Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy May Day! The 78-day slog of April is done, and we welcome in the month of May coming off a [double checks notes] record month for stock performance. It’s hard to believe, but yes, the US stock market bounced back to return over 14% for the month. Given the drop in March, this is certainly no victory-lap. What we did learn is that investors have shown some patience as the quarantine continues and additional Federal stimulus/rescue comes online.

While the April stock rally was greatly needed, there is still a large amount of uncertainty in the months ahead – case in point; rent and mortgage payments are due today and we have no idea who will and will not pay. This information will start to creep out next week. Some clarity was gained by way of corporate America reporting first quarter earnings. We heard things that ranged from the pandemic “devastating” business to Microsoft reporting that it had “minimal net impact”. Ultimately the question du jour has been…

How? HOW? how? hOw? HoW? how? HOW? hoW?

How can the stock market be 27% higher than recent lows when unemployment is above 17%?

It is a head-scratcher, but the question itself reminds us of the classic idiom, “the stock market is not the economy”. Are they related? Yes. Do they always move in the same direction? Absolutely not. This has shown up many times in the past, but none clearer than now. Given the recent rally, one can say that the stock market is looking past 2020 and into 2021. That said, further sinking down from here would be no surprise. We are in a bear market and throughout history bear markets show one common element – aggressive moves higher within the cycle. These moves are a more natural reaction as things get repriced and have little to do with components of the economy like employment, production, inflation, etc. Over a longer time period like 5 years the economy will have much more influence on the market. As we sit in this divergence between the two, it is important to be patient and opportunistic which is our mission every day.

In terms of the portfolios, we have little news to report this week. We feel the composition represents the patient, yet opportunistic approach mentioned above. Rates are low, but bonds are holding their value providing a nice ballast along with the extra allocation in cash. The daily watch continues.

What we look forward to next is any information on how the reopening is going around the country. This data is going to be anecdotal for the most part, but could provide some insight on the American consumer. We did get some actual information from Starbucks on how their stores performed after getting back to business in China. What’s that saying about if you don’t have anything nice to say…? Let’s just say that the recovery in China is SLOW. But the Chinese consumer is not the American consumer, so it is an interesting data point, but not one that seems directly applicable. Our friends in Georgia, Florida and Texas will be a much better indication on the speed of recovery post quarantine. This information should start to be available in the next couple of weeks.

Let’s get into a little more detail…

<<< FINANCIAL MEDIA NARRATIVE OF THE WEEK >>>

“From Fear to FOMO”

- Monday to Thursday of this week as the stock market finished April strong, we heard a lot of talk about the lows of March being gone forever. We heard of investors scrambling to get back into the market for Fear of Missing Out. Well, that narrative did not last long as Friday sellers jumped in to say, “not so fast”. While it makes for an interesting talking point, it is a good reminder to turn off the TV and go for a walk. Kidding. But really, it is a reminder that watching the daily moves has relevance only when taken in a larger context. Could the lows of March be gone forever? Sure. Could the lows of March be back in a week? Sure. Either would be reasonable outcomes given the current state of the world. What is more important than making a guess or falling for a “from fear to FOMO” narrative is having a plan for either outcome.

<<< HIGH NOTE QUICK HITS >>>

BREAKING NEWS – GILEAD

- Just after the market closed for the week, the FDA granted emergency authorization for Gilead’s drug Remdesivir. As we have discussed, this is no cure and no vaccine, but it has shown to get some hospitalized for COVID-19 out of the hospital without needed ventilation or worse. If this can help patients heal and ease the burden on the nation’s hospitals, this is great news. You can read more here.

Sidewinder

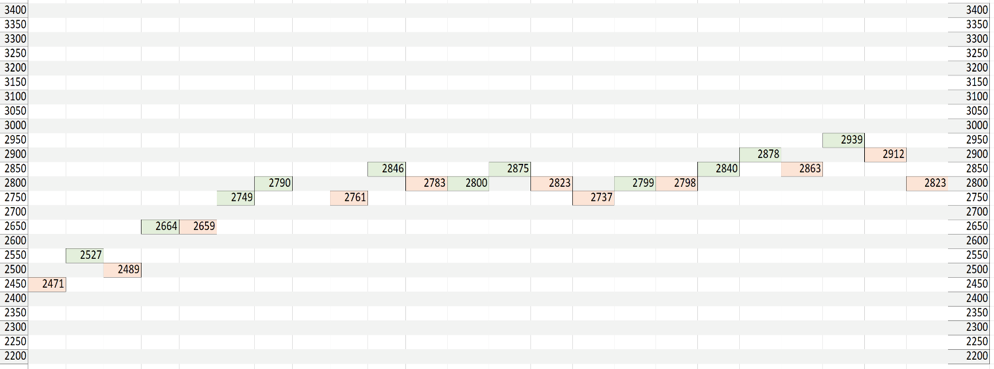

- Throughout April, the market gave a few head-fakes up and down, but mainly ran due east while having the treadmill set with a nice degree of incline. Here is the daily closing price of the S&P 500 for each day of April.

