Happy Fri-YAY, fam! We have lots to be thankful for this week as the reports and visuals out of Ukraine continue to be awful (and sad…and horrific…and tragic…all of it). We talked around the issue last note as market impact was relatively muted, and we were hoping for a quick resolution. Clearly that wasn’t in the cards so we will explore the topic a little more as it relates to the near and far investment landscape.

First, let’s go to the board for a quick reset. Year-to-date, the S&P 500 is down about 7.4%. Not-so-surprisingly if you read last week’s note, it’s up about 4% since Russia initiated their invasion. If you would have sold weeks earlier while Russia was staging troops on the border, you’d be even. We can file that in the captain’s log under, “market timing is a fool’s errand” and move on.

The NASDAQ index has been a total WOOF in 2022, down 14%. In the NASDAQ we find friends like Amazon, Apple and Alphabet but also some three-thousand other stocks that are most heavily weighted in technology and tend to be newer publicly traded companies. This index peaked a week before Thanksgiving and has the look of ski slope since. Fortunately, we have very little exposure to this index, outside of the names above, but it is a data point to consider when begging the question, “so how is it going, American economy?”

The real story continues to be the interplay between interest rates, inflation and the bond market. The quick view of the American bond market is something called the Bloomberg-Barclays US Aggregate Bond Index (how fancy) and that puppy is down about 5.45% in 2022. Now that doesn’t sound terrible but think of it as a 20-25% drop in stocks. The only way for that thing to get back to even is for rates to go down and the odds of that are about the same as your March Madness bracket being perfect.

This week the Federal Reserve finally popped the top on the Pringles can of interest rates, raising them 25 basis points. Speculation is all over the board in terms of how many more rate hikes we will have this year. Conservative estimators see 2-3 more while others believe that since the first one was “popped”, they “can’t stop”. There are even shops on Wall Street predicting as many as 10-12 rate hikes (LOL).

This is where we get back to the layer of complexity the war in Ukraine adds. Let’s first remember this: markets are in their current state for two simple reasons – 1. FREE MONEY during the pandemic and 2. inflation as a result of the pandemic. It makes sense logically. A deadly global pandemic calls for extreme measures to “keep the lights on” so the money printing machines didn’t stop. This keeps demand for goods high. The goods aren’t being made because of lockdowns and that gets you inflation. Well guess what war does…yep, it requires more FREE MONEY and strains supply/demand leading to more inflation. If there’s ever been a time for the True Detective season 1 quote, this is it – “time is a flat circle”.

So as Chair Powell and the Fed shut down the free money machine and start to raise rates in the middle of a war that the US is very involved in financially, it reminds one of a Public Enemy lyric, “get up, get down”. Get those rates up ASAP, Fed, because you might need to bring them back down – a very difficult terrain to navigate. With all of this as a backdrop, we expect the second quarter to continue to be a grind. That’s not necessarily a bad thing as you can get there from here.

High Note Quick Hits

The Russ Belt of Eur-Asia: Sanction City

The Russian economy is only the 11th largest in the world by GDP. You can argue that it is much more important than 11th based on the vital commodities that they control and export, but it pales in comparison to the US, China, Germany or even California. But they have oil and they have nukes and those don’t exactly show up in GDP.

The West’s economic sanctions and number of businesses voluntarily choosing to pull out is something to behold (see the graphic below). Putin has made the comment that the West is trying to “cancel” Russia, using the vernacular of the times. He’s not wrong. As the opposition governments slap on sanction after sanction, the companies want nothing to do with the Russian Bear. It might be too early to call WW3 but it’s easy to see that Cold War II is fully underway.

The sanctions back and forth to this point are basically stealing. The Western banking system has locked up Russian reserve funds and repossessed yachts. Russia has decided to just keep a fleet of commercial airlines on lease. The US and UK have banned Russian oil imports but that is more ceremonial than crucial. The “big one” the West is sitting on is banning oil and natural gas into the European mainland because they are very dependent on it. If they do ban it, then we are most likely in WW3. At that point, Russia will really have nothing to lose.

The most tossed around estimate of GDP impact, based on current sanctions and exits, is a 7% loss. That doesn’t sound like a lot but think about it this way: it’s about double what the US declined during The Great Recession. It’s a big deal. Add to that the Russian population losing access to Western companies, and it will be impactful over time. Remember back in the Soviet days, not being able to eat Big Macs and wear Levis was a powerful force. Hopefully, cooler heads will prevail.

Ever Seen a Bear Trap?

In market analysis, there is an agreed upon definition of a “bear market”. Twenty percent down from peak and you are there. It gets a little confusing because you can have short-term bear markets in the middle of longterm bull markets and vice versa. So, it doesn’t really tell you a whole lot in terms of what will happen tomorrow, it’s simply defining what is happening today – as in, the NASDAQ Composite Index has declined 20% from peak and is in a bear market today.

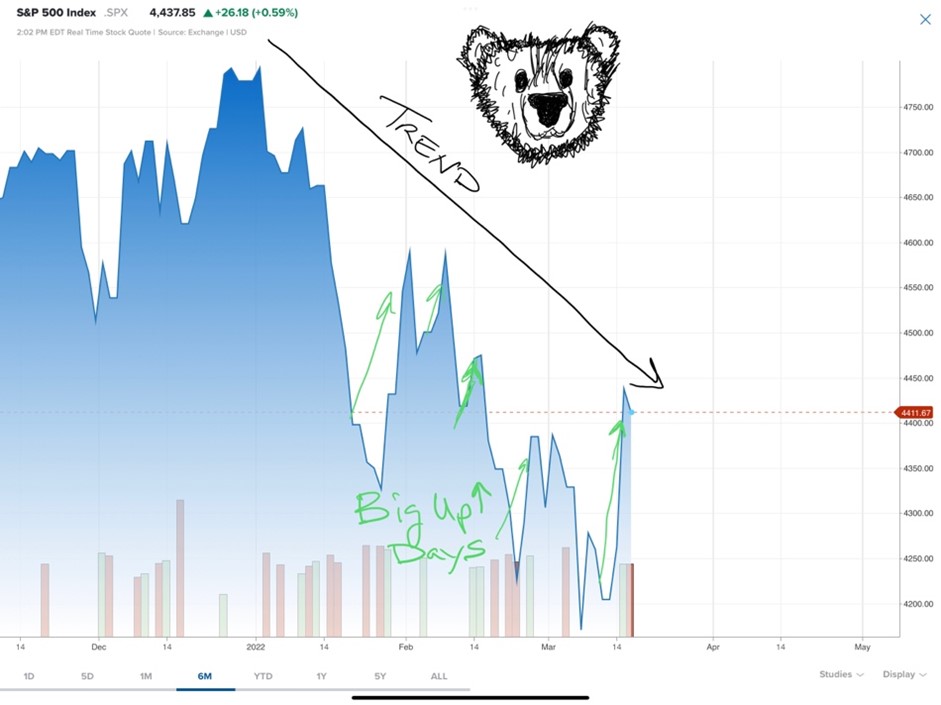

One tricky characteristic of bear markets is the occurrence of violent rallies to the upside. In a bull market, you tend to see small positive gains each day – just a slow and steady move to the upper right corner. In the bear market, you get positive days of 3% or 4% relief which can lead to taking your eye off the ball. For the bear to fully go into hibernation, you are looking more for a period of sideways market movements. After treading water for a while, the bull can come jumping out of the shoot.

Here’s what that looks like in the S&P 500 year-to-date: