Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Fri-YAY, friends! No easter egg hunt this week, but we must say that the outpouring of well-wishes two weeks ago was incredible. Truly meaningful and greatly appreciated – another reminder that we at High Note are fortunate enough to work with greatest group of people we could ever imagine. So, you keep being you and we will keep doing our best to serve. With that, let’s get into it.

The stock market continues to sneak around all-time highs and interest rates are lower? But we were told interest rates were going to rocket up and there wasn’t a darn thing anyone could do about it. Well, that didn’t happen, so good thing that we filed all those hot takes in the “we will see” file and not the “actionable items” file. It’s incredible how financial prognosticators can get on the same narrative and not get off. They say it with their chests, so it sounds good, but it’s never that easy. If one had acted on the peer pressure, it wouldn’t have turned out well – you would have sold bonds that have since gone up and you would have dumped some stocks fearing rates were going to cause market correction. Like with many things in life, the best prediction is often, “not really sure.”

Building a case for higher rates is easy right now, so let’s do it. We see a global economy re-opening, unemployment dropping, inflation showing up significantly in spots (housing prices, grain prices, used car prices, oh my, etc.) and we know the amount of debt on the old balance sheet of Team USA is well…super high…or said nicely, “historic”.

Typically, the relationship is that when the economy is cooking and inflation is throwing gas on the fire, interest rates have to go up to prevent the kitchen from exploding. We can think of rate increases like Patrick Swayze’s character from 1989’s seminal masterpiece, Roadhouse, the “cooler,” brought in to settle things down when the party gets too rowdy.

Interest rates are a market themself which can sound odd. It gets lost as there is always talk of what Chair Powell and the Fed will do with rates. They have a hand, yes, but there is a whole market of rates out there moving based on the supply/demand dynamic no different than anything else that’s for sale to the public. Factors like inflation, asset prices and economic activity all play into the pricing of that market. The global bond market dwarfs the global stock market meaning the influencing factors are even greater and more complicated. It’s easy to paint the picture that’s it’s just this easily understandable thing with Chair Powell pulling all the strings but it’s not. Central banks have a say, but they aren’t the only vote.

Thinking back to what Dalton, Swayze’s Roadhouse character, famously told his mentees, “…be nice…until it’s time to not be nice.” Right now, interest rates are “being nice.” They definitely have the ability to “not be nice” and clear out a bar faster than Dalton could ever dream. But that is not today, and most likely, the warning signs will be very present.

One last thing before we get to Quick Hits and send you on your way. CAP GAIN TAXES were all the rage on Thursday after the White House leaked a proposal to increase the top rate from 20% to 39.6% for earners above $1M. It caused a little market selloff midday which was then recaptured on Friday. Like we mentioned, there are going to be a lot of ideas leaked, floated, proposed or whatever you care to call it. This definitely feels like a classic bit of anchoring the negotiation on a higher number only to settle lower but it’s hard to say. We will follow all the news cycle fun, but the true planning solutions will be discussed when we are closer to an actual change.

That’s it. All the best.

<<< HIGH NOTE QUICK HITS >>>

Bustcoin & Friends Lost $250B in No Time

Saying cryptocurrency is volatile is sort of like “old man yells at cloud” from Simpsons fame. Every time we say it, we sense youngsters in the corner snickering and calling us narcs. It’s just one of those things. Well, volatility in pictures is fun. Here’s a chart of Bitcoin for the last month with the last couple of days being down significantly. In fact, Bitcoin has already been off as much as 25% from all-time highs. Those most enthusiastic about the space just take the level of volatility in stride which is a whole new world to us old men yelling at the clouds. Bitcoin, along with other cryptos, evaporated $250B worth of value in about 48 hours. But the market never closes, so maybe it’s all made back by Monday. As we have said, there is something here and everyone is still trying to figure it out.

New SPAC City

Late 2020 and early 2021 have been boomtimes for Special Purpose Acquisition Companies (SPAC). It’s been such a trend that we have already surpassed froth territory and have reached a cooling off period. We haven’t written much about it, as it’s more relative adjacent to our investing, but it is a part of the overall narrative.

In easy-to-understand terms, here’s what a SPAC is…a person, preferably someone with investing experience, legally forms a SPAC and sends out the call for money. It’s a shell company that owns nothing. Ultimately what it will do is buy a private company and roll it under this new SPAC shell. Before doing that, the SPAC, even without owning anything of any kind, becomes a publicly traded company. It might be publicly traded for months without owning anything. Eventually it will buy a private company and the shell will essentially dissolve. What it’s doing is taking a private company public without having to go through the onerous and tedious process of doing an initial public offering (IPO) to become a stock that’s traded on the market.

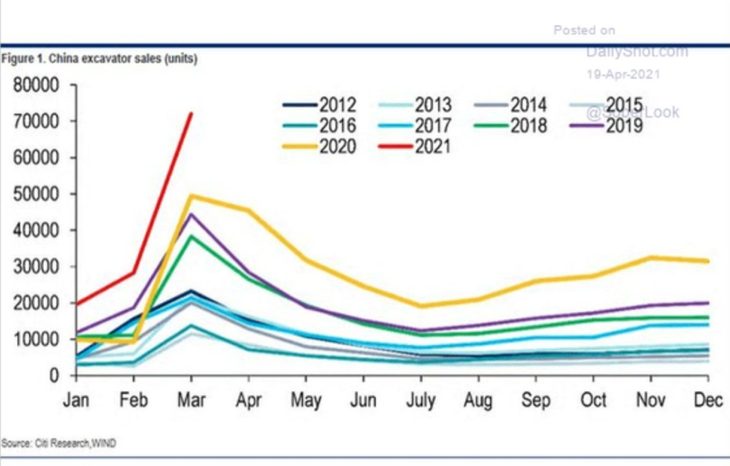

China Building Corp. Goes for It

Wowzer, check out sales of excavating equipment in China YTD compared to past years. Did they pass an infrastructure bill or something? [haha, sorry that was too easy] Clearly, they are building and planning on additional building. This is a single data point, but it points to big plans. This will be worth monitoring to see if other factors fall into place around it.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.