Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

It’s Friday, High Noters! Short update this week and not necessarily in length, but breadth of topics. A little focus is good sometimes. This week’s focus comes from multiple requests for content on a topic that has been vast, positive, enthusiastic, optimistic, and uplifting. So much so that we cannot wait any longer. It’s time to address the elephant (and donkey) in the room and discuss the November Presidential election. So, grab your popcorn and “I Voted” stickers and follow along.

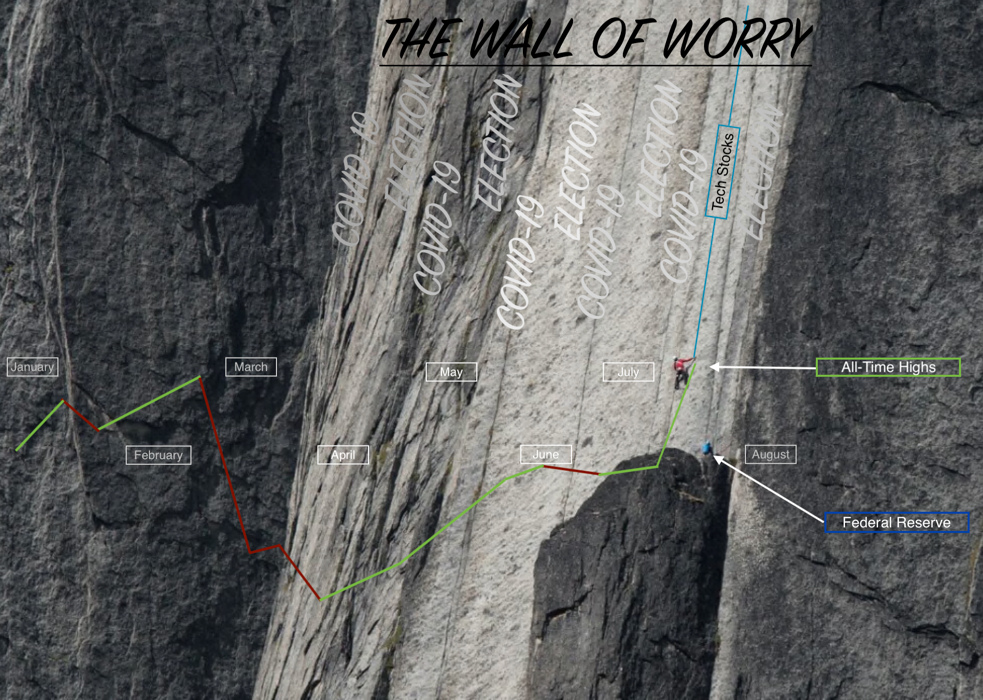

Mount Worrystone

“Climbing the wall of worry” is a statement that often gets tossed around at times like this. All it really means is that the market is going up in the face of issues that seem massive. Is that ever not the case? Maybe, but it seems like in almost all up-moving-markets there is a bogeyman hiding under the bed just waiting for the right opportunity to strike. Anyway, in that spirit, I put together a visual. Honestly, this is more of a recreational art piece than anything relevant, but it was fun and plays to what we have been hearing this week – the stock market made new all-time highs, but COVID isn’t under control and we have an election looming on the horizon.

Speaking of election…

Election 2020: Bayesian High

Nothing gets the juices flowing like a good old-fashioned presidential election. Well, maybe not, but it is a topic that requires some attention as we sit a mere 73 days away. The anecdotal sentiment we have picked up is split somewhere in between, “ugh” and, “oh boy no”. With that, we trudge along.

While there are many that are truly excited about their candidate (right?), we aren’t here to discuss the political nitty gritty, but rather to share our perspective on what matters most – the financial security of our clients’ portfolios.

Elections, and presidential elections in particular, do have some bearing on financial markets, but it is typically much less than one thinks. Yes, that statement is intentionally flawed because this “effect” needs a timeline associated with it to have any relevance. Tricky.

It’s logical to think that the result would dramatically move things up or down in the short-term. It certainly seems like a big deal being a four-year decision, but the historical charts just don’t really show it. Sure, it may move a little one direction or another, however we know that the stock market is a forward-looking vehicle. Decisions are being made and money is moving way past the election and into 2021 and 2022. Most of the short-term noise comes from the giant institutions making oversized bets trying to score big wins over a couple of trading days.

