Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy New Year, High Noters. 2021 is out of the gates with a BANG. Some good (market returns) and some really bad (insurrection). The last two weeks really tested the notion that the market can look past politics. Watching protestors break into the U.S. Capitol building on the same screen as the market index ticker moving straight up was a bit surreal. But move up it has, so it’s worth putting a note in the captain’s log for next time we confront scary headlines.

With all of the political craziness and the stock market frenzy, the items we are watching closely are the i-words – interest and inflation. These are flying a little under the radar but the 10-year Treasury note yield has been moving up, while mortgage rates are still making all-time lows (2.65% on a 30 year? Wow). The interplay between stocks and bonds is complicated, but let’s just say this – when stocks are moving up, interest rates should be moving up in a “healthy” market, so this is good to see.

The other i-word, inflation, is a convoluted topic in its own right, so we won’t wander off into the weeds here. Let’s just say that strong demand for goods and materials should cause their prices to increase and that is starting to show up, which fits the up-market narrative. It’s very hard to capture it in a moment, so it’s something that is mainly viewed in hindsight.

Since it’s been a couple of weeks, let’s play everyone’s favorite game, The Bull vs. The Bear:

Bull Market Case:

- Government stimulus/spending – the money press continues to roll. The initial Biden administration package is an increase to what has already been established (more on that below).

- Positive rotation in stocks – this is a fancy way of saying that people are selling some stocks and taking profits to buy different stocks (a negative rotation would be selling stock and keeping proceeds in cash, for example).

- Vaccines are out in the wild and even some High Noters have been inoculated.

- Healthy signs from the i-words mentioned above.

- The price of Bitcoin.

Bear Market Case:

- Government stimulus is too late and small businesses are drowning.

- Market levels are high and what goes up must come back down.

- The vaccine rollout is not moving as fast we thought/hoped.

- Have you read a single headline in the past year?

- The price of Bitcoin.

There are compelling arguments from both sides and a game well played. As you know by now, there are always reasons to be overly optimistic or proudly pessimistic about the market, but the truth lies somewhere in the middle. While it makes for a fun game and sells lots of ads on television, take comfort in knowing that there is a path through all market conditions. Avoiding a strong stance will prevent us from dunking on people on our next Zoom cocktail hour, so we’ll have to be the boring, reasonable person. Sigh.

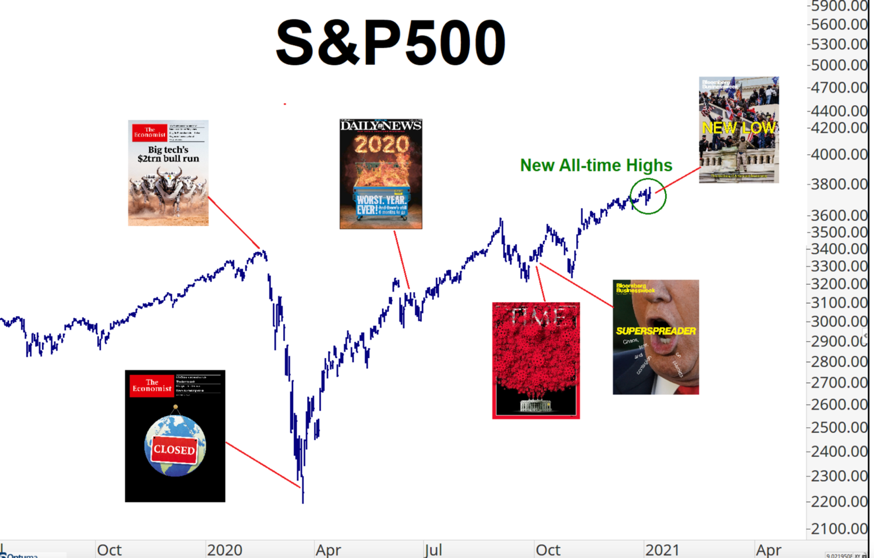

Before we get deeper into some topics, here is a fun visual – it’s the classic seeing-is-believing, truth-is-stranger-than-fiction or the-stock-market-is-not-the-economy narrative. It comes courtesy of JC at All Start Charts.

<<< HIGH NOTE QUICK HITS >>>

New Administration, Now What?

In this day and age, it seems very difficult to discuss government policy impact on the market, without being political [ducks]. Bias easily trickles in when we discuss what could be done which turns into what should be done and, you get it, it’s a mess. While very difficult to do, Morningstar Research stepped up to the challenge and put out a report as a reminder of the things that the Biden Administration can address and what power they have to make change. They do a nice job of going through the tools available, the limitations, and some possible scenarios. This falls more in the category of extra credit than required reading, but it’s here for those curious. Here is the article.

