Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Saturday, friends! It was Katherine’s birthday this week which means we have officially reached the end of January. Somehow, she’s been a financial advisor for twenty-five years, yet just turned thirty-five years old. The great ones start young.

For everyone that caught a financial headline or two this week, you know there is a gigantic elephant in the (chat) room. Before we address that, let’s take a look at a couple of other updates to set our base.

The stock market was down on the week settling roughly 4% below all-time highs. There are some pockets that could be labeled frothy, so this week’s dip wasn’t a surprise and can be seen as a necessary occurrence. We are still positioned favorably as we walk the line of strong cash positions and adequate growth exposure. The bond world remains calm and we heard from the Federal Reserve this week that they are continuing to be cautious on their outlook. Business as usual.

New stimulus deal? Don’t be silly. That is still “being worked on.”

We got really solid news on vaccines this week with both Novavax and Johnson & Johnson coming through trial and ready to go. The pace of inoculation also seems to have improved with a high of 1.6 million vaccines administered in a day this week. In an interview, the Pfizer CEO said they alone can have enough vaccine produced for the world by the end of July. Add to that ramp, vaccine production from Moderna and now J&J and Novavax, and we should be in really good shape soon. As a side note, 6.3% of Minnesota’s population has now received at least the first dose. Heading in the right direction.

Okay, without further ado it’s time for the financial story of the week. It’s a tale made-to-order for Hollywood, so we are giving it that treatment. Outside of being highly entertaining, it’s relevant to recent and current market conditions, bigger-picture investing trends, the move to decentralization of financial markets and a flair of populism we have seen in global politics. As we wait for the final scenes to be shot (Act Three, the final act), it’s hard to fully grasp the takeaways. Could this be indicative of a market top? Have we entered in an entirely new class of investors? Or does this become a footnote in financial history like the countless other times “the little guy” tried to take on Wall Street? As the saying goes, only time will tell.

If you want some historical context, check out the story of Clarence Saunders and his scrap with Wall Street over the ownership of the company he founded, Piggly Wiggly. It’s something else. Author, Nick Maggiulli, shares a brief summary here.

The Week the Stock Market Made a Movie

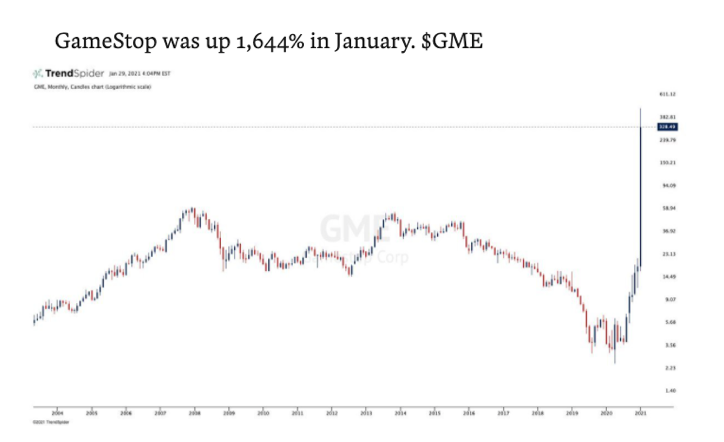

The Plot: Downtrodden retailer GameStop looks to be headed the way of Blockbuster only to see its stock rise 1,644% in January providing the company a much-needed lifeline. But who’s behind this meteoric rise…and how does it end…

The Scene: The world is 11 months into a global pandemic that has caused incredible death and suffering among citizens and impossible market conditions for brick-and-mortar retail businesses. Layered on top of that is a long and substantial trend of digital gaming.

The Characters:

- The Protagonists – Wall Street Bets (r/wallstreetbets): a group of stock traders/investors that discuss market ideas in very modern vernacular. As in, your post must include an emoji or two and do not bother if you are a supporter of punctuation and grammar. Memes make as many points as sentences and be ready to read every vulgarity you can name while learning many more. This group has often been dismissed as “millennial bros,” but there are some very intelligent contributors running complex investment and option strategies in their own portfolios. The founder of the group is known to formally be a financial advisor and Chartered Financial Analyst, like yours truly. The risk appetite of this bunch is something to behold. They are certainly not buy-and-hold investors to put it lightly. They are looking for high-risk, short-term, high reward moves that make most traditional investors very uncomfortable. On Tuesday there were approximately 500k members. As of Friday morning, there are 5.5 million.

- The Antagonists – Wall Street (Hedge Funds, Investment Banks, “Suits”) and Robinhood: FinTech investment brokerage like E*Trade or Datek for those who remember the 1990s. Robinhood entered the financial world with a very direct focus – first time investors and tech savvy young people. They state their mission as “democratizing” the investment world by offering a unique app and completely free trades. In terms of users, they have been wildly successful and have often been given credit for “changing the game.” Critics have accused them of applying a “gamification” style to market trading. They were instrumental in getting stock trading fees to zero across the industry and did much to de-stigmatize the wild world of option trading [foreboding music plays in the background]. They are known to be the go-to option for the Wall Street Bets crew and millennial investors.

