Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Fri-YAY! Hopefully everyone had a happy and healthy week. In putting this note together, some weeks are calm, quiet and relatively easy. This isn’t one of them. We have some stories that are difficult to interpret and downright messy. That said, we have never been one to back down from a challenge, so let’s mask-up, put the gloves on, and dig into it.

Last week closed with the president being taking to Walter Reed Hospital after testing positive for COVID-19. From what is being presented, he’s mostly recovered and ready to get back on the road. The reporting around all of this is sloppy, if we are being polite. We then got word that former governor Chris Christie was positive, as well as press secretary, Kayleigh McEnany. A host of others have quarantined, particularly those who attended the events that the president had attended. The information is still limited at best, as there are national security concerns around those in the Pentagon, the Secret Service, etc. In a word, “messy”.

On Wednesday, Senate Majority leader Mitch McConnell was asked about the White House COVID spread, to which he replied that he hadn’t been there since August 6th, “because my impression was their approach to how to handle this was different from mine”. This revelation wasn’t a slip, as he later doubled-down by saying that he “personally didn’t feel they were approaching the protection from this illness” in a manner he felt “was appropriate for the Senate”. Hmmm. Here is the story.

“Why so much political talk, High Note?! I thought the election didn’t affect the stock market! Boo!!!” Yes, it can be exhausting, but hang in there. The relevance at the moment is getting or not getting a stimulus deal done. As of this writing, still nothing even though consensus among economists, Fed officials, and arm-chair-market-wonks is that there has to be another round of stimulus. Reports have Chairwoman Pelosi and Secretary Mnuchin still working on a deal, but President Trump flipped the proverbial negotiation table over on Tuesday by taking to Twitter to call off any deal on stimulus. This was more-or-less walked back 9-10 hours later in more tweets stating that he would be fine with a deal for the airlines. So, where we truly are with getting a deal done is anyone’s guess at this moment.

Complicating the matter is the election that’s now a month away. Both parties are making bets on who they think will win and based on results, if their party could get a better deal done on the other side. That’s what makes Senator McConnell’s statements above so interesting. He’s been very reluctant to take positions in opposition to the President, so one has to wonder if he is giving a tell on how he thinks the election will go.

Minneapolis Fed President, Neel Kashkari, added his name to the list of people publicly urging Congress to get a stimulus deal done. Kashkari is generally known as a straight shooter when it comes to public statements. He is somewhat reserved, so when he does speak it carries some weight. This week he characterized the current economic state in America as “roughly as bad as it was at the peak of the Great Recession”. His plea was to get something, anything, done ASAP. Kashkari here. With the backdrop of the drama above, the U.S. stock market posted a positive return this week. It closed at the levels of late August, just under the highs made on 9/2. We have yet to see the market slap the wrist of Congress for not having a deal done, but that’s very much in play in the next week or two. The market quickly pulling back 5% followed by a thrown together deal is no coincidence. For portfolio purposes, these can be nice spots to do some rebalancing and get money invested. The next few weeks will be interesting.

<<< HIGH NOTE QUICK HITS >>>

THE VIROLOGY LAB

Lockdowns 2: The Return

More virus trouble in Europe’s bigger cities with Paris locking down. NYC is having trouble in some pockets as well. This time it seems that lawmakers are trying to target very specific areas to restrict/close in lieu of citywide lockdowns. Not good for economic activity, but a considerable improvement from the restrictions of March and April.

