Happy Fri-YAY, all! Hopefully everyone has their Halloween costume pressed and ready to go for the weekend. May your Spooky Season be merry and bright.

As 2022 winds down, the financial markets are asking more questions than providing answers. The biggest of which is on the topic of recession that can be asked in a multitude of annoying ways such as: Are we going into recession? Are we in recession? How bad will the recession be? Will the recession ever end? Does the recession have an Instagram page, etc.?

The answers to these questions are obviously unknown but also less important than we probably think. The fact of the matter is that the stock and bond markets have already been acting as if we are in a recession which is more relevant. The overall pattern of the last six months remains intact – stocks are range bound (up and down, yes, but mainly moving sideways), interest rates are going higher, and inflation continues to burn hot. It’s this last item that brings us to the Federal Reserve.

It’s good to remember the official mandate of the Federal Overlords: to control inflation. While this has been a task that has felt like it was on autopilot the last 40 years, it is a vital role. If you find you yourself asking why it’s so important, imagine a scenario where everything in the grocery store increases as much as it has in the last year for four more years. We are talking $10 boxes of Fruit Loops which is a tough scene for many.

The mechanics of how they control inflation is deeper than we need to go but the simplistic version is this…when everyone is employed and has money, they buy stuff (lots of it) – lots of people buying lots of stuff creates strong demand – strong demand causes prices to go up – to reduce demand we need people buying less stuff – people without jobs and less money buy less stuff. Therefore, we need less jobs and less money.

To achieve this goal, the Fed continues the path of increasing rates and reducing money supply. Essentially, they ARE the recession. Dress it up and call it a “slowdown” or “shallow recession” but the reality is that they are intentionally trying to cool down the economy. This then begs the most important question of the day which is, “how far will they go”? In the past, they have gone way too far and that’s the most likely outcome again this time. This is partially because the data to determine such things isn’t exactly real time, so it is hard for them to gauge, but there is something larger at play and that’s the $10 box of Fruit Loops scenario above.

For those reading this, increased costs at the grocery store are maybe annoying but we will all get by. But the Fed would view it as a complete and total catastrophe. They know that if basic costs of living double over a couple of years, then wages would need to double and that’s not going to happen. So, they are going to do everything and anything they can to cool down inflation because putting the country into recession is a preferred outcome to letting inflation continue.

As we remain in this environment of the Fed doing all they can to stop inflation, these conditions will remain. That doesn’t necessarily mean that markets will go down further, or things will get worse. In fact, there are plenty of investments that are working quite well right now. But reasons to be excited about growth and economic expansion are off the table until the Fed logs out. In the meantime, the investment strategy is to continue to be positioned in the things that are working and not hoping or trying to predict that it’s all going to turn around quickly.

That’s where we will leave it for this week! We do have a few more things below including a fun piece by editor Shaun, on THE topic of the season – Social Security. We hope everyone has a fantastic weekend. Don’t hesitate to let us know if we can help.

High Note Quick Hits

Shaun’s Social Security Snippet (SSSS)

♫ SEE OH ELL AY, CO…LA ♫

We saw a positive spin on the inflation discussion this month when the Social Security Administration announced the highest cost-of-living adjustment (COLA) in 40 years. While it’s not the double digit increase projected in July, the number came in at a whopping 8.7%. The last time the annual COLA was higher was in 1981 at 11.2%. It’s not news to anyone at this point that costs have gone up substantially in 2022, but this is great news for older Americans and tops the already substantial 5.9% increase beneficiaries saw last year. All social security beneficiaries aged 62 or older benefit from the increase so the annual cost-of-living adjustment should not influence your decision on when to start benefits. How the increase will affect each individual will differ and depend on multiple factors. As always, we are here to help and happy to discuss in detail how this affects your plan.

Bulled-Up and Beared-Down

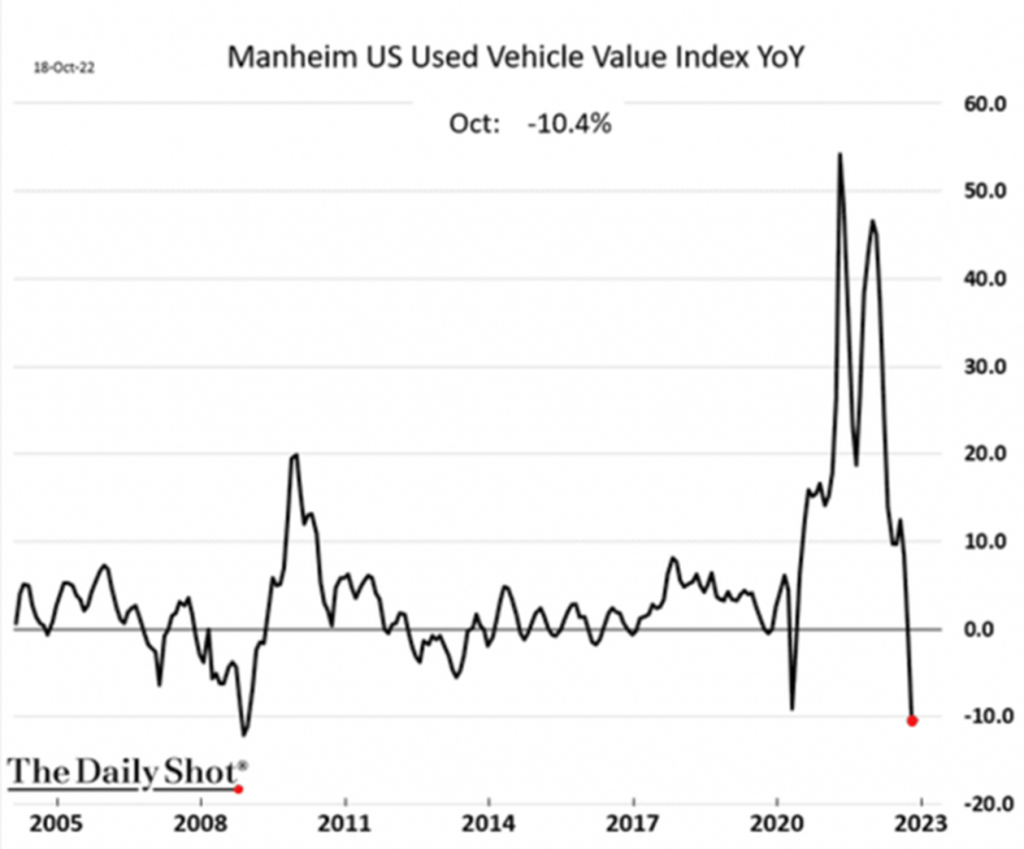

Part of the problem with tracking inflation and then trying to control it is that it pops up in different places so you end up playing a game of Whack-A-Mole that leaves you frustrated and dizzy. We are finally starting to see a few metrics that have cooled off. The first chart below is the price of shipping containers from Shanghai to Los Angeles which got to ABSURD levels a year ago (and this is a very important import route). Prices have finally come down. The second chart is the average price of used vehicles in the U.S. which went down after a big run up. Again, part of the problem with inflation is it’s not one thing we can look at to say it’s over but it’s good to see a few of these things coming back into line.

Housing Market Mush

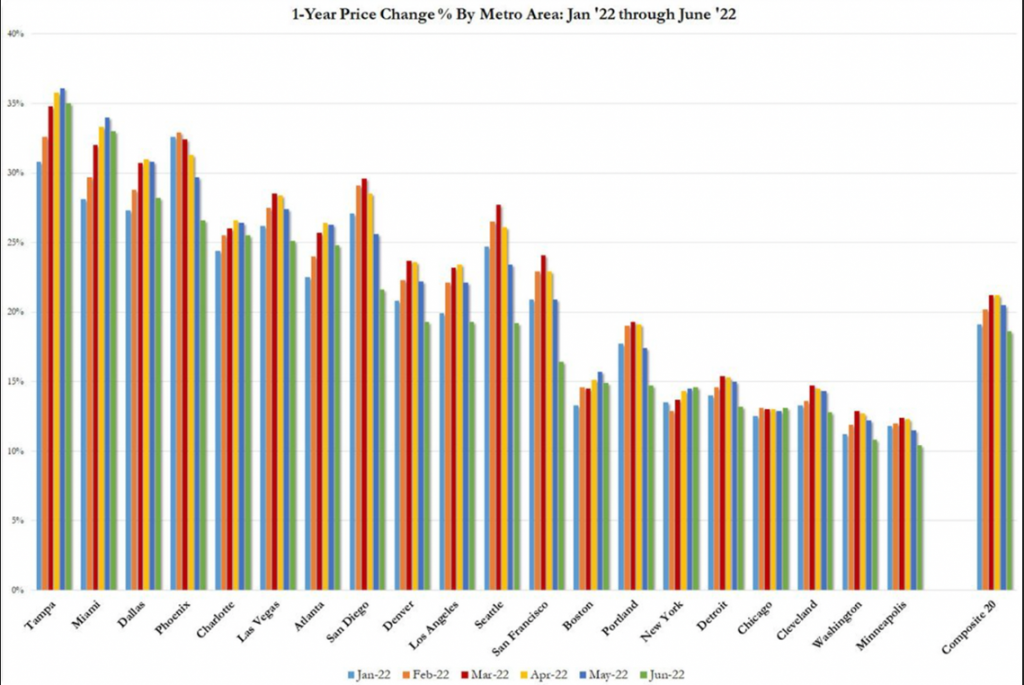

As homeowners, we don’t want price decreases, but we NEED IT. The cost-of-living calculation for the majority of Americans is vital to the long-term viability of the economy. Over the last couple of years the prices of single-family homes have increased at unsustainable levels. Those increases then filter down to rents and everything is expensive. Increased allocation of dollars to housing leaves less to spend on goods and services and blah blah blah, yada yada yada. You get it. So, there are a couple of ways this can go – the easy way and the hard way. The easy way is a gentle, orderly, and consistent sagging of prices one month at time. Not exactly fun, but we can work around it. The hard way is a calamity like we had in 2008. Yuck. In addition to creating a housing mess, a shock like this can cause second order effects that are bad for everything. This isn’t ideal. The good news is that we are seeing some signs of the “easy way” playing out. The chart below is the price change by city and it’s slightly lower from peak almost everywhere. There needs to be additional correction but at least the trend is negative (which is positive!).

Rates are obviously a contributing factor. 30-year mortgage rates settled over 7% this week. Will we see 8%? It’s definitely in the potential range of outcomes at this point. When rates are this high, prices have to adjust down – it’s just math.