Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy 4th of July! Happy Independence Day. America, you are a little beat up on your birthday this year, but you have been through countless tough times in the past. We know that you can get up, dust yourself off and get this sorted out. You’ve done it before, and you can do it again.

We hope that everyone is enjoying a longer weekend with friends and family. We wrapped up the second quarter this week so 2020 is officially 50% complete even though it feels, at times, like the year that time stood still. The markets didn’t sit still this week posting a nice little gain even though reports of COVID case increase popped up across the country and economic indicators remain less than pleasant. We will hit on those points and more while we also keep a close eye on any interesting items that cross the tape this weekend.

Name a More Iconic Duo – I’ll Wait

- Part Batman & Robin and part Bash Brothers of late 1980s/early 1990s fame, Fed Chair Powell and Secretary Mnuchin are the “Bump Bros” at the helm of the economic recovery. This week the economic duo testified before Congress to address their attempts at super heroic policy to keep the economy moving. Over the course of two plus hours there were a few interesting nuggets, but the main takeaway was ANY & ALL. As in, the two indicated that the financial threat of the pandemic is significant enough that any and all action is up for consideration. As the country has opened (and reclosed in some parts) they seem steadfast in addressing economic issues for the foreseeable future. They aren’t letting up. They have quite a bit of power at their disposal, but they did drop a lot of hints about phoning a friend for backup. The friend, of course, is Congress and their ability to initiate further direct stimulus to the unemployed or businesses on the brink. We probably won’t have word on that for a couple of weeks, but some version is feeling more inevitable than not at this point. Until then, the Bump Bros will be on watch. Wherever we are. Sleeping or not. Lurking in the shadows.

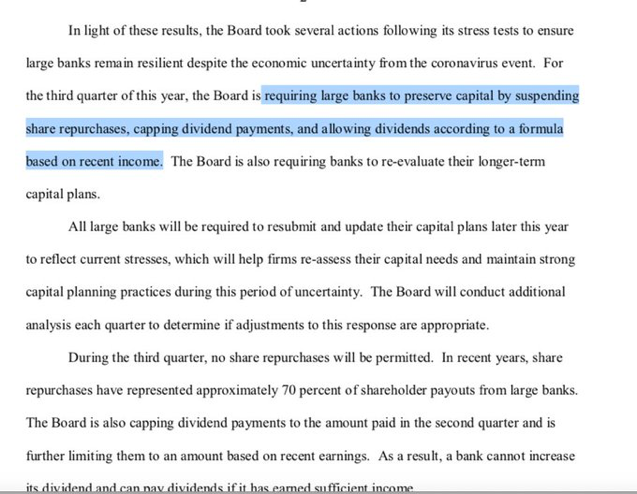

- If we had a dollar for every time we have heard, “but this time the banks aren’t in trouble,” we would have approximately $1,212 in the bank. It’s been the constant narrative. While Bump Bro Powell didn’t completely walk that back, he did make the statement below about bank guidance for the third quarter. The summary is that the recent stress-testing of the banks went well, but they want them to sit on more cash and not be careless about dividends and buying back shares of stock. It’s a slight shift in tone, but falls more into the category of the popular 2020 phrasing, “out of an abundance of caution…”. It’s worth monitoring as 2008 taught us that if the-banks-aint-happy-aint-nobody-happy.

To Be the Best You Have to Beat the Best

- As crazy as it has been in the stock market year-to-date, here is a little context. 2020 made the historical top 10 for both best quarter return and worst quarter return but didn’t really threaten the top 5 or make it close to the podium.

