Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Greetings, High Note fam’! As if times are not strange enough, we can add Minnesota Easter Sunday blizzard to the list. Perhaps it’s Mother Nature’s way of doing her part in promoting social distancing. Speaking of which, it does seem as though the tide is turning in spots. On Sunday, New York state reported the fewest new hospitalizations for coronavirus related illnesses since they started tracking – this is very good news. Clearly, there are still more questions than answers on how any of this will play out, but signs of improvement of any size are welcome at this point. We will get to some of those questions and more below, but first let’s do a quick reset.

Last week was holiday-shortened with the markets closed on Friday. The US stock market finished its homework early, skipped class on Friday and still posted one of the best weeks in history finishing up over 12%. Since March 23rd, it has rallied from the depths of despair to close at 13.65% down year-to-date. In some ways it feels much worse than that, right? We can answer with a resounding YES mainly because of the larger questions still looming overhead. Sharp, positive rallies are old hat in bear markets, so we won’t fly the “all clear” banner yet, but they do provide opportunity for us to do some rebalancing and upgrading of positions. The bond market was also positive with rates gently moving up and risk indicators moving down. From this perch, it appears that the market is in more of a wait-and-see pattern than trading with firm conviction.

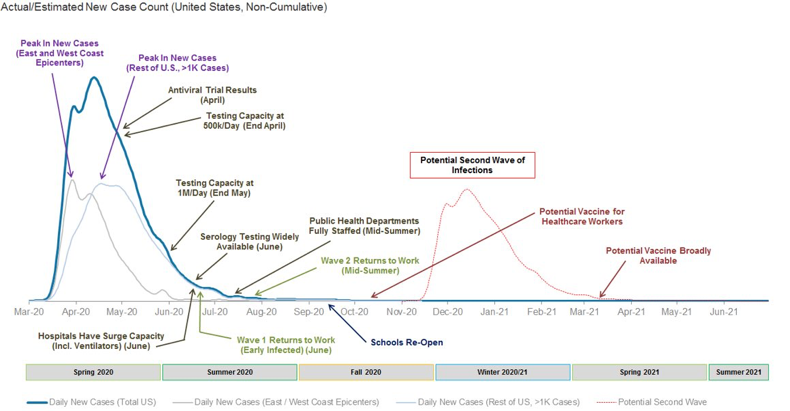

The crucial piece of information in sorting through the financial disturbance is WHEN and HOW the economy will reopen. Only then can some of the numbers move from wild-and-crazy-guesstimates to sure-to-be-off-estimates. They seem like the same thing, but they are not, and they will guide a new pattern of market movement. In terms of the “when”, we have politicians making assumptions, but there isn’t anything resembling a consensus. The White House is set to announce a “reopen counsel” this week which could shed some light. Our friends at Apple Corp had stated a couple of weeks ago their US stores would stay closed “for at least a month”. On Thursday, they made another vague statement of “another month” which puts their target closer to mid-May. As investors, I think the “how” is more important to the overall picture. Unfortunately, there is little direction to hold onto here. Will restaurants, bars and movie theaters be “open”, but with 50% capacity restrictions? Is the economy really “open” if it’s completely different than before? What about the businesses that have folded and won’t reopen? Delta eliminated all middle seats on their flights so when we will get to be smushed between two strangers again? More questions than answers…Morgan Stanley put together an interesting sample timeline of the economy intersecting the virus that we have included below with some thoughts. These crucial questions are at the forefront of our research on a 24/7 basis.

High Note Quick Hits

Cash Money:

- Worth stating as a reminder: if you have any new needs for additional cash in the next 6-12 months certainly let us know. The more time we can prepare for such things, the better. This is true under normal circumstances, but even more important today.

- Opposite, if you are sitting on additional cash that’s not going to be spent in the next year, it makes sense to have it here on standby. Savings rates and money markets are trending to historic lows, but there is a delayed effect. Basically, whatever rate you are seeing published today is not going to hold. There have been and will be opportunities, but the windows close fast.

Volatility Causes Volatility Which Causes Volatility:

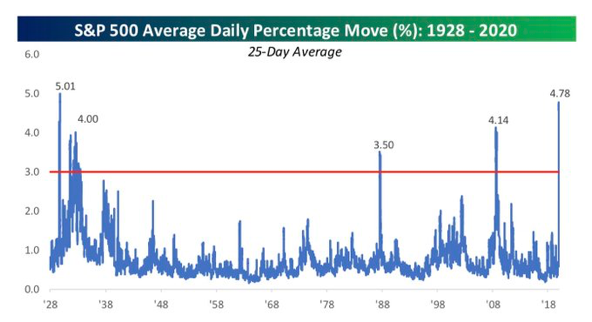

- Wondering what the market is going to do this week? The odds would suggest that in this high-volatility regime the moves up and down will continue. When the market is flip flopping around it can feel like the moves are bigger than they have ever been. Well, this time we are close. The average daily market moves (up and down) that we are experiencing now are second only to a period in 1929.