What the &$%# Did You Buy?

Elon Musk recently surpassed Jeff Bezos as the world’s richest person (on paper), so safe to say he has some decent ideas. However, the cult-like following crashed on Fantasy Island when he tweeted out two simple words – “Use Signal.” Those of us familiar with Signal knew that Musk was suggesting that people move their text message conversations from the native iPhone app to the more secure and encrypted Signal app. A friendly thing to do. Well, traders immediately took that recommendation as a buy signal (pun intentional). Appreciate the hustle, but Signal, the app, is not a publicly traded company, so what does one do in such a predicament? Obviously, you buy a stock with a similar name that has nothing to do with the company you are trying to buy. Traders started piling into a company called Signal Advance, WHICH HAS ABSOLUTELY NOTHING TO DO WITH THE SIGNAL APP IN MUSK’S TWEET. Before the party was over, the stock had gained over 6000% before starting to crash back down. What a world. Safe to say that there is still an “edge” in stock selection, and it starts with buying the actual company you are trying to buy. The chart is something else.

The State of Vaccinations

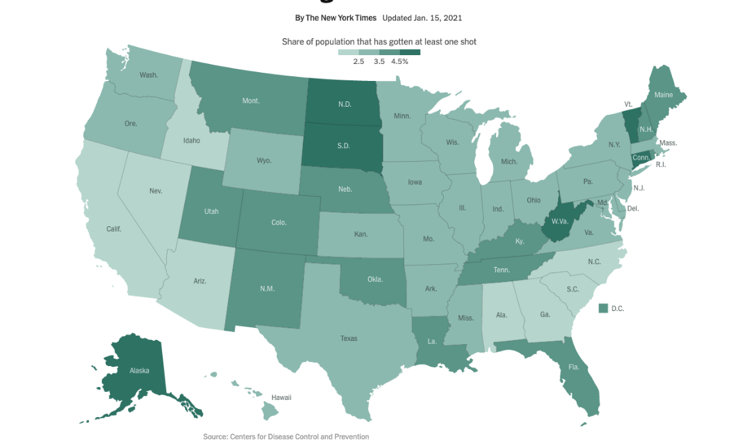

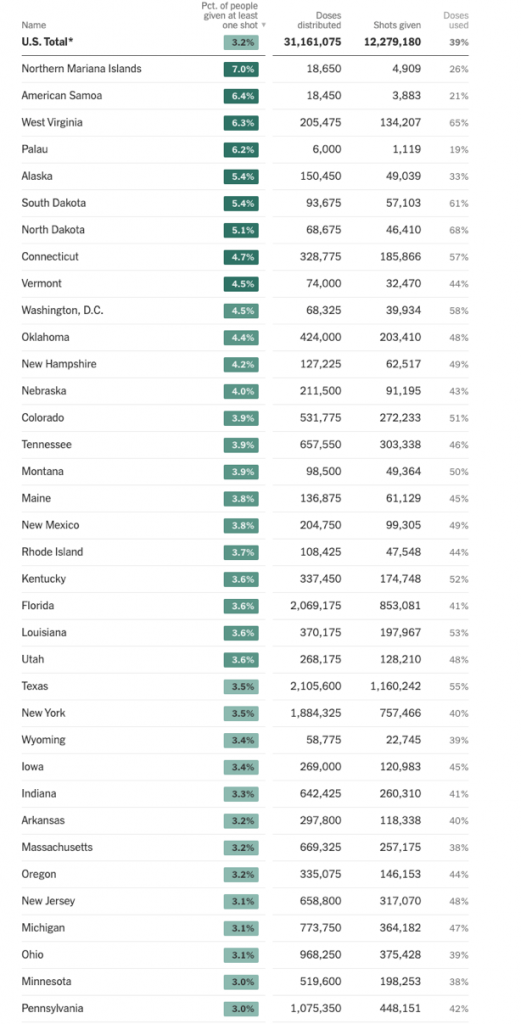

Here’s a fun map and breakdown of state level inoculation. ICU bed capacity has increased slightly in the past couple of weeks, so there are some positive signs on the horizon. Looking at the raw data of those vaccinated it’s easy to see there is a LONG way to go. How’s Minnesota doing you ask? Staying firmly on brand, Minnesota is nice(ly) sitting close to the middle – don’t want to show off and be first, but don’t want to get called out for bringing up the rear. Here’s to hoping that the great land of the frozen north finishes in the top ten when it’s all said and done.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.