Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Did you miss us? Hopefully you did which means that you are getting the notes on a regular basis and they are providing value. We inadvertently took a week off as we worked on getting this new format and system ready to go. We will continue to make tweaks, but with any luck this will make it a little easier on the eyes and easier to read. With the visual format change, know that we are always open to feedback, requests or specific questions on this material or anything in the general categories of personal finance and investments. On to the show…

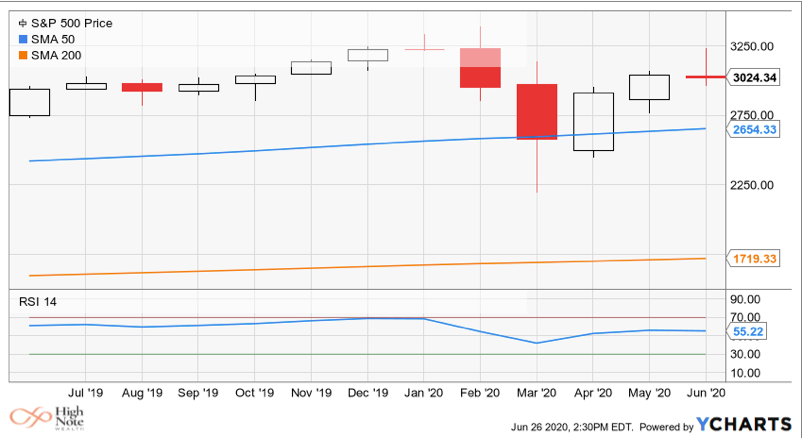

Perspective is a tricky thing as you almost always feel like you have it, but then you take another step back and realize that you don’t. With markets, one trick that’s helpful to keep perspective is to look at charts with weekly or monthly returns instead of the common daily timeframe. It tends to smooth out the data and provide a nice vantage point. Below you will see a chart of the monthly returns of the S&P 500 for the last year. A couple of things that jump out are the gigantic moves, by comparison, of March, April and May. Also, it highlights that levels are pretty darn strong overall given the magnitude of a global pandemic. With that little reset, we dive a little deeper.

“Don’t call it a comeback,” as the COVID virus has been here the entire time. As we mentioned weeks back, you cannot have a second wave if the first wave never reaches the beach. We have seen a great deal of virus suppression and flattening, but we are continuing to see it spiking here and there around the country. We did finally have a White House pandemic task force press briefing on Friday after silence for a long time. The guidance was little changed with the message for the most part being that states and cities need to manage the virus locally.

Speaking of local management, we saw more of that this week with closures in Texas (Apple closed all 7 of their stores in Houston), San Francisco delaying their opening and [GASP] Florida banning consumption of alcohol in bars. NY and NJ are working jointly to implement a 14-day required quarantine for those traveling in and out of the area. These are big moves and will certainly have an impact on economic activity. The murky spot here is that as millions of unemployed people head back to work only to be sent home for a second time, there is no plan in place in D.C. for support. There have been discussions of additional rounds of stimulus, but it hasn’t gone any further than that.

What this all adds up to is much of the same uncertainty we have had the past couple of months. The stock market has rebounded and recaptured most of what was lost, but is more or less heading due East. Better than going South for sure, but the case for it to point due North seems to rely on a vaccine. Certainly, some of the reopening exuberance deflated this week, but none of this is a surprise. It’s logical to think that it will continue in this relative pattern until more information comes forward.

With the stock market slightly down this week, and our never-ending need for a direct explanation, the rhetoric focused on the quiz below.

Pop Quiz – The stock market went down this week because:

- Resurgence of COVID cases across the country and particularly in the economically important states of Texas, California, Florida and Arizona?

- Increase in Joe Biden’s betting odds to win the November election signaling a potential increase in corporate taxes?

Windsong Farm Didn’t Get the Crop in this Year

- Over the years, many of you have been kind enough to make the trek out to Windsong for a round of golf. Just in case you were wondering if your invite this year got lost in the email, we wanted to let you know that there will be no such invites in 2020 but we hope to resume in 2021. Standing in the way is an uncooperative spine and a L4/L5 disc fissure.