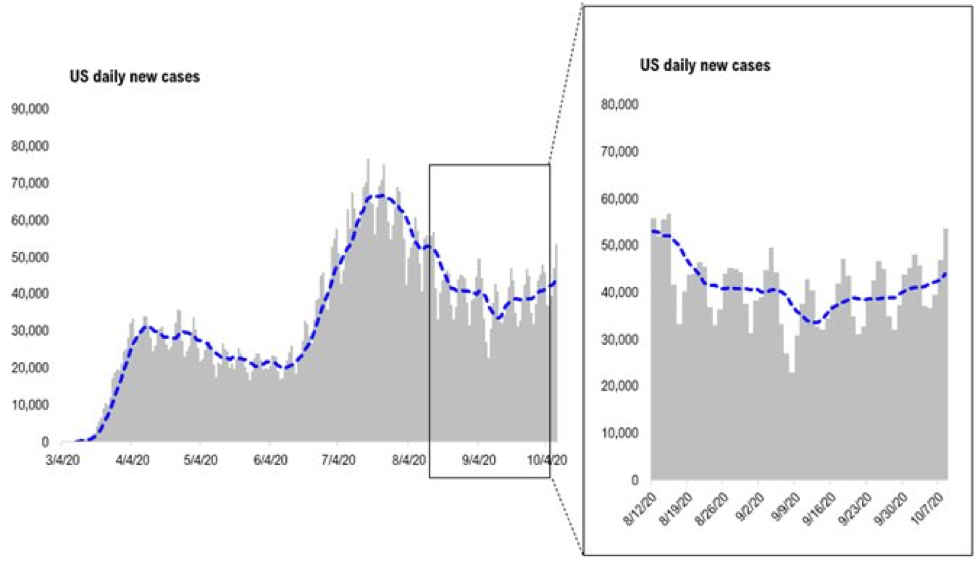

The data from the US is still dicey. This week we did have another day of 50k+ cases reported; the first since August. On the chart below you can see the trend starting to creep back up. Chart comes courtesy of Fundstrat (@fundstrat).

Mutants

The concern with targeting viruses with vaccines is their ability to mutate over time. There have been some scientific reports that this has been taking place already but nothing solid. Scientists in Chile are reporting evidence that the virus has mutated in the Patagonia region. The good news is that they feel this mutation is still close enough to not render a vaccine ineffective. The bad news is that the virologists are chasing a moving target.

One thing that seemed to be a trend this week is more focus on the effectiveness of therapeutic treatments in comparison to a vaccine. This could be because the President seemed to have a great response to the treatments and they are close to ready…or there are some concerns behind closed doors that we are going to get more reports like the one from Chile of the virus mutating which could push back a prospective vaccine. Hard to say, but important to watch.

Here is the article.

Now What, Minneapolis?

It’s been a difficult six months for America’s city centers. Minneapolis is certainly included in this group having suffered from the pandemic and from the extra pressure of civil unrest. In another blow, Target Corporation announced this week that they are keeping their corporate employees home until June. As the largest employer downtown, this is a big hit to service businesses. Here’s the article from the Star Tribune.

Government officials around the country seem sufficiently overwhelmed with handling the day-to-day of the pandemic and don’t have the time or resources to be planning a couple of years out. Hopefully they can start working on these things as well because it’s setting up to be a problem. As we have seen countless times throughout history, city centers can deteriorate quickly with the recovery taking much longer.

In a related story, a report on Friday estimated that there are currently 16,000 apartment vacancies in New York City. It’s a big city, yes, but that’s a lot of vacancy for them.

Meme of the Quarter (left without comment)

Little Trouble, Big China

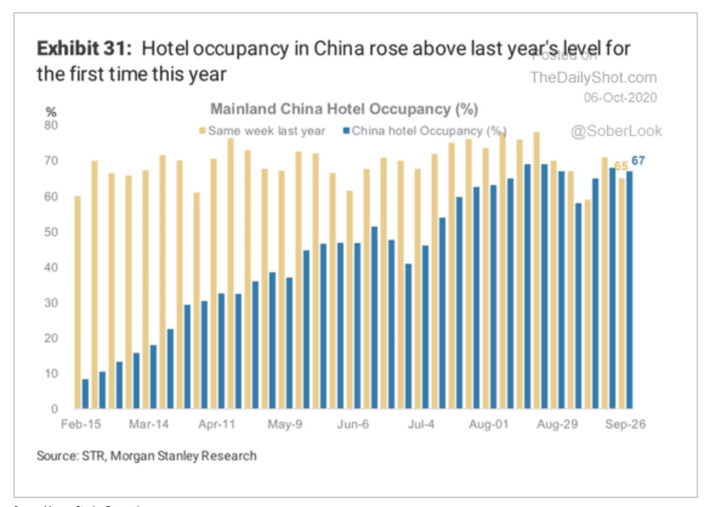

We know that data from China should always be taken with a grain of salt (this piece is from Morgan Stanley which adds some credibility). With that disclosure, this does seem to show strong economic recovery taking place in the region with hotel occupancy surpassing September 2019 numbers. As we know, they locked down HARD and put into place very strict reopening measures, so they are ahead of U.S. pace. Regardless of the strained relationship between Beijing and D.C., the Chinese consumer is an extremely important part of the global economy, and they seem to be getting back to “normal.”

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.