Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

LIBERATION! “Liberate Minnesota!” Well, that’s what the President said in a tweet on Friday. Awfully nice of him to think of us. Hard to say how any of this “liberating” is going to look in the weeks to come, but it will be interesting to watch. With the individual states taking different approaches it will be quite some time before we have reliable economic numbers or any true sense of a return to production. In the meantime, the stock and bond markets will be making their feelings known, as they are wont to do.

Believe it or not, the US stock market has now made gains for two consecutive weeks. Friday’s closing level takes us back to March 10th which, in quarantine time, is four years ago. This rebound has occurred with less conviction than the move down based on the number of buyers and sellers in the market (trade volume), but it still counts. That leaves us down about 11% for 2020 but under 1% for the past 52 weeks. We are happy to see the bounce but remain in a “prove it” posture as we wait for the slew of financial issues the shutdown has presented. We have used the recent upswing to raise a little more cash in the portfolios while keeping the core holdings intact.

If you accidentally found yourself watching the financial news on TV this week, you probably heard a lot of speculation on the “shape of the recovery” that we can expect. It makes for an interesting talking point, but it is pure speculation at the highest level until there are more answers than questions. That said, from a financial planning standpoint it’s important to consider all possibilities. To understand better, we put together some precise and detailed drawings of the types of recovery shapes that economists are debating:

The “V-shaped” recovery would obviously be the most preferred. It’s the old quick-down-and-quick-up, let’s move on as there is nothing to see here. The “U-shaped” recovery is the economy (or market) going down, hanging out for a few years then climbing back to where it started. We can think about the time period of 2006-2013 as a version of the “U” with the fallout from the financial crisis keeping markets in a holding pattern for years. Then we have the dreaded “L-shaped” recovery which isn’t much of a recovery as it goes down then heads due east for a long time (a decade plus). The best reference for the “L” is the stock market crash of 1929 leading to the great depression. It makes the list because we do have economic data from that time period, but it is a supreme stretch to compare the financial world of the 1930s to today. The Federal Reserve did exist then, but many historians blame the Fed for contributing to the depths of the drop and the length of recovery.

Being fans of sneakers at High Note, we have a special affinity for the fourth and final shape – the recently coined “Swoosh-shaped” recovery drawn below. It looks and sounds like a Nike-based recovery, but it is actually a combination of the “V” and the “U” where the stimulus provided by the Federal Reserve prevents the extended period of slow or no growth. This style of recovery does have some long-term advantages in that in the downturn the strong companies survive while the weak disappear. Not just a return to “normal”, but a new and improved economy with important structural changes. It is way too early to tell, but there are some reasons for hope that this is the result.

And with that on to the more detailed items…please reach out if there is anything else that we can help with…have a lovely weekend…

<<<High Note Quick Hits>>>

Real Estate Update: Fannie, Freddie, Ginnie Mae Oh My

- 2.9 million mortgagees have requested forbearance. These 2.9 million properties have a combined loan balance of 651 billion.

- Fannie Mae’s initial report is projecting 15% less residential sales for 2020.

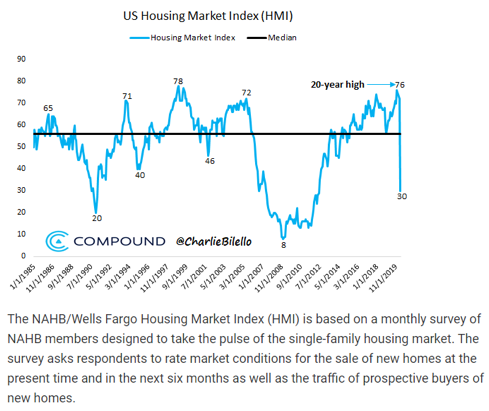

- We got our first reading of the US Housing Market Index and, no surprise, it’s not great. This is more “sentiment” based, so it is not pure data, but it is used by homebuilders in making projections. The pandemic scores another record…largest monthly decline in its recorded history.

Berkshire Hathaway: Who’s Frozen?

- Still no word from Uncle Warren himself, but the Wall Street Journal did get Berkshire Vice Chair, Charlie Munger, on the record with some updates on what Berkshire is up to. Munger refers to companies being frozen and unsure what to do, but it reads like Berkshire is frozen and unsure what to do as well. They have a lot of exposure to banks, oil and airplanes so it would make sense. However, that has not stopped them in the past so it is hard to know what the strategy is in Omaha today. We will get more from Buffet himself in a couple of weeks which will shed some more light. WSJ Link.

Gilead: Any Good News is Helpful

- Thursday night a report was released that there was some success in mitigating the effects of COVID-19 with Gilead’s drug Remdesivir. There is still a long way to go as this was a very small sample, but the market loved it. We are holding the stock, so it was a nice little bump, but not something that is going to drive it forward long-term. Ultimately, whoever gets to an effective therapeutic or vaccine is going to give it away. It will take all the drug makers working on it to get it up to scale fast enough. There are over 200 therapeutics and 70 vaccines around the world being worked on in a race to find a solution for the virus. The drug makers are taking this so seriously that competitors Sanofi and GSK have put their collective heads together in a joint effort to get to a vaccine faster. Bloomberg Link.

Chinese Data: Fire the Person in Charge of Counting Please

- As the narrative around the globe continues to swirl that the Chinese virus reports are not accurate, they went ahead and revised their total death count by 50%. Almost like some sort of weird concession. Not helpful in any manner.

Stimulus: More Like StimuMAX

- The Fed’s actions continue to be swift and extreme. Congress isn’t exactly acting with the same urgency. The small business loan program has been fully subscribed and an additional $250 billion is being requested for those who missed out on the first run. Signs point to that getting done. Currently, the total amount of stimulus committed through various channels amounts to 10% of US annual GDP. That is historic and unprecedented, but we think it will be closer to 15-20% by the time it is all said and done. We have been delaying the conversation about the Federal deficit and its role in the recovery and future growth. We promise we will get to it, however it’s hard to say how this all shakes out in the short-term. If this is a topic of interest, you probably already know what this chart looks like:

Oi Oi Oil

- 2002 called and they want their oil price back. Crude oil went down again this week retracing prices all the way back to 2002. At $19 a barrel, that is half of the cost it takes to pull it out of the ground and ship it. Even with the agreed slow-down between the US, Russia, and OPEC, there appears to be more pain to come in the short-term. China is consuming some, but their demand is still nowhere close to where it was before slowing down in November.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.