Longer-term, elections certainly have an effect on the stock and bond markets as the U.S. economy and the world are influenced by policy changes and legislation. While there are some immediate changes a President can make, they are not as substantial as the collective direction of Congress. These things take time to implement and they take time to succeed or fail. Just something to keep in mind as you hear the media debates start to heat up over the next two and a half months.

Yes, this year feels different with the pandemic and the recent civil unrest. It’s unique like every election year, but there have been many in the past that were rough as well. Think of the 1968 example we discussed a few weeks back (refresher here). That was no barrel-of-monkeys. Or consider the contested election of 2000 where we didn’t know who won the election for a full month.

If you look back at that period, you see a situation where one would logically assume the whole thing tanked – crash, boom, bang. March of 2000 marked the peak of the internet stock bubble. The bubbles popped and they popped hard. With things already heading southeast, the time was ripe for a complete and total freak-out. State courts deciding the election sounds like something the markets would hate (bad news is better than no news). And they didn’t like it per se, but the movement was muted. From election day to the day Bush was declared winner, the market was down 3%. Not 33%, but 3%. Not great, sure, but how much of that had to do with the election and how much had to do with a market that had its chair pulled out from underneath it?

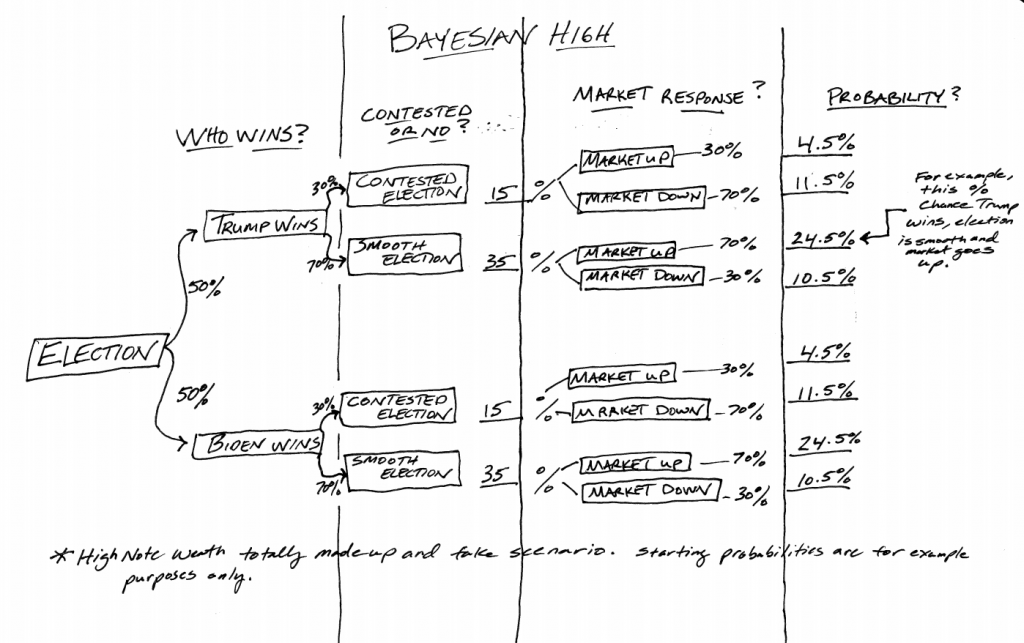

Okay enough of the pontificating and more to the doing. The takeaway is what to do about this information which brings us to old-time mathematician, Thomas Bayes. Mr. Bayes was able to eloquently simplify the idea of probability in statistics to put forth what is known as Bayes Theorem. YES, THIS IS GETTING LONG – PLEASE HOLD ON – THE PLANE IS PREPARING FOR LANDING!

The short lesson is that in portfolio management we can use this technique to address risk. The best part being that we can see it visually like this….

This doesn’t tell us what will happen, but it does allow us to explore outcomes for which we can build a plan around. There is a way to navigate almost any outcome the markets can throw at us. That is rarely the problem in investing. The problem is not understanding all the potential outcomes and what to do for each. Or having a strong desire for a specific outcome and behaving accordingly. So rather than having a preference or drawing a line in the sand, we are spending our time working on tactical game plans for whatever happens.

There’s a Mark Twain quote that seems appropriate to end with – “history doesn’t repeat itself, but it often rhymes.”

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.