Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

For some of us, 2020 is the slowest moving year in our lifetime. It’s hard to even comprehend how much has taken place since last Friday, let alone make sense of it. With the disclaimer of looking at this solely through the lens of financial planning and investment management, we will do our best to summarize the key financial events and frame a high-level view of where we stand today and what we are watching in the days ahead.

Following the death of George Floyd and the ensuing civic disruption in Minneapolis, protests and demonstrations broke out in the rest of the country over the weekend and throughout the week. In a matter of days, social distancing was in the past and the country was moving to open in a rapid fashion; an additional quarantine resulting from a secondary wave of COVID becoming less and less likely. The genie is out of the bottle.

With the quarantine door kicked off the hinges, the stock market turned positive, shrugging off civil unrest, increasing estimates for the re-opening and no longer fearing a second shut down. It is this dynamic that explains how we can see stock market futures solidly up at night while the media televises citizens clashing with the police, the National Guard deploying, and looters running up and down the Soho neighborhood in NYC. The logic being that stockholders had already dismissed the financial performance of the second and third quarter, so the actions of today have had only positive influences on prices.

With Friday’s positive stock market return, the S&P 500 is now down (double checks notes) 1%. Yes, it’s still a negative number, but not a big one. Within that mix of 500 stocks, there are still quite a few that are down 20%, 30% or 40%, while others are up significantly for the year. The hardest hit industries (or “epicenter” stocks) like travel and energy are still lagging, but they did have a very strong week with more areas of the country getting back to work. The areas that we are focused on like technology and health care continue to outperform while adding a level of stability to price movement. There are still major questions to be answered about the underlying economy, so this is far from an “all clear.”

One such question is employment. The past couple of weeks the country was hanging in the 20% unemployment range with expectations for this to hover or increase. Friday’s jobs report said, “not so fast”, coming in with a positive job creation number and reducing unemployment levels. The report was so surprising that when it was received by MSNBC to put on the air the host asked if it was a type-o. You don’t see that every day. The numbers are big and moving so fast each day that it’s hard to put a lot of faith in the data, but it is good news for now.

We have some additional topics below as usual. First, we want to recognize that this has been a very trying and difficult week for the country. There are issues bigger than money and issues with lasting effects. We care deeply about all of you and want you to know that you are continually in our thoughts. We are here to help. We are here to talk. Please do not hesitate to reach out if there is anything that we can do. All the best.

<<< HIGH NOTE QUICK HITS >>>

Zoom In and Zoom Out

- Everyone’s favorite video conference tool has had an explosive run in the past couple of months. We entered the stock in the $131 per share range on March 30th. On Wednesday, this week we took some profits when it touched $220 and reinvested the proceeds into Abbvie. As we have mentioned, when we buy an individual stock we are doing so as investors, as in, we intend to hold it long-term compared to traders that intend to hold it for a short period. Well, sometimes an investment turns into a trade and vice versa. With the meteoric rise, we took the position down by 40%, so the profit is secured while retaining interest in the stock. Fortunately, we did this on Wednesday before it fell back down to around $200 during trading on Friday.

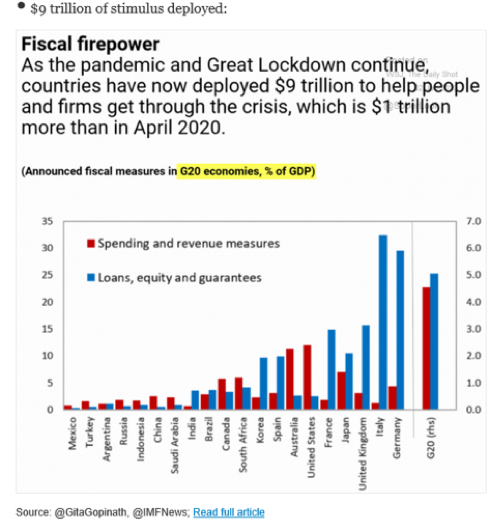

Global Stimulus: JUMBO MAX EDITION

- We spend a lot time discussing all the stimulus done in America by Congress and the Federal Reserve, but it’s not just here – it’s everywhere. About $9T (and counting) has been unleashed around the globe. Some countries are doing so with government-backed loans or direct cash infusions or a combination of both. China this week said they have more on the way, so the numbers will keep climbing. All told, this is stimulating in the short-term while creating a mountain of debt.

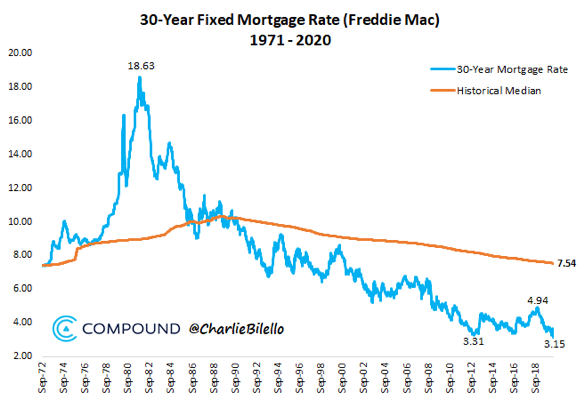

Mortgage Rates, More Like “Lessgage” Rates, Am I Right?

- Early in the week, 30-year mortgage rates made all-time lows before ticking back up late in the week. The move off the bottom is correlated with overall interest rates moving up on positive stock market returns. Rates are still in a very low range with very little sign of them moving up and out in the near term.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.