Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

It’s Fri-YAY, all! Summer is getting closer and mask-free America seems like a real possibility. Depending on the state you find yourself in, the businesses you frequent and your state-of-mind, it might already be here. What a difference a May makes.

The last couple of weeks have continued the feedback loop of the “I words” – inflation and interest rates. We’ve heard tell of so many inflation panics that it is hard to remember if we are still panicked or if that has subsided? Chair Powell and the Federal Reserve still think inflation is merely transitory (“temporary” seems like a more appropriate word to describe their position, but what do we know). Their position was looking a little dicey a week ago with all sorts of commodities running out to new highs. This week that all reversed with grains, lumber, cotton and more coming down 10-20%. So maybe transitory is a word we should get to know.

One thing we can always look forward to is summer blockbuster movies and this year is no different. Coming soon to screens near you is, American Taper Tantrum, Part 2. The original came out eight years ago when the Fed announced they would begin to unwind the fiscal stimulus that was five years in, post Great Financial Crisis. For those who don’t remember or didn’t see it, let’s just say it wasn’t received well by audiences in emerging markets and Asia. Assuming the plot is similar in the sequel, safe to say the same will be true this time around.

As a quick refresher of the temper tantrum, then, like now, the Fed is buying government issued bonds to stimulate the economy. The mechanics are confusing, but don’t worry about that. Essentially, by buying bonds, interest rates are kept low because the Fed is a huge buyer in the marketplace and more buyers means more competition which in turn means lower rates. Take that buyer away and, you guessed it, demand isn’t as high causing rates to naturally increase.

This causes some concern in the U.S. stock market, but it’s not the true cliffhanger. This part of the movie is more like Maverick having to take on the gritty, wise veteran, Viper, during training sessions in Top Gun. It’s going to be tense, sure, and the U.S. market might look shaky for a couple of days, but we know who’s going to win. The real drama occurs when Maverick and Iceman end up in a dogfight with Soviet MiGs. In the case of American Taper Tantrum, Part 2, the tension starts when the Federal Reserve gets tangled up in a staring contest with central banks around the world.

This stare down is a result of rising interest rates in the U.S. which makes bonds/debt much more attractive to foreign buyers. Or put another way, the bonds of other countries look way worse. This causes bond buyers to flow to the U.S so foreign rates rise even faster. And many of those countries cannot really afford to pay the interest on higher bonds and, well, you guessed it, they throw a tantrum. So, this dogfight opens with the Fed stating that they are going to start easing, tantrums are thrown in the global bond market, thus leaving the Fed with the dilemma of staying the course or slowing down. In the 2013 original moving picture, Fed Chair Ben Bernanke did decide to slow down the easing after many sleepless nights and much consternation. Will current Chair Powell follow the previous playbook or forge his own path? We will have to tune in to find out.

With that not-so-succinct description, it is important to know that we aren’t seeing it as a big issue. It will be a “talker” for sure and most likely we will have a few patches of volatility, but the market will carry through. Sometimes it’s nice to just sit back and enjoy the entertainment.

<<< HIGH NOTE QUICK HITS >>>

Tales from the Crypto…

Bitcoin and cryptocurrencies, et al, had a wild month in about 24 hours this week. In the middle of April, Bitcoin made new all-time highs around $65k per coin. On Thursday, after relentless selling, it touched the $30k mark for a tidy return of negative 55% in just over 30 days. It wasn’t just Bitcoin taking the hit as the majority of the cryptos took a bath as well.

For those who weren’t following the asset class as closely in earlier days, it’s a nice tutorial to see how this asset class can trade (read: WILD). The 5-10% moves day-to-day have been present this time around, but that’s generally easier to tolerate when the overall trend is up. However, when an asset, regardless of what it is, loses over half of its value in a day, its startling. Compounding that feeling is the fact there is almost no indication as to why it happened.

Some loose speculation explains the drop on rumors of regulation and a statement from the Chinese government warning banks to not do business with cryptocurrencies. We know these explanations are thin as regulation has always been a shadowy overhang and anyone who owns any crypto of any kind knows that the Chinese Communist Party hates any idea of de-centralized finance.

Most likely the move is more understood as profit-taking from a big run-up and specifically profit-taking by those with leverage. When big, levered trades start to unwind the snowball picks up steam exponentially as it tumbles down the hill.

After the downturn began, we did get two interesting pieces of news on Thursday. The first being that the IRS will require notification of any and all transfers of crypto over $10k (uh oh, that sort of defeats the purpose of a cross-border decentralized currency innit). With all the recent gains, the Treasury Department will figure out a way to take a slice and that will reduce the overall market share.

The second news item came from Fed Chair Powell who warned that cryptocurrencies could cause instability to the overall market and that they were preparing a paper on the possibility of a US government digital currency. WHAT. A government backed cryptocurrency would be like going to a concert with your friends as a kid and having to bring your parent as a chaperone – it’s not the experience you are looking for.

This market is still really big, and it’s been around so long that there is something “there”. Exactly what that is has yet to be totally determined, but it’s not going away. We continue to say that it is totally fine to own a little here and there. This recent clip allows new buyers to enter at substantially lower prices and reminds us all that the value can be cut in half any time, any day.

Bitcoin YTD, 2021 with the legendary frowny-face chart pattern.

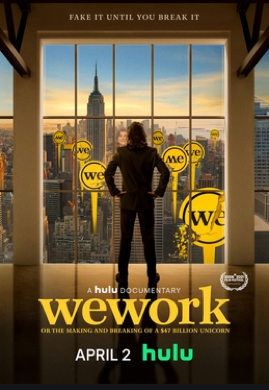

We(ird)Work

Looking for a new financial documentary to watch about a super successful, fraudulent grifter that gives off cult-leader type characteristics? Well, you are in luck. Hulu recently dropped a new documentary on the rise and fall of WeWork that is a fun, yet troubling watch. If you aren’t familiar with Soft Bank’s Vision Fund, this is a nice introduction as they were large investors in WeWork. Someday, there will be a doc on the Vision Fund and that too, will be must-see TV.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.