Optional Background Information:

- Reddit – a social media platform that is essentially the internet’s romper room. It’s a message board style platform that hosts group chats that run the gamut from flat-earth conspiracy theories to chicken tender aficionados. The group known as Wall Street Bets has been an active group on the platform for almost ten years.

- Hedge Funds – simply put, they’re like a mutual fund that requires an RSVP. This industry started out just like it says, “hedging.” What does that really mean? Here’s a way-too-simplistic example: you’ve done your research on the two largest soda companies, Coke and Pepsi, and you have determined that Coke is going to go up in value over the next year. So, with that information you could simply buy Coke – easy. But, in doing your research, you not only conclude Coke will go up, but you think Pepsi is heading to the dumpster. Instead of simply buying Coke, you decide to bet on Coke going up and Pepsi going down – not as easy. To do this you, you buy actual shares of Coke and you borrow shares of Pepsi to sell. When Coke goes up and Pepsi goes down, you win both ways. Yes, the mechanics of borrowing shares to sell is a mind melt, so check out short selling below for a refresher.

- Short Selling – the movie The Big Short helped clear this up for a lot people with better things to do than learning trading techniques, but it can feel like an odd concept. We know the two options of being invested in the market or parked on the sidelines sitting in cash. There is this third option where we are invested, but we are betting that stocks or markets go down. If we think the market is going up, we buy. If we think the market is going down, we sell…but we don’t want to be on the sidelines we want to be in the game. So, we sell stuff that isn’t ours. How do we do that? Well, anyone with a brokerage account that has a cash or stock balance can get a margin loan (it’s like a home equity line for your stock account). With this loan you can then borrow shares of a stock that you do not own and sell them. The loan charges you interest on the amount and you are off and running. Just like when you buy at a certain price, you sell at a certain price that you carry forward as the market moves around. When you’re done for the night and closing out your tab, you buy the stock at the market price and pay back the loan. Anyone have time for an example? You recently started collecting antique trunks(?) and are so mad with your most recent purchase from Etsy that you determine that stock is going in the tank. Not only do you not want to own that stock, you also want to make money when it goes down because other people realize it’s a bad company. So, you take a margin loan on your brokerage account, borrow a share of Etsy and sell that sucker for $200. Two weeks later the stock is trading at $180 and you make your move. You buy a share, throw it on your broker’s desk and get your check for $200 netting you a return of $20. Investing is so easy.

- Short Selling Level 2 – Options. In short, options are IOUs. They are contracts (or digital sticky notes) that give you the right to buy or sell a stock on a certain day at a certain price. You don’t own the stock nor are you buying it, but you are locking in the right to do so. You pay for that privilege. These require much less capital to make huge bets.

The Story Arc:

Act One – Chatter among the WallStreetBets crew for quite some time had been that there were a few companies that hedge funds had too big of short positions against (bets to fail). One of these companies of course was GameStop. The chatter turned to some buying of the stock and options to take the opposite side of the trade. Some buys would drive the price up and the hedge funds would short some more shares and the price would go back down. This continued for a couple of weeks with little excitement. As the conversation on Reddit continued, the excitement around the trade continued to build while more buying occurred. As the group as a collective continued building a position, they noticed that more shares weren’t being shorted by the hedge fund. Instead, seeing trouble ahead, the hedge fund started to close out their position. Meaning, they had to buy the shares, which sent the price up further, which lead to more enthusiasm among WallStreetBets and on and on it went until the dam broke. The stock went up 400% in a day as the story raced around Reddit, Twitter and StockTwits. The movement was just getting started. On Tuesday we learned that Melvin Capital, the main hedge fund on the short side, had to bail out of their positions and received rescue funding to the tune of $5 billion. They more or less put the fund on the verge of bankruptcy. Claiming victory, the holders of GameStop shares and options could exit their positions with record profits and go on their merry way. If only things were that easy…

Act Two – On Wednesday, preferred trading platform, Robinhood, did something remarkable. Under the guise of “record volume” they put limits on the buying and selling of GameStop and a few other stocks that were heavily shorted, essentially not allowing profits to be taken. This didn’t go over well at all. Foul play was declared, and it turned into a media frenzy for Robinhood. Traders claim that Robinhood froze the trading, so Wall Street could catch their breath and figure out how to mitigate the damage. Politicians from both sides of the aisle quickly jumped in and demanded answers. Robinhood had to do the media rounds attempting to do damage control, but it fell on deaf ears. The members of WallStreetBets encouraged others to hold, not to sell, as they are proving a point which is part pure rebellion and part a force for change, feeling the game is rigged against them. They’ve received support from big names like Elon Musk and Dave Portnoy which has emboldened their stance.

On Friday, Robinhood had started to allow “some” buying and selling of GameStop, but it’s still a mess. Current estimates are that hedge funds are down $19 billion on this circus. Calls have come in for investigation, more regulation and even eliminating short-selling. These are things that have all been on the table before so it’s really nothing new. What ultimately comes out of this will be playing out in the next few weeks and it’s worth pulling up a chair and grabbing a bowl of popcorn.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.