Black Gold/Texas Tea Truce:

- On Sunday the oil price war got put into a timeout with the OPEC nations, Russia and the US figuring out a way to reduce production by millions of barrels. Wow, I bet the price of oil shot straight up? No. Not at all. The market understands that there is clearly an endless supply and demand is nowhere to be found. Overall, this is helpful as it should put more of a firm floor on the price and allow the major oil companies to catch their breath and work on a path forward.

Morgan Stanley Virus Timeline & Economy Reopen:

- Here is the timeline I referenced above. This prediction is more or less a first wave returning to work in early June and a second wave in July/August. This is working under the assumption that we have testing capabilities of 500k per day. With 140k tests completed on 4/12, it seems that we are already off the pace necessary to achieve that number. For certain, we know this timeline won’t hold true, but it’s very helpful to use as a jumping off point for one of the many scenarios that could present.

What We Are Optimistic About:

- Projections: Studies are reducing the projected number of deaths.

- Participation: Social distancing seems to be working in terms of buying more time for therapeutics and a potential vaccine.

- Innovation: Bio-tech firms, drug makers and tech companies are in complete OVERDRIVE working at a break-neck pace on treatments, containment and innovation. While the goal is narrowly focused on the coronavirus at the moment, this fast-forwarding of work could lead to some positive ancillary benefits on the other side.

- Uncle Fed: The Federal Reserve is committed to doing anything and everything they can to mitigate the financial fallout. Let’s use this caveat, we are optimistic about these aggressive actions in the short-term, specifically to stabilize the economy. Whether we are optimistic about how this plays out over time is a discussion for another time.

- University: College tuition correction on the way? As everyone knows, the annualized rate of college tuition increases over the past 20 years have been incredible (unsustainable). We will keep an eye on this, but a couple of things are starting to show up. Stanford announced they were permanently cutting management positions. Harvard drew on their line of credit. Both institutions have billions of dollars in endowments. However, they are seeing a difficult path forward with international students potentially limited and a shift in the economy. We could be heading toward a significant reset.

What We Are Non-Optimistic About (let’s not say the “p” word):

We mentioned in a previous note that the stock market is a forward discounting mechanism which is why when a company makes no money for a month their stock doesn’t go to zero. The “watch list” items below are not factors in the short term, but will play a vital role in overall economic stability and growth down the road. Whether they directly change corporate earnings or apply pressure for increased taxes, the health of these items have an overall influence on GDP and economic prosperity. They are lagging issues that will primarily be sorted out based on the length, or duration, of the shutdown.

- Real Estate: residential, commercial, US, global, et al. 68% of Americans paid their rent on 4/1. Is it ever 100%? No, there are always those late and behind. However, 68% is a bad number. As a reminder, the property chain is renter – landlord – bank – mortgage-backed security – credit default swap. The mortgage-backed securities are owned by big institutions like pensions, hedge funds, mutual funds, private equity firms, etc. If there is a break in the chain, the entire thing falls down or the government steps in. On this topic, JP Morgan announced they are tightening up their mortgage borrowing standards – the harder it is to get a loan the fewer buyers there are in the marketplace.

- Health Care: Hospitals are losing crazy amounts of money. Add them to the top of the list of those that will need assistance. The list is getting long (in no particular order): unemployed people, small businesses, airlines, cruise companies, US Post Office, municipalities, pensions, states, etc.

- Pensions: They are going from bad to worse – not only are most of the world’s pensions underfunded, but safe haven returns like US Treasuries are so low that they are being hit from both sides.

- Time: Businesses are running out of patience. Going back to the WHEN and HOW questions and having no answers, we are seeing businesses shell up. Disney announced they would lay off 43k employees “indefinitely” as they struggle to have a timeline for when their parks could reopen. Originally, they were in the mode of keeping everyone employed in the interim, but as the days add up this gets harder and harder. Locally, we are starting to hear of restaurants that have waived the white flag and stated their intentions to be done permanently (Egg & I, which has been open for 40 years, made this known over the weekend).

From us to you…

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.