Happy Fri-YAY, e’rybody! We hope that your Fall has been pleasant and perfectly pumpkin-spiced. The wild and wacky world of finance has not been short of headlines this “snuggle season” so we will catch you up to speed on what we are seeing and the thoughts rattling around in our old jack-o-lantern heads. Let’s get it.

Geo-political issues influence the markets less than we think (or maybe hope). One could easily assume that the tragic loss of life in Israel and the Middle East over the past two weeks and the potential for further escalation would cause markets to sell off. Perhaps, if the markets were more sensitive to human events, we would have a better world with less suffering but that’s just not how it works. Even as the Russia-Ukraine conflict grinds on in awful, World War One like conditions, the global economy chugs along in the shadows. Regional conflicts can move commodity prices and influence currencies which play a role but not in a meaningful way. Or certainly not in a way that feels equivalent to the horrific images coming from Hamas’ attack on Israel.

So, if that’s the sad news, the good news is that U.S. Presidents don’t matter either. Like, really not at all (hi-five emoji). The data has been parsed a bunch of different ways and essentially no correlation exists between stock market returns and the party of the President. Historically, year 3 of a President’s term has produced the highest returns but it doesn’t matter if it was a Democrat or Republican. This is a good reminder to file in the logbook as we move into the silly season of the next presidential cycle. We will all need to hear it again in the spring, summer and fall as this election cycle sets up to be…WILD.

Thanks to the hard-working folks in the U.S. House of Representatives we are getting an answer to the age-old question, “does the stock market care if there is no Speaker of the House”? So far, it doesn’t really appear that it does care. However, you must appreciate the thoroughness of the Republicans, going above and beyond, seemingly hellbent to test the absolute limits of this question. As of late Friday afternoon, there is still no speaker or even a viable candidate for said role. The dysfunction continues in DC but that’s not really news at this point is it? How bad can they fumble the ball with this? It’s hard to say but let’s assume their talent for chicanery is higher than our tolerance for it so hopefully it gets resolved sooner than later.

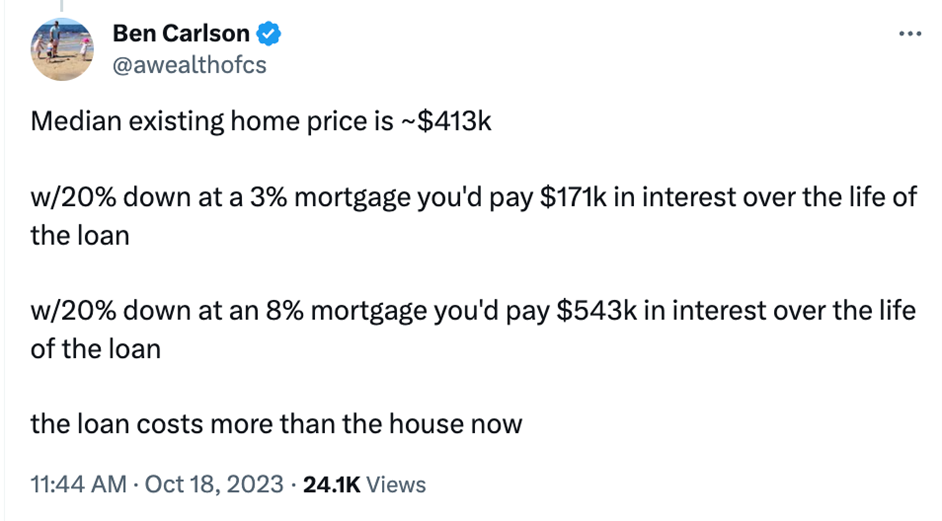

Inflation and interest rates are still the biggest market factors in 2023. Stocks had a good first half of the year but have tumbled and gone sideways since July. Interest rates have persistently increased, and inflation just doesn’t want to go away. As we have mentioned before, this is a 40-year trend reversal in interest rates. Maybe it sounds like a bigger deal than it is but it’s certainly changing the fundamental underpinnings of the economy in real time. Almost every day, there’s a new [insert time frame] rate back to its 2007 or 2006 levels. A few have even gotten back to their 2000 level. A notable rate reaching back to 2000 levels is the 30-year mortgage rate which topped 8% this week (we did it, Joe!) We ran the calculations of what 8% could or should mean to house prices previously but here’s a reminder courtesy of Ben Carlson:

Pay more in interest than the price of the house? Well, that’s not fun. Japan recently played around with the idea of 100-year mortgages because of high rates, high prices and a stuck housing market. That feels extra, but who knows, maybe it’s the future. Strange times produce strange ideas.

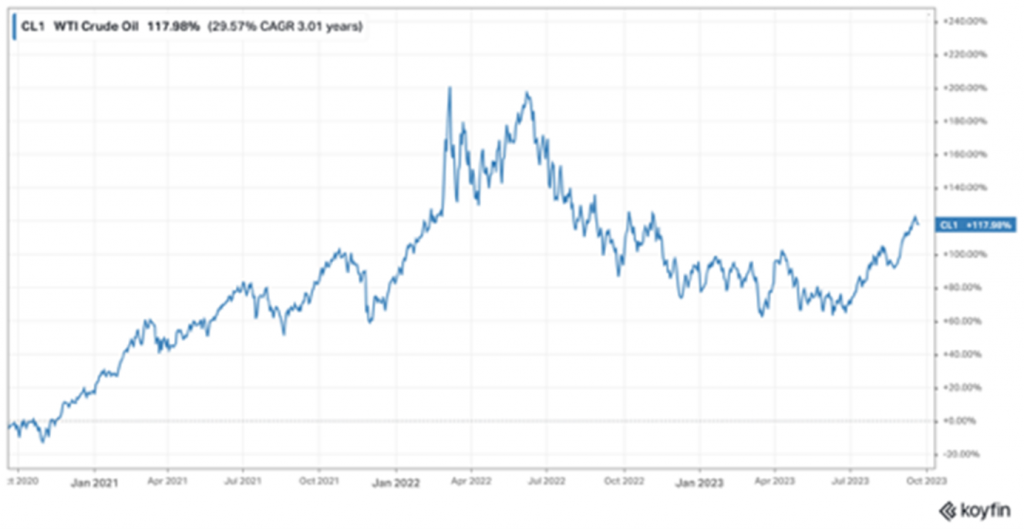

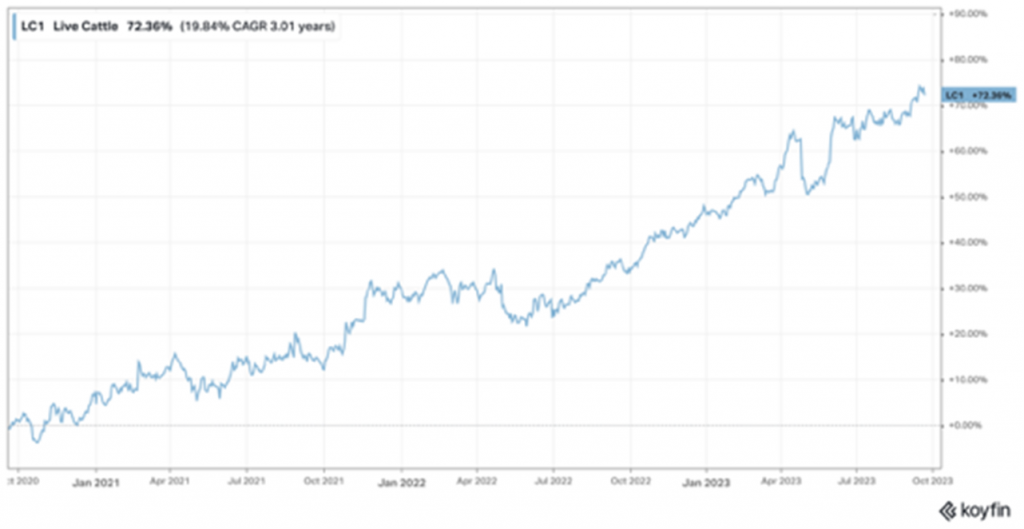

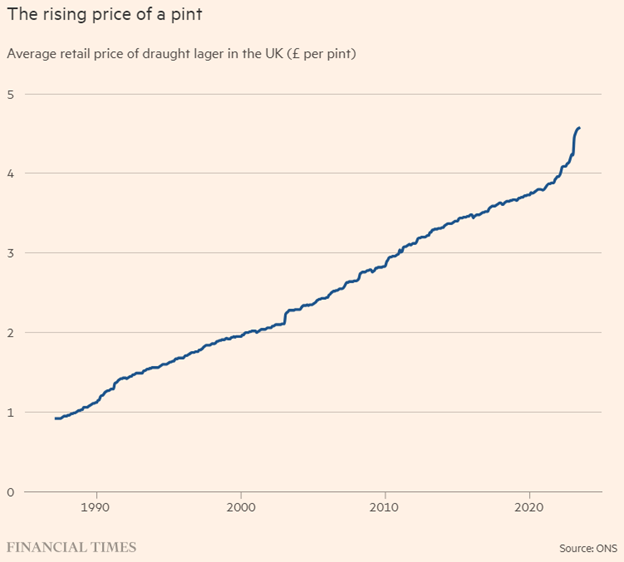

Jumping back to the inflation topic, we can see from the charts below that some goods are continuing to move hard to the upper right. Commodities like oil, coal, sugar, cattle, olive oil and even orange juice have been moving higher (pint prices in the U.K. reached all-time highs, oh my). Now, before you say that these commodities are “cherry picked” for effect and not all goods are going up, let us assure you that they are indeed “cherry picked” for effect because that’s the point. That’s the little devil that is inflation. It’s under control or descending in some areas while popping up in others – like a bad brush fire jumping around in the wind – it is difficult to declare victory.

For pint’s sake, how can we afford this?

Quick reminder on the interest rate-inflation connection: the Federal Reserve no-likey inflation above 2% and they will raise rates until inflation gets back to 2% or something breaks. Some regional banks broke in the spring but those weren’t big enough to be considered a “break” by Fed standards. Depending how you measure it, inflation is still nowhere near the 2% desired level, so rate increases are still on the table as is the idea of higher rates for a longer period. Typically, commodity and interest rate cycles are longer than a couple of years. As mentioned, the last interest rate cycle was forty years of rates going down. Commodity cycles are often 8-10 years so history would suggest this current regime that started in 2021 is probably here for another 5-8 years.

Chair Powell spoke this week and did his best high-wire act of saying that the economy is “good and strong but inflation is too high because oh gee wouldn’t it be nice if everyone didn’t have a job and wasn’t spending money that keeps pushing prices higher because then we wouldn’t have to hike rates and create unemployment as we really don’t want to create unemployment but because the economy is so strong we probably have to because we could have taken rates up much earlier but we really didn’t want to because well we didn’t so deal with it but the strong economy and jobs, etc.” Regardless of the Chair’s eloquent posturing, all signs, at the moment, point to rates increasing.

Longest-story-ever-short: our investment outlook for the next year is mostly unchanged. These are not bad market conditions, just different. It will be choppy at times for stocks. Rates on money markets and treasuries are over 5% and seemingly heading higher which sets a very nice portfolio baseline. Valuations on stocks have come back to reasonable levels which is helpful for long-term growth. There will be new opportunities and there is always a path through. Overall, this year is still setting up to finish very positive which is nice to see.

That’s what we have for today. As always, we love to hear from you and are more than happy to discuss investing in further detail. All the best.