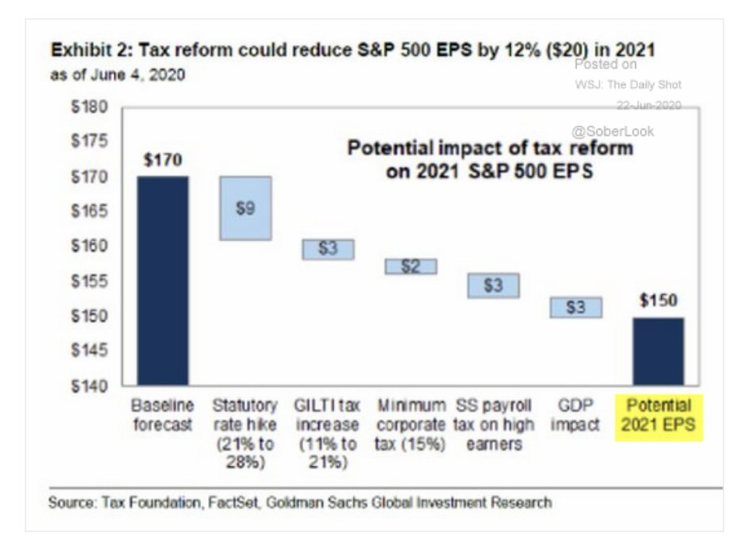

‘Cause I’m the Taxman

- We are putting this study here simply as an additional explanation for Pop Quiz multiple choice answer #2. Goldman Sachs put pen to paper and made estimates on the effect of increased corporate taxes to S&P 500 earnings. The back story is that Presidential candidate, Joe Biden, has said that he would roll back the corporate tax cuts implemented during the current administration. Whether he could or would get this done is up for debate. However, with Biden’s betting odds to win increasing, analysts are starting to look at tax reform possibilities. The results of the study aren’t great for markets when viewed through this lens. However, the Democrats would argue that these increased taxes would be efficiently redistributed to low income earners which bolsters them as consumers – a classic Red vs. Blue debate.

Billionaire Boys Will Be Billionaire Boys

- Everyone’s favorite billionaire rivals, Elon Musk and Jeff Bezos, are back at it again. On Friday, core High Note portfolio holding, Amazon, announced the $1.2 billion purchase of autonomous driving start-up Zoox. Bezos and Amazon have already been reaching into this space which will now be greater. The endgame could be self-driving delivery trucks or perhaps even a robo-taxi company. Either way, Musk wasn’t impressed calling Bezos a “copycat” on Twitter. The rivalry continues! Per usual, the internet loved the drama.

Deutschland’s Bernie Madoff Known by Friends as “Tom Petters”

- German online payment company, Wirecard, is in search of a CEO. Well, in addition to a new CEO they need to find the $2 billion that seems to have been “misplaced’”. After years of allegations of cooking-the-books, German regulators arrested CEO Markus Braun this week on charges of falsely inflating sales to fake income. By the looks of it, this isn’t an error or accident but very intentional. Wirecard carried an asset of $2 billion on their balance sheet that was supposed to be cash in trust accounts. Except the trust accounts didn’t exist. It is natural for us to assume that when the numbers get in the billions and trillions that enough oversight exists to prevent such blatant theft, but it still happens. From WorldCom and Enron to Madoff and Petters, the plan is the same – prey on the trust of investors for one’s own benefit. Sad. Here’s the link to the WSJ story.

The Real Estate Cul-de-Sac

- Price discovery is always lagging with real estate (as in, we find out how much something sold for 30-90 days after price was negotiated) so it’s no surprise that we are seeing some rough numbers now given the shutdown of March, April and May. This week we got word that existing home sales hit a 10-year low. Here is the article from Reuters. While this is expected, it will be important to watch from here if numbers move back up to the previous levels quickly or remain suppressed through the summer and fall.

- Mortgage delinquencies continue to be a problem. About 8% of US homeowners are past due or in foreclosure. While still not a crazy high number historically, it is significant. Particularly when we factor in the recent regional closures of businesses due to the outbreak which will add to the pressure. If we play this out going forward, the fall/winter is setting up for a substantial amount of foreclosed properties on the market. Banks price these to move fast which will be a headwind on overall real estate prices across the country. The wild card being if the government jumps in with additional rounds of stimulus to help folks stay current on payments.

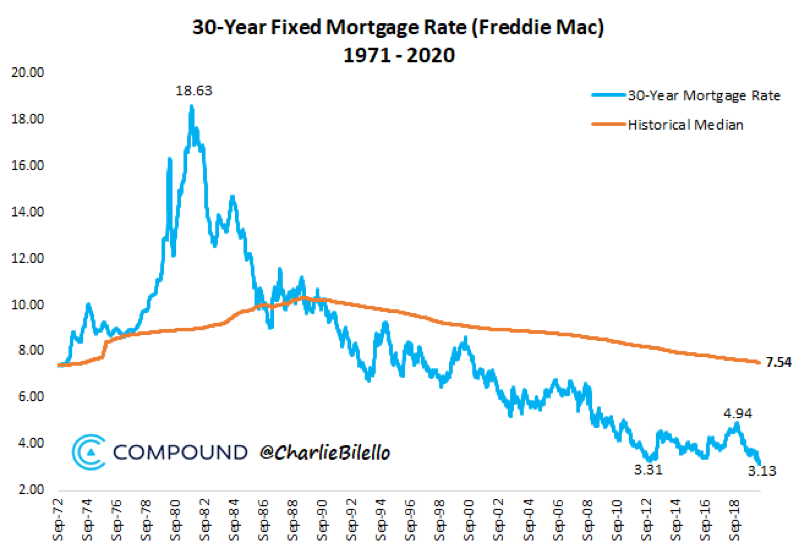

- Meanwhile, mortgage rates continue to go down and stay down…

The University of Google Applebook

- For the young people! Business Insider put together a list of the ten universities that produce the most recruits for tech giants Google, Apple and Facebook. Some of the names are obvious (Cal Berkeley) while a few others are a little surprising. For young people showing interest in tech, choosing a school with a known pipeline is helpful to consider. Here is the article.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.