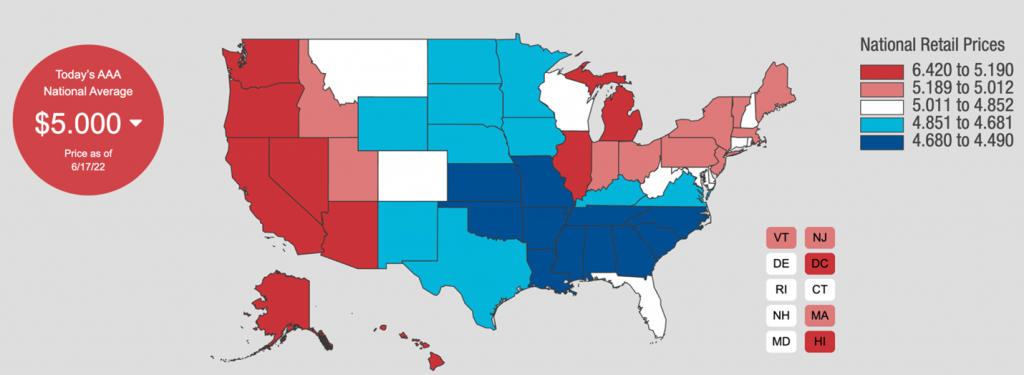

Freedom Isn’t Free; It’s $6 per Gallon

Already setting records for the highest national gas prices, there is seemingly very little relief in sight – the war in Ukraine is still raging, production is capped, and China’s demand should be picking up significantly as they get on the other side of their recent lockdowns. A $6 per gallon average looks very likely by the 4th of July and $7 is within the range of outcomes. Yikes.

The Golden Rocking Chair

As you’ve most likely heard us talk about before, retirement isn’t easy for some. It seems like the mystical oasis on the horizon that we are all striving for but it’s not uncommon for those that reach the proverbial “rocking chair” to struggle with purpose, drive and even health. Because of this we always try to talk about “what’s next” when we are building financial plans. Luckily, there are a lot of options like consulting, volunteering, and immersive hobbies but those don’t always just fall into place with ease. It can take a little work and a little experimenting to determine what’s a good fit, so we recommend giving thought to this early and often. If you are short on ideas, give us a call and let us help brainstorm. Interested in finance and want to be a senior intern at High Note? Give us a shout. Anything is possible.

CNBC wrote an article about a gentleman who started a coaching business around this topic. Article is here.