Happy Fri-YAY, earth people! Hopefully, everyone has enjoyable plans for this fall weekend. Before we get into it, we want to recognize that there are quite a few readers of this note that own property and/or live on the west coast of Florida. The photos and stories of the havoc inflicted by Hurricane Ian are devasting. We are keeping you in our thoughts.

In turning out attention to the wild and wonderful world of investing, we are sharing an internal piece from earlier in the week that went out to the High Note team to keep them up to speed. You’ll notice the writing is a little more succinct (read: not as fun). It’s really a quick weekly update to hit on the main topics driving the inter-day moves in the market. These “drivers” aren’t going away so we will continue to explore them in the notes to come. Now that our course is set, lets pull the “remove before flight” tags and blast off.

We are and remain positioned defensively but are getting a little closer to adding more risk as the market returns to the lows of June. You can overlay this round trip back down with the currency trade and see a substantial correlation. The US dollar hit peak strength in June before easing throughout the summer while stock markets went up. With the recent Fed rate hike, the USD sharply rose causing stocks to sink. Right now, the USD is worth more than the Euro and it is the strongest it’s ever been against the British Pound. These currency moves reflect the overall sentiment of the world is most likely in recession, it will be worse in Europe than in the US, inflation can only be stopped with additional rate hikes, rate hikes by definition slow economic growth and in times of uncertainty, the highest quality currency becomes the safe haven (USD and US Treasuries).

Always good to remember that the stock market is a predictive mechanism – as in, investors are making their predictions about the future. As we get back to June lows and perhaps beyond, it’s building in the worst-case scenario for the near term just as it was building in the best-case scenario when it peaked in August. Both extremes are always possible but not likely. Most likely is something in the middle ground where we grind sideways for the next 6 months.

Remember, we know from behavioral finance that the general public sentiment is almost always inverse – as in, if randos on the street think that it might be time to get conservative, it’s probably the time to get aggressive. Whereas we (as professionals) were feeling the need to get more conservative when stocks were peaking on 8/15 so we were taking risk off the table and adding treasuries paying over 4%

HIGH NOTE HITS

ETFs: The More We Learn the Less We Know

Have a favorite stock you like so much you want a double return?? Want to bet against Tesla and make (or lose) 3X if you are right? Well, does the investment community have something for you! Dripping with oxymoron flow, a single-stock-ETF is what you would guess – an exchange-traded fund with…yep, only one stock. And why would you need such a thing when you can just buy the stock? Fair question. The answer is because you want to make MONEY, lots of money. Said differently, you don’t like taking risks, you love it. The purpose of the single-stock-ETF is to use leverage to outsize the return of a single position. Back in the Olden Times, like six months ago, if you wanted to do such a thing you would have to go through the trouble of adding margin on your account or buying options. But that’s no fun so in stepped savvy investment institutions to remove any barriers between investors’ appetite for risk and the all-you-can-eat buffet.

These products have rapidly increased in availability and popularity in the last year. Unfortunately, many individuals that get involved in such things don’t really understand the risk. In the sideways and down market of the past year, it’s an easy way to make money evaporate. You can read more about the burgeoning business here.

The Simulation is Real

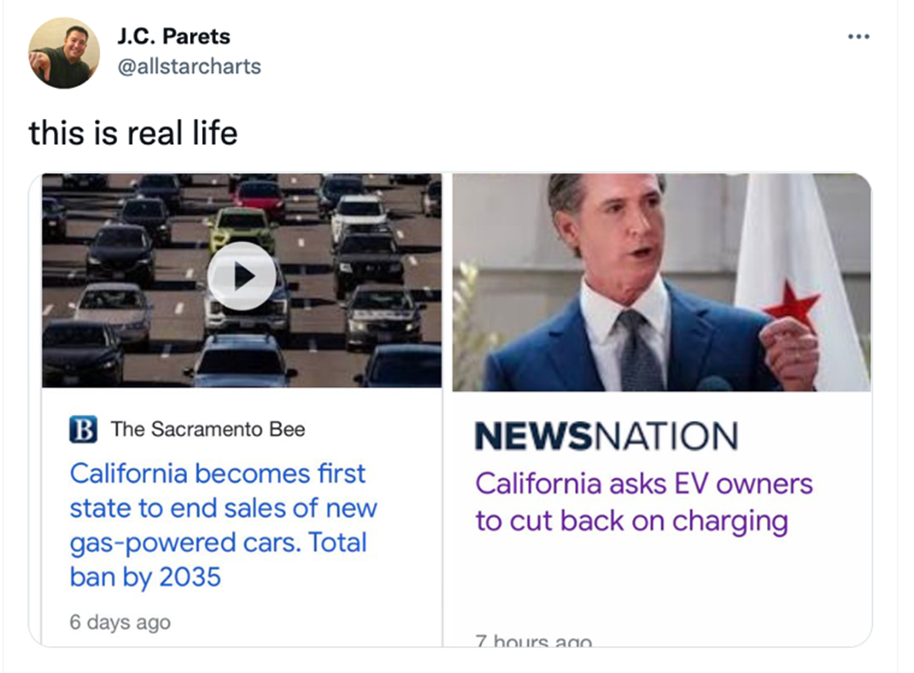

In these strange, strange times we can at least count on the internet to come through with a little humor. This recent rush-to-EV and the passing of the Inflation Reduction Act (which does NOTHING to truly address inflation) are causing additional near-term inflation but that is a topic for another day. In the meantime, irony wins…