Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

It’s the first Fri-YAY in December, all. We hope everyone had a delightful and delicious Thanksgiving weekend. As we get close to year end, it is hard to not fantasize that at the stroke of midnight on New Year’s Eve the pandemic will just disappear, everything will open up, and normalcy will return. While that’s certainly a fantasy, the light at the end of the tunnel continues to brighten just a little bit each day. The stock market certainly sees it. As the fatigue of pandemic life continues to set in for many, perhaps we can follow its lead and continue to focus on better times ahead.

Much of the news the past couple of weeks has been focused on calculating the brightness and corresponding distance of said light at the end of the tunnel. As the market drifts higher, there is always the real possibility the light takes much longer to get here and we go through a pullback, so we sit firmly in our seats as cautiously optimistic.

To go high-level here’s a quick takeaway scorecard:

Good

- Stock market positive; performance continues with new highs.

- Jobless claims have been better than expected the past two weeks. Here.

- Vaccine is officially approved in Europe; multiple close in USA.

Not Great

- Initial estimates expect vaccine for kids to be pushed to later in 2021.

- Virtual schooling percentage back up – 43.5% nationwide, 5% increase in a week.

- New stimulus round still not done; talks ongoing, but the runoff Senate elections in Georgia are hanging things up.

- California and others are set for more lockdowns.

Yikes

- Small business is in a bad spot. Those that survived the initial shock of closures in the spring are now going through another lockdown period in certain areas. Add to that no stimulus and it could be very touch-and-go for local spots.

<<< HIGH NOTE QUICK HITS >>>

Salesforce is a Slacker

Salesforce was an add to the High Note portfolios during the summer pullback. Slack is a product we use, but hadn’t owned. Now we do. After rumors last week, Salesforce’s deal to purchase Slack was formally announced this week with a price tag of $27.7B. Was that a Cyber Monday price or did Salesforce pay full retail? Hard to say, but in deals like this it hardly matters. A couple of years from now it will either look like they paid $20B too much or stole it for 50% off. Much of that hindsight analysis will depend on how Salesforce integrates the Slack platform into its product and if it helps them compete upstream. CEO Marc Benioff isn’t the type to sit idly by with the state of Salesforce today. He is always looking for ways to change the game exponentially. It’s that attitude that gives the stock incredible potential while causing some volatility along the way. Here’s the story for those looking to do extra credit.

Picture This: Breadth

Breadth is one of those words that wasn’t created by the financial industry, but given how often it’s used, you’d think it was. According to Merriam-Webster, breadth is the “distance from side to side” and synonymous with “width.” You ever hear someone ask, “what’s the breadth of that queen size bed?” Didn’t think so. Well in this world it’s a constant.

Market breadth is an indication of the number of stocks that are positive on the day versus negative. Think of it as the second question that should be asked when discussing stock market performance on any given day. Here’s a quick example…there are 30 stocks in the Dow Jones Index…on a given day say 3 of them are positive and 27 are negative…the Dow could be positive that day if the gains in the 3 are greater than the losses in the 27…or the other way we could have 20 positive and 10 negative, but the losses are greater than the gains, so the index is negative for the day. Using these examples shows us that we can have the dynamic of “market up for the day, but breadth bad” or “market down for the day but breadth good”.

We would say “good breadth” is when a majority of the stocks are participating positively compared to just a few having big returns. The reason this is of mind today is that much of the 2020 recovery has happened on bad breadth (must be too much mask wearing…hehe). Particularly in the first couple of months it was the behemoths of Amazon, Apple, etc. that bounced back pulling the rest of the stocks with them. They were doing all the heavy lifting, while much of the rest of the market just hung out on the sidelines licking their wounds. That wasn’t necessarily a bad thing as we are very well positioned in those names, but we know for the market to have long-term success we need more players in the game – a healthy market has many participants. In the last month, we are now getting much better breadth.

With that little explanation, you are now ready to use this on your holiday Zoom calls when making small talk. When someone says, “the stock market sure has performed well recently” you can reply, “yes, and I’m particularly impressed by the breadth.” That will grab some attention.

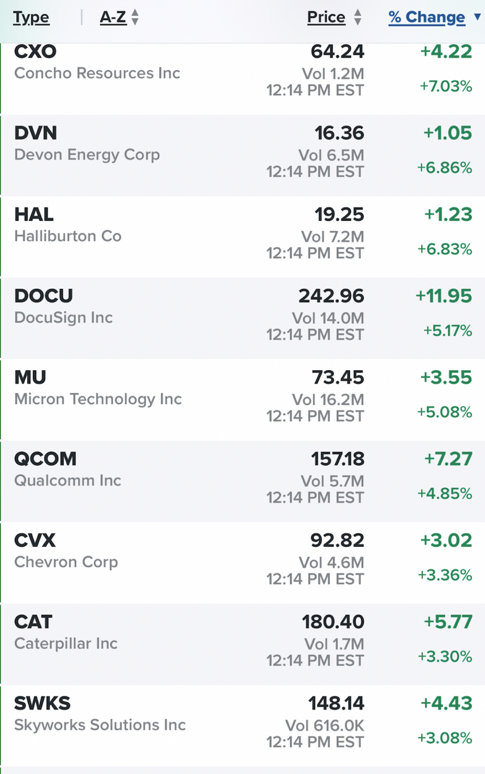

Here’s a visual of this from today:

This summer, the pair of Devon Energy & Chevron were only up on days when there was positive vaccine news and hopes of reopening. The pair of DocuSign and Skyworks were part of the “work from home” group or the “oh my, we are never leaving our houses ever again” trade. We didn’t see these very distinct groups on a positive leaderboard like we do today. This is good to see.

Black Fizzle Dizzle?

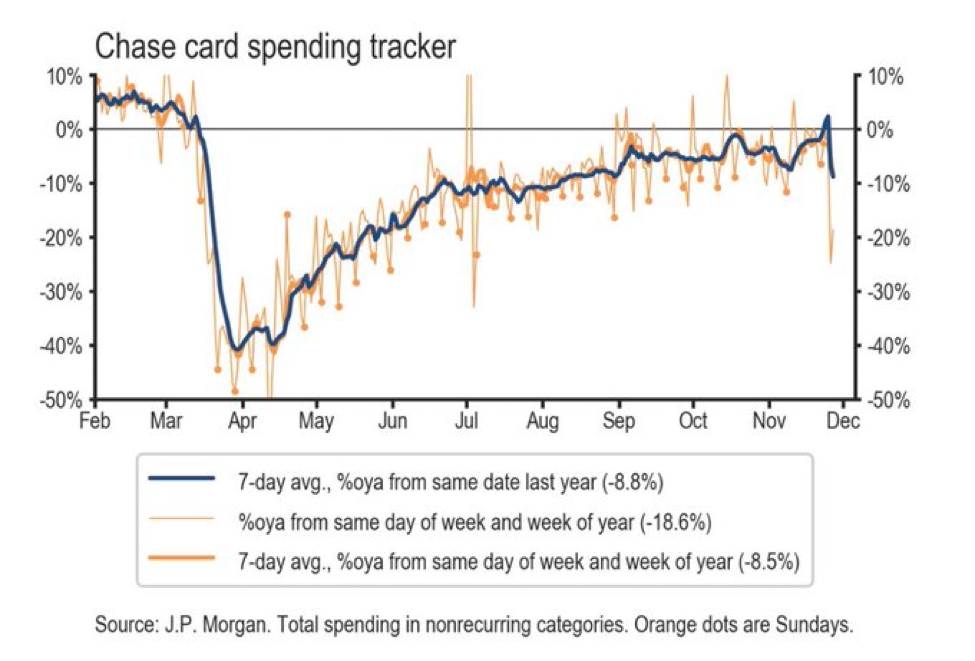

It was obvious that the Super Bowl of Shopping (aka, Black Friday) was going to take it on the chin this year. Literally less people taking it on the chin as the result of a squabble over a $3.99 DVD at Walmart with most retailers scaling down the in-person experience. We know the move to online was significant, but it will be very interesting to see the spending comparison year-over-year. We did get one data point from JP Morgan on credit card spending which shows spending down 19% from last year. That’s not great for our retailing friends, so it’s going to be interesting to see how they report for Q4. Wondering aloud here, but payments by way of PayPal and Square continue to take market share from cards, so those factors could be in play as well. Also, notice the time just before card spending surpassed last year’s number so maybe the holiday shopping just moved up a couple weeks earlier.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.