Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

That’s a wrap! Another week is in the books with the financial markets closing in a relatively calm manner. Calm in context, of course, as Friday was still over a full 1% move in stocks. It just so happens that the move was positive which contributes to the feeling of calmness. Funny how that works.

With Friday’s finish, we still have more >1% up or down days this year than <1% days which keeps life interesting. There was a lot of news this week, some good, some bad, but nothing that would indicate volatility is going away anytime soon. The highlight of the good news would be the federal government passing a new round of funding for small business loans. The lowlight of the bad news being another 4.4 million unemployment claims. These two things are closely related with the former attempting to reduce the latter.

The bond market has settled down substantially with the overall trend being rates going lower. Hard to say if this trend continues all the way down to negative rates, but it’s certainly in the range of outcomes. Speaking of negative prices, oil had quite a year this week…

At High Note, the way that we have always played musical chairs is that when the music stops the person without the chair is simply eliminated and the remaining players continue until the winner secures the final chair. This version of the rules feels widely adopted, but this week we learned that Big Oil has a whole different version of the game. The way that their game is played goes as follows: when the music stops and you are left without a chair you are eliminated AND you have to pay rent on the building for the month. On Monday, traders owning contracts to receive barrels of oil in May saw their contracts drop to -$35(sic). Wait, what? Negative oil? How? When there is a global glut of oil due to both oversupply and under demand, it is more expensive to drill the oil, transport the oil and in this case store the oil. So, yes, in theory if you had somewhere to store oil in May, say like your bathtub, you could have gotten paid to take it. In practice, since oil storage is full, the holders of these contracts lost their shirts (and all their pants, socks and underwear). It’s a very odd situation, but the takeaway is that even with some parts of the country and world open for business, demand is nowhere to be found. For those keeping a log, you can add the entry “oil can go negative”.

In terms of information on the virus and economies opening, we received very mixed signals. The news on therapeutics and vaccines, just this week, is enough to fill a term paper. The summary is that pharmaceutical, health care and biotech companies are working like crazy on development, trials, scaling and production. There is still nothing solid enough to hang a hat on, but the pace is encouraging.

Without a hat-hanger, we get the impression that states are going to slow-play the opening of their economies until testing is scaled and cases are decreasing. Georgia is taking more of the YOLO approach by opening on Friday. Apparently, the idea of opening salons, gyms and tattoo shops on Friday with restaurants to follow on Monday had the support of the White House behind closed doors, but then was criticized openly the next day as “too early”. Must have been a classic case of “wires getting crossed” or maybe the connection on the Zoom call wasn’t great? Either way, all eyes will now focus on Georgia and how things go early in their attempt to open. Hopefully, the testing and health care supply machines are humming behind the scenes and they can set the standard.

We will jump into some additional details below, but as a reminder, do not hesitate to call or email if there is anything that we can help with, anything that you would like to discuss or if you are simply looking for someone to talk to while stuck at home. Thank you for reading. Enjoy the weekend!

<<< HIGH NOTE PORTFOLIO UPDATES >>>

Are You For Real (Estate)?

- In general, our portfolio models include real estate exposure as an asset class in the 2-5% range. Based on modern portfolio theory, global real estate has warranted inclusion as a diversifying element that can move differently than stocks and bonds in certain situations. As we have discussed in the previous weeks, going into this hot mess we were underweight on real estate which we quickly turned into no weight given all the headwinds in the current environment. While there are many segments in this mammoth asset class that are very dicey at moment (e.g., shopping malls), we do not want to throw the baby out with the bath water. In that spirit, we have added back approximately 1% in a custom-built real estate sleeve consisting of four names (Digital Realty Trust, Coresite Realty, Crown Castle & Century Link). The theme is cloud computing storage facilities and 5G technology. These are themes that will not only survive rough economic conditions, but thrive as online demand usage continues. Prior to the recent pullback, these are stocks we would have loved to have had in the portfolio, but the price was a little frothy.

Stocks We Own Making Moves

- Facebook: Made a couple of interesting announcements this week. First, they made a big splash by investing $5.7B in India telecom, Jio. They are using the downturn to expand their strategic reach in the world’s second largest country (source Tech Crunch article). Second, they announced on Friday afternoon that they are releasing a free video chat platform. Video chat you say?

- Zoom Video: Reported they had 300M users on a single day alone. The implementation and growth are staggering.

- Apple: Announced that they will start building computers with their own processing chips. This has been in the works for a while, but they are now moving on this to control more of the process, reduce reliance on outside firms and control costs. Hard to say if they will be able to make chips that can compete with Intel but if they can it would be very helpful to the stock.

<<< HIGH NOTE QUICK HITS >>>

Real Estate Update

- Still no hard data on up to the moment sales or price movement given the delayed effect of closings. While we wait for that, there are some things worth watching. A little over a week ago the Mortgage Bankers Association reported approximately 4% of US mortgages were in forbearance. Friday, that number has moved up to 6.4% with estimates that it could increase to 15% before it’s all said and done.

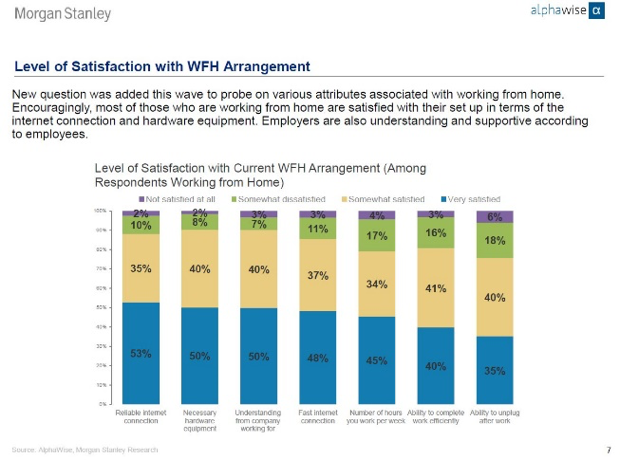

- Weeks back we suggested that companies may learn that allowing employees to work-from-home will not only be a fine short-term solution but may lead to increased productivity. We are starting to see some things that point to this. The satisfaction survey below is an indication that the transition for many is going smoothly. Also, I included an article that we believe could be a trend – CEOs reassessing their square footage needs. CEOs Rethink Office Space.

Anything You Can Fund, I Can Fund Better

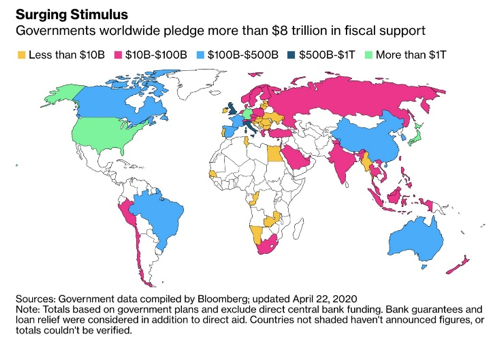

- While we spent quite a bit of time focusing on the US Fed, it’s important to point out that the record levels of stimulus/easing/bailout/rescues are happening across the globe. As you can see from the graphic below, it’s happening all over as more countries start to feel the effects of the coronavirus related shutdowns. Soon, they will need to add a few more colors as the “more than $1T” club reaches capacity – many of the powder blues will be navy blue soon (China for sure). There may not necessarily be a singular global plan, but everybody senses the need and we can feel it holding up the markets the past couple of weeks.

Europe Gets Techy With It

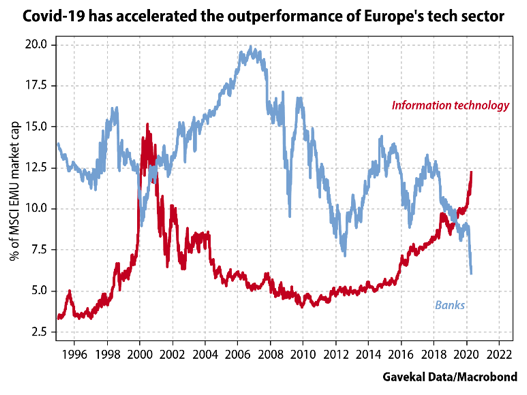

- Nobody likes underperformance. It can feel hard having assets allocated in places outside of the US when the markets here are on a tear. At the end of the day, to outperform, you must live with underperformance in spots. Europe has performed “fine” in the past couple of years, but not as well as the US. Part of the issue has been the dominance of Euro banks in the overall market share and the lack of tech. Europe has been dealing with negative interest rates for many years which makes it very difficult for banks to perform. With this recent downturn, the great rotation is finally taking place as tech takes over market share. This adds a new level of growth potential to the major European indices.

Whose Charge is it Anyway?

- Similar to the lag in real estate, we have credit cards and auto loans to consider. With this week’s claims, there are 26.5 million unemployed Americans. Yes, temporarily is the hope. While the financial demographics of those sitting on the sidelines is unknown, safe to say a few of them have credit card balances and car payments. When we think of the hierarchy of needs, we know that in times of stress, spending will go to rent, groceries, cell phone and car payments. Rent may be deferred for a month or two, but credit card balances will not get paid. Issuers are bracing for severe losses by increasing their loan loss reserves (which is step 1, step 2 is the dreaded “write down”). Capital One tripled their reserves which still may not be enough. Here’s a statement that tells you everything you need to know – model can’t compute, we have no idea, etc. Capital One Loan Loss Reserves (Bloomberg)

“Due to the nature and novelty of the crisis, our credit and economic models may not be able to adequately predict or forecast credit losses. The pace of recovery is uncertain and unpredictable.”

- On the auto loan front, 7 million Americans are at least 90 days late on their auto loans. That’s a lot, but we are still not 90 days into the trouble. Also, there’s a plot twist – this report is from February of 2019, not today. If we were playing the Price Is Right game “Higher or Lower” on the 7 million number, the correct guess is “higher”. Asset-backed securities like auto loans are bundled together and spread out around large institutions all over the world.

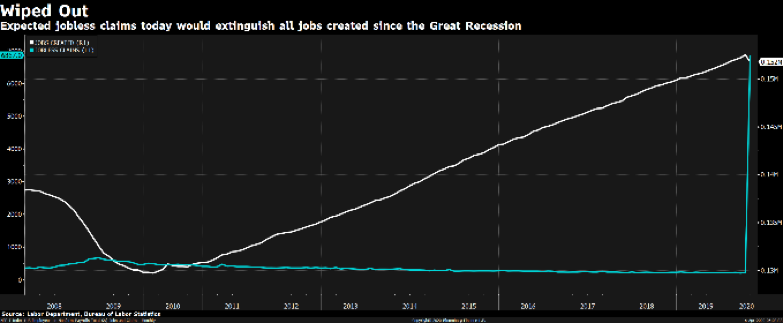

Unemployment

- 4.4 million claims this week which takes us to 26.5 million in total. This is tracking to 20-25% by May 8th. To put it another way, every new job created since the great financial crisis of 2008 has now been eliminated (graph below).

Consult a Friendly Financial Advisor

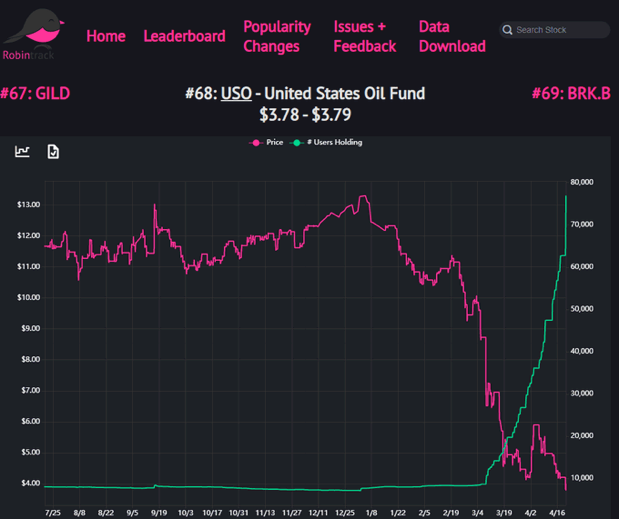

- Typically, when we hear of a massive loss in a commodity or derivative, we think of a leveraged hedge fund or a rogue trader. What’s odd about this week’s oil debacle is that much of the money lost was by regular retail investors. The chart below is from Robinhood, the hippest trading app available and most popular among investors under 40. As you can see by the green cash flow line, investors were piling into oil futures as it tanked thinking, “it can’t possibly go down anymore?” It is puzzling for sure. In general, commodity futures even if using an ETF like this, are not a place for anyone that doesn’t trade for a living. Idle hands?

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.