Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

The trading week is over and oh what a week is was! While this has not been a very positive week in the stock market, I do want everyone to know that this isn’t a surprise to us, and we have been positioning accounts for something of the sort. I do not mean that this isn’t a surprise in that we were predicting it – definitely not – but as the market continued to make new highs last Fall and early this year, we have been making some subtle moves to prepare for times like these. In terms of investment positions, we have been heavier on cash than normal, we have kept bond exposure to high-quality credit and we have been light on both energy and emerging markets. For clients taking money out of their accounts on a regular basis, we have been getting further ahead with the cash needed for upcoming months in safe vehicles. While these things don’t make all the short-term paper losses go away, they do mitigate the damage significantly.

I have three sections to this note: High Note Actions, What You Can Do and Market Charts with Commentary

High Note Actions:

We certainly do not predict short-term market movements. Instead of speculating on what might happen, we go to our playbook on what needs to be done. In markets that are moving down, there are opportunities (believe it or not), just as there are opportunities when markets are moving up. They are different opportunities, but very vital to long-term investment success.

- Tax Loss Harvesting: One of the things to do is harvest any capital losses, which we have completed. This doesn’t feel like a “win” in the moment, but down the road it helps immensely with managing taxes (not just next April, but in retirement as well).

- Cash to Work: Additionally, we did put some cash to work that has been waiting for such an opportunity. When investing cash in a downturn, we take a dollar-cost-average style approach; i.e., we aren’t going to predict a market bottom, but we want to start getting it to work after significant pullbacks have taken place.

- Opportunistic Rebalancing: We are not trading accounts back to original targets, so the word “rebalancing” is a bit of an overstatement. What we are doing is taking advantage of what’s available – selling some bonds that have been very positive this week, buying some positions that have been beat up and adding stocks here and there that have come down to an appropriate buying range. This is a very simplified explanation, but know that we working to reduce exposure where we can while picking up any advantage where possible. The technical jargon explanation is that we are reducing bond duration, buying US and international equities outside of the energy and manufacturing sectors, and still holding off on emerging markets and commodities.

What You Can Do:

There are a couple of things to consider given the conditions of today.

- Move Cash: Any cash that you have been squirreling away, now is a great time to get it here. We will work diligently to get it invested as opportunities continue to appear.

- 401(k) Contributions: Some people end up reaching their 401(k) max late in the year or with the last paycheck. If cash flow allows, increasing that slightly to get it in earlier this year makes sense.

- Consider Mortgage Refinance: This is only for those who have considered refinancing their home in the past and put it off or decided not to do it. Mortgage rates have gone lower with the 30 year around 3.49% and the 15 year near 2.95%. For the 30 year, this is getting back to the historic lows of 2016. With interest rates moving down sharply over the past week, the trend suggests these will move lower (see charts below). If this applies to you, please let us know as we can help run the analysis to determine if it makes sense.

- Don’t Stress: If you are feeling stressed, call us. We can talk specifically about your situation or the investment market in general. Unnecessarily worrying doesn’t do anything but make it worse.

Market Charts with Commentary:

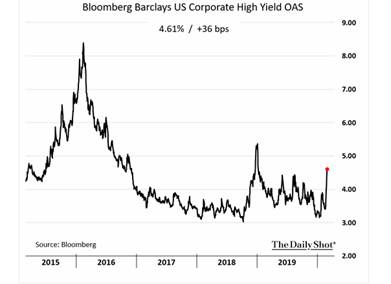

Credit Quality: You’ve maybe heard the adage that the bond market is ahead of the stock market in pricing risk. This chart is one of the ways that we examine how the bond market is doing just that. Without getting too into the weeds, this chart tracks the yields on corporate debt. Stated another way, the interest rate that companies must pay when they issue new bonds. When the bond market is nervous, the yield goes higher. As you can see in the chart, we are still under the rates that we saw in late 2018 and nowhere near 2015-2016 levels. The recent move up that we have seen has been controlled and subtle, by comparison, to the past.

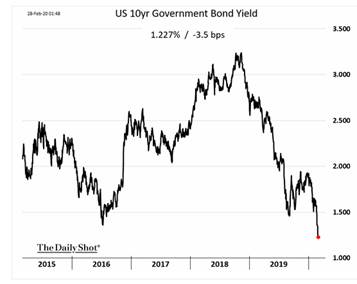

Government Bonds: Interest rates on both the 10 year and 30 year have moved down significantly. This means that sellers of stock are buying these conservative assets. This isn’t always the case in downturns as we can see interest rates hold and the sellers go to cash. This is also the visual of why our fixed income positions and had positive returns this week (when interest rates go down our holdings increase in value).

Mortgage Rates: Could we see 30 year mortgage rates price down to 3%? It doesn’t seem out of the question. This will help the real estate market continue to stay liquid.

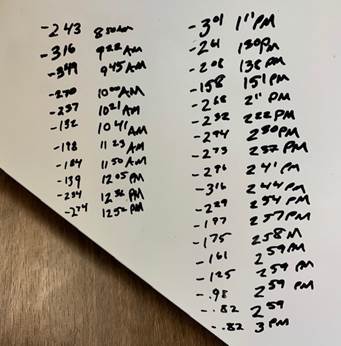

Daily Market Moves: This is more for fun than anything, but it does show the volatility of today and how timing the bottom is impossible. When I am working on accounts, I will sometimes write down market levels throughout the day while waiting for screens to load. If you can work through the handwriting, you can see the level of the S&P 500 at various times throughout the day. For example, the first entry on the left is the market opening down 2.43% at 8:30am. At 9:45am it hit -3.49% and then recovered to -1.32% less than an hour later. 2:44pm marked the worst of it for the afternoon before recovering substantially in the last fifteen minutes of trading. The NASDAQ exchange got all the way back to positive right as the day ended.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.