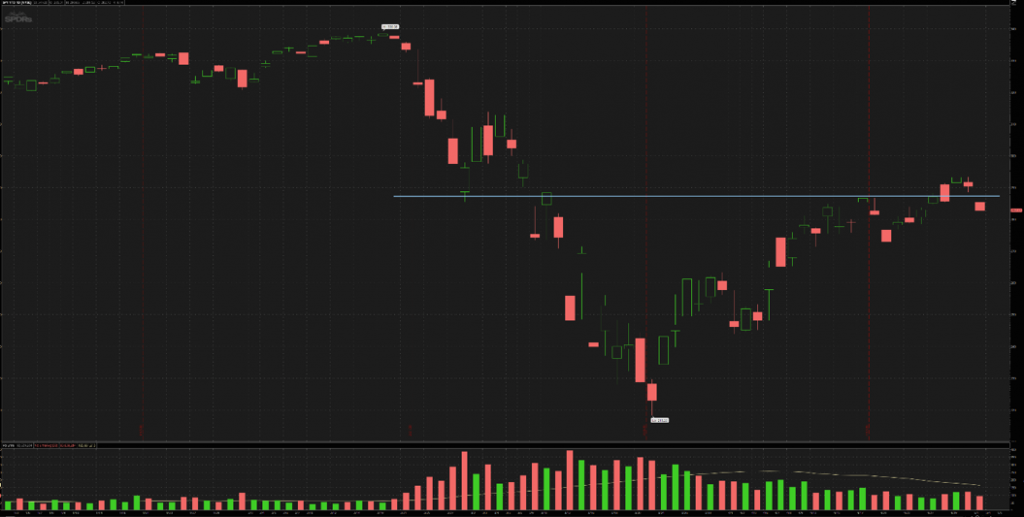

- In the year-to-date picture below, the blue line I have drawn in still shows relevance. This past week the market did poke its head above for a couple of days, but closed the week below it. One could make the hypothesis that all the stimulus injected by the federal reserve created this blue line level for the markets as we wait for more information. Notice the bar graph on the bottom – this is average trading volume on each day. Lows of March were made on very high volume why April recovery happened on much lower volume. Maybe the sellers were on the golf course those days? More likely its indicative of a classic bear rally that could lose a little steam before shooting back again.

Work from is Home

- Google announced that their employees are not going back to the office until June 1st. Never to be upstaged, Amazon came over the top and announced they will keep their employees home until October 2nd. Your move, Google. As other companies continue to explore work-from-home on a more regular basis, we like the positions related to this theme – cloud storage, software, service, broadband, etc.

What’s Faster Than Warp Speed?

- As economists and investment pundits play the role of human behavior psychologists, many point to a vaccine being needed for planes and amusement parks to be filled again. This may or may not be true, but a vaccine is key to ultimately put this in the rear-view mirror. The White House has launched Operation: Warp Speed to assist in getting a vaccine to market sooner than later. Even with the warp speed boost, that most likely puts a vaccine in play around late next summer. There is a very interesting piece on the typical timeline for the development of a vaccine and some of the steps taken to move this at WARP SPEED. You can read more here.

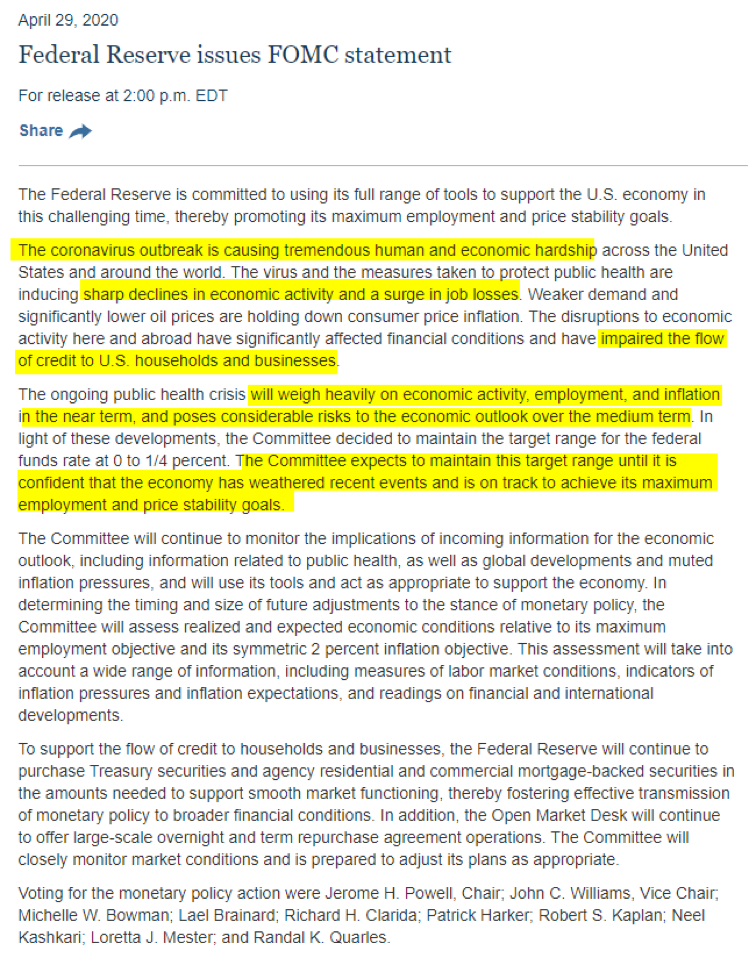

We Got the Action, but Now the Words

- The Federal Reserve of our grandparents loved to write, pontificate, consider, suggest and then maybe act. As we have witnessed in the last 60 days, this Fed acts first, writes later. In the first days of the downturn, they started by backing up banks and cutting rates on a timeline like they never had in the past. After this week’s meeting, we did get some statements from the Fed released since they have had a little time to reflect. Most Fed statements of the past are vague at best. This statement is very direct – they took the coronavirus outbreak as a severe threat from the jump and are acting accordingly. The Fed cannot recreate jobs for the unemployed, but they can prevent a banking collapse as a result of the pandemic.

Bob the Builder

- Real estate is always tricky as it mainly lags the economy, but homebuilder sentiment can sometimes lead. The Star Tribune reported very strong building permits for the Minneapolis-St. Paul area in April which is a good sign that optimism still exists in the market. Minnesota certainly hasn’t been hit as hard by the outbreak as other parts of the country which is also a factor. It will be very interesting to see if the trend can continue in May. You can read more here.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.