Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Whew. So much going on since our last note. We will try to keep this categorized and concise since the volume of information is staggering. We’ll start with a quick level-set as it can be hard to track exactly where the markets are at today when the headlines most days are “record drop”, etc. At market close, the S&P 500 is valued at 2432. Yes, we are down substantially from the all-time highs made in February of this year. However, let me offer this: we are .42% above the lows we reached on Christmas Eve of 2018. Given the hysteria and panic in the market caused by the pandemic, this could certainly be worse. Where we go from here is paramount, so we are focusing our energy on analyzing the various possibilities.

One thing seems very clear and that is that the world is changing very rapidly. Whether it’s how we approach social gatherings, companies’ thoughts on working from home, our interaction with technology or how we shop and feed ourselves; dynamic shifts are occurring. We expect these themes to continue even once things return to “normal”. As investors, we know that industry has a way of adapting quickly to these changes, so there will certainly be some winners and losers on the other side.

Before we get into the details below, we want to mention that we fully expect the sharp day-to-day and intraday volatility to continue. Just as we are processing the endless amount of news cycle information and distilling it down, the market is doing the same. I sound like a broken record but it’s worth repeating – the market likes bad news better than no news. I do not say this flippantly, but we need more bad news – more cases reported (because tests are happening), more companies struggling with cash (so we know who they are) and more jobless claims (so we know who needs help). One of the main reasons that we say that we cannot ever call the bottom is that bottoms occur when the news flow gets so bad that the market no longer responds. Like a defiant child told to eat their greens, the market pushes its plate away and moves on with its day.

To highlight this, take a look at the Wall Street Journal article from March 9, 2009 titled, “Dow 5000? There’s a case for it.” On this random Monday, the Dow was trading below 7,000 after reaching highs of 14,000 in the fall. The article made a case using valuations from previous meltdowns that another 28% leg down was a real possibility. There was no good news. What’s perfectly clear in hindsight is that this was the day that the financial crisis bottomed and launched the greatest bull run in stock market history.

Below are a few pieces on the various components of this unfolding narrative. If you have any questions about any of these topics or anything else, please reach out to us as we are more than happy to discuss.

CORONA VIRUS UPDATE:

Long story short is that most of the U.S. is taking the spread very seriously and things are finally moving. What could or should have been done or when it was done is moot in this moment (we will stick to the facts). There still seems to be disconnect on where the tests are coming from and why there are not enough.

- Washington State’s statistics are showing a slowdown of positive tests with testing numbers remaining the same – appears that the Korea model of contain and test is making headway.

- New York reported another 1,100 positive cases today which means many tests are happening.

- China has reported zero new cases in the virus center the past two days.

- Italy is still in very bad shape. Today they surpassed China in deaths from the virus – tragic.

CORPORATE RESPONSE – SOME GOOD NEWS:

Corporate America is trying to pitch in. Here are a couple though there are many more.

- Facebook is giving all 45,000 employees $1k. They are also doing free ads for local businesses.

- Many Fortune 500 companies are suspending dividends and buybacks.

- Nike is giving $15M, JP Morgan $50M and Bank of America $100M to support organizations.

THINGS WE ARE DOING:

Our overall all strategy is very much intact. We are doing everything with caution, loss harvesting where relevant, tilting sectors (technology and healthcare) and putting a little cash to work on down days.

- Of note, only twelve of the S&P 500 stocks are up year-to-date (we hold two of them).

- We have reduced corporate bond risk with potential for credit downgrades being high.

GOVERNMENT RESPONSE:

- Word today is that they are close to getting the relief bill passed. This will provide direct cash relief to citizens. More details coming, but it sounds like the rumored $1,000 per person and $500 per child will be the numbers.

- European Central Bank announced $750B in funds for market liquidity. The U.S. has been working on this for weeks now.

FEDERAL RESERVE RESPONSE:

- Perhaps you’ve heard that the Fed is trying to “fix the plumbing” of the bond market. Without getting too lost in the details, what they are doing is providing an incredible amount of liquidity to specific segments of the market, so that things can keep flowing. The most recent move was to provide liquidity to back up money markets which is very important. As huge institutions move these massive positions, the pricing can get out of whack if there isn’t proper liquidity.

MORTGAGE RATES:

- Those that are tracking have noticed that rates have gone up this week. This is directly related to the point above. Rates are higher because there has been a backup of mortgage-backed securities. When rates dropped down, there was a rush to refinance. Banks were overwhelmed in getting the loans together, packaged and sold to free up their books to write more loans. When this happens, rates go up to slow down the frenzy. These current rates don’t necessarily reflect where they should be today as the liquidity is needed to keep things moving. I suspect we will see rates coming back down shortly.

INFORATION BY GRAPH AND PICTURES:

Secretary Mnuchin (whether right or wrong) is on a mission to unleash the full financial power of the U.S. Government. He’s already committed a lot of capital but we expect this to continue.

Precious metals continue to fail as a hedge. I guess if you’ve read this far you can handle this…in the past when asked about gold as a hedge I have responded, “if you want a gold brick to carry with you in case you need to hit a zombie over the head in the apocalypse, fine…but it’s not going to hedge your investments in bull markets.” 😊

Referenced below, the Fed did provide liquidity to ensure money market stability. This is was an issue in the financial crisis, so they wanted to get ahead of it before it became an issue.

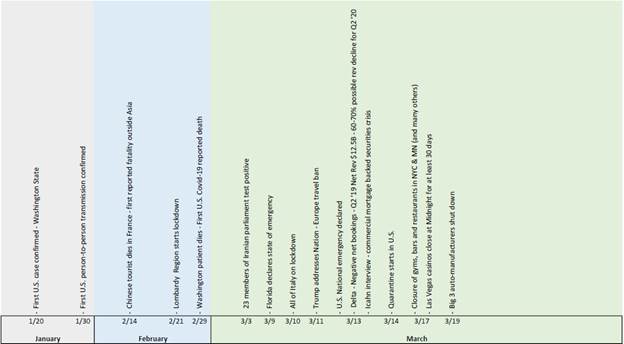

We are putting together a timeline for all things financially relevant to the virus outbreak. We will build this out more robustly but want to share as a first look. Forward looking, as companies go dark (casinos, movie theatres, airlines), it will be very important to analyze their cash reserves and the viability of them coming back online.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.