Happy Friiiii-YAY! It’s definitely fall and fall was supposed to bring us news of an infrastructure bill and tax changes, but here we are, and still

nothing. Speculation is abundant and lawmakers are talking a big game in the media, but up to this point, there is very little to report.

The stock market certainly isn’t waiting with bated breath as it has zoomed to new all-time highs on the back of some good news – positive Fed meeting notes, a strong jobs report on Friday, and Dr. Scott Gottlieb stating that the pandemic is winding down in the U.S. given all the tools to combat it (vaccines, therapeutics, and additional products on the way).

Inflation and supply-chain issues are still lingering in the lexicon as potential negative catalysts. This certainly could be the case, but we could also be in the midst of an M. Night Shyamalan-type ending where the narrator gently whispers, “these were priced in all along.” It’s hard to say, but it’s an interesting idea given the positive price action we have seen in the last week. Add to this the potential for a “Santa Claus” rally and the finish of the year could be very positive for stocks.

You know us well enough by now to understand that we approach these sentiment swings with a healthy amount of skepticism. Experience has shown that things can change quickly, and the highs and lows are fleeting. Enjoy the day while planning for tomorrow….

High Note Quick Hits

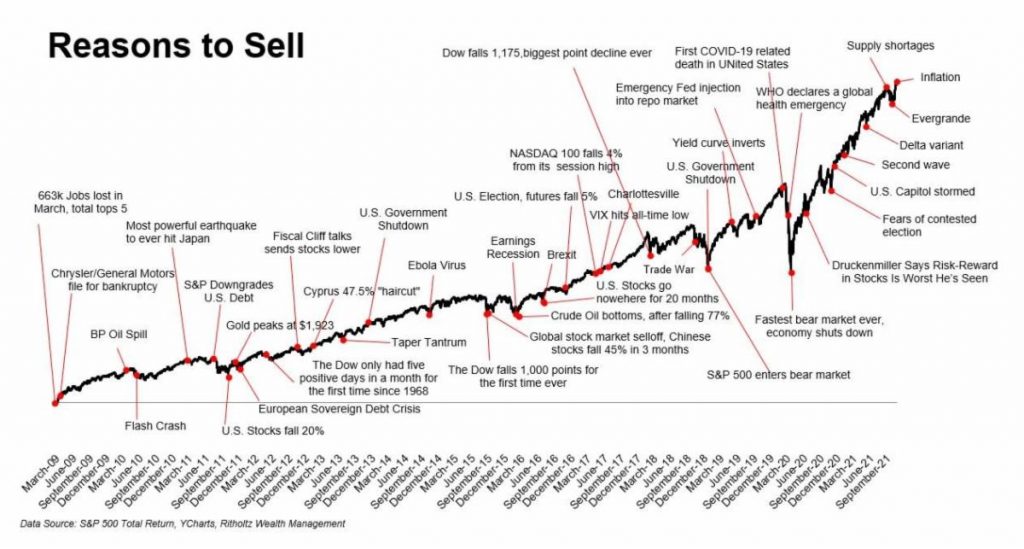

99 Reasons to Sell and This Aint One

Quick and fun history lesson from Michael Batnick (@michaelbatnick) on the various “walls of worry” the market has overcome in the past decadeplus. Looking back, some of the issues seem minor, but at the time they felt like a big deal. One of the more interesting periods was 2015 when volatility was higher than normal for what felt like no reason. There wasn’t a clear one-off “issue” to point to, so the story was much about the market selling off and nobody knew why. The irony of that thought process is that’s the point – we may know of a reason the stock market “should” sell-off, but it rarely concerns itself with what we think it “should” do.

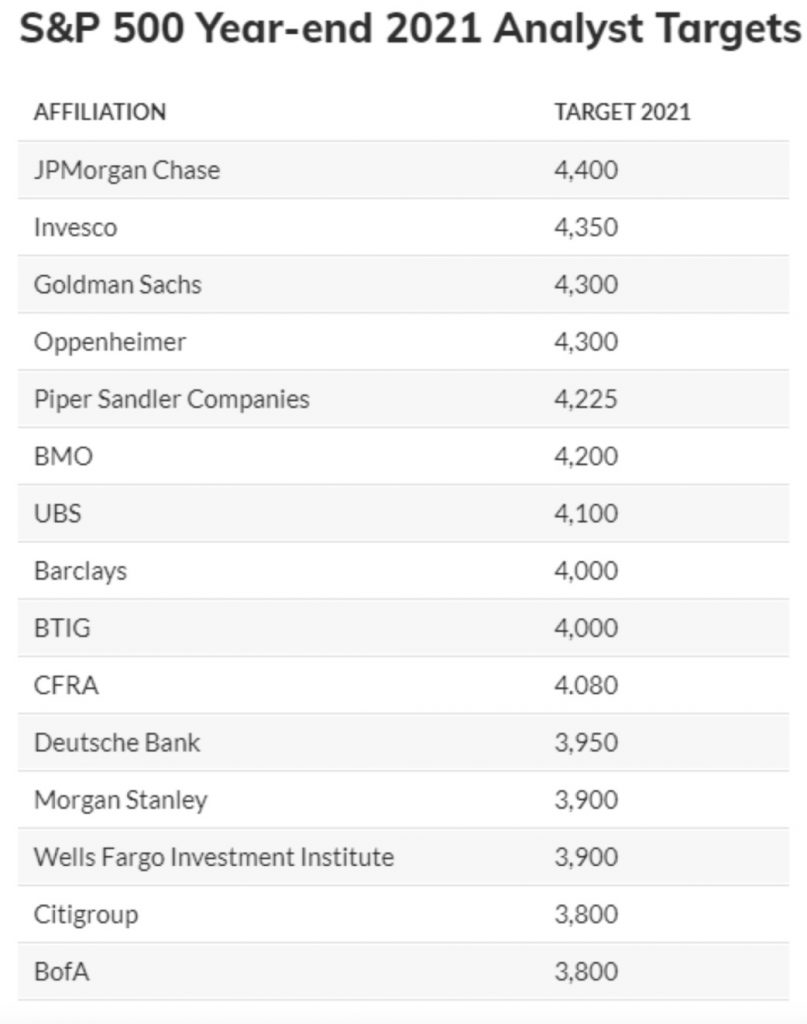

Line ‘em Up to Knock Them Down

Back in the day, we used to keep track of the big Wall Street shops’ year-end forecasts for fun. At the end of the year, we would do a little comparison to see how the predictions panned out. We stopped keeping track because the results continuously looked…like the chart below. The S&P 500 is trading today around 4700. It crossed the highest year-end estimate of the group in July. Not great. The takeaway is something you’ve heard us say many times – even the best and brightest minds, with all the resources in the world at their disposal, don’t have a clue as to where the market will be twelve months forward. Another reminder that process and planning are more valuable than prediction.