The American Consumer

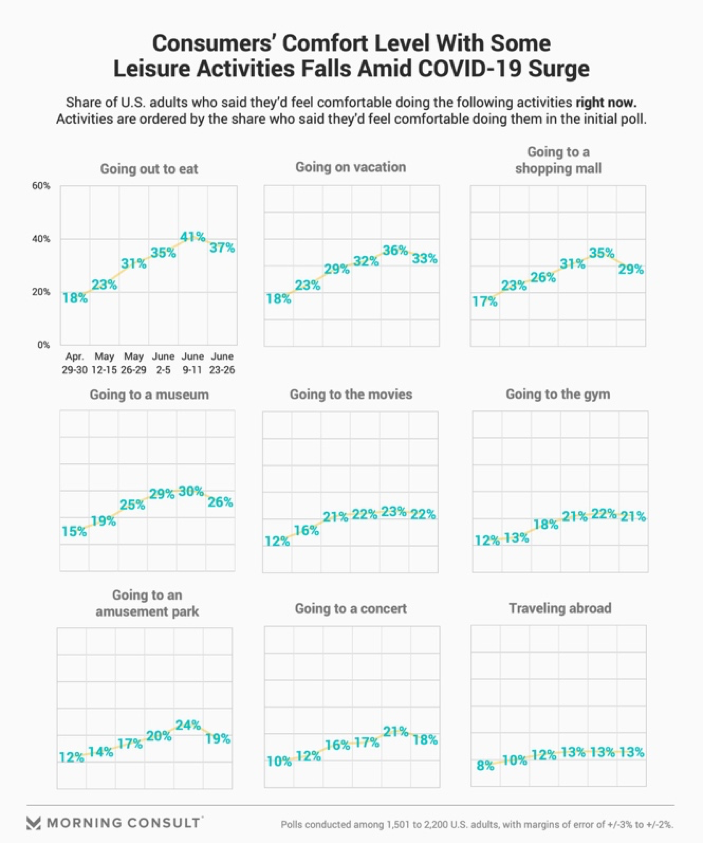

- Recovering 7.5 million jobs in 60 days seems like a lot, but then you factor 20 plus million lost almost overnight and there is still a long way to go. In terms of economic recovery, we have a couple of things at play. Jobs are big piece for sure, but also of importance is the mindset of the consumer and their comfort level with returning to “normal” life. This poll is interesting as it gauges relative comfort with leisure activities. Going back to work is one thing, but engaging in the fun things is another. We can see from the numbers that as cases of the virus have increased across the country people’s desire/willingness to participate in leisure has retreated. No surprise. While some politicians and market participants are taking the mindset of wishing it away, people won’t just go back to normal until they feel safe. There’s an old saying about “wish in one hand and something else in the other and see what you have”???

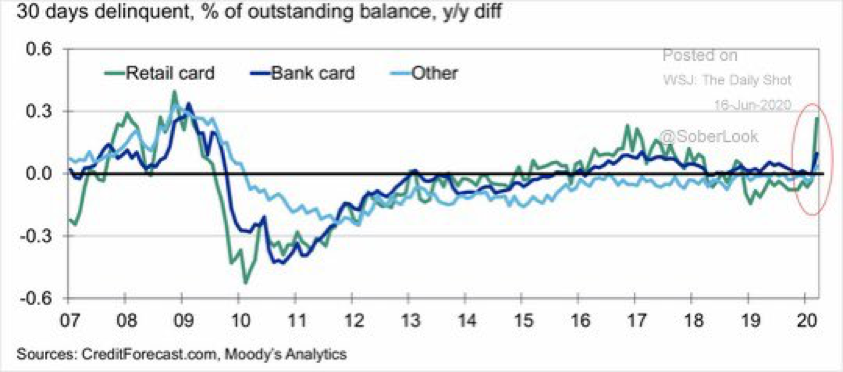

- While new credit card debt may not be accumulating on leisure activities, we are having a little trouble paying the previous debt. The 30 days delinquent chart below shows the trend starting to approach 2008-2009 levels. Like that time period, the first to show increased delinquencies are the retail store-issued cards followed by the bank cards. Like rent or mortgage payments, the data is starting to show up now for the trouble of April and May. As we spoke of previously, banks are setting aside substantial loan loss reserves to write this off, which they can to a certain point. If the lines start shooting up through the top of the chart, that becomes a different story.

Cases, Cases and More Cases

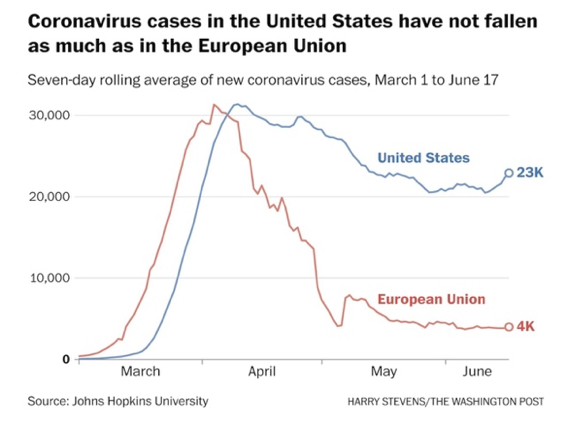

- A tale of two continents left without comment…

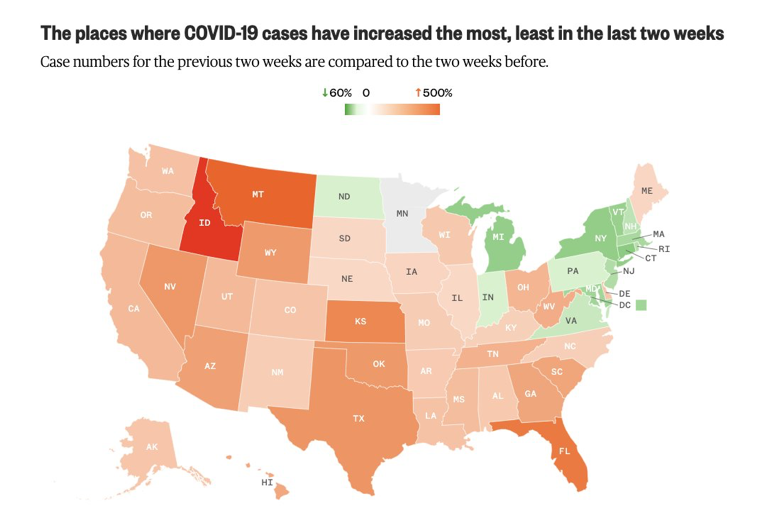

- By this point, we are guessing most are aware of where we are seeing cases increase across the country. If not, here is a handy breakdown. Everything is bigger in Texas, they say, and that goes for their mask requirement as well. After much resistance, Texas Governor Abbott did issue an order for the state to mask-up to try to limit the spread. While not in the prediction business, it seems as though more and more states will be following suit in the days to come. Locally, Edina is trying to get ahead of the trend by starting their own mask requirement which goes into effect on Monday.

Bankruptcy Log Needs Updating

- More companies are feeling the pinch including Cirque du Soleil, Chesapeake Energy and everyone’s favorite sports bar, Chuck E. Cheese, all filing for bankruptcy protection this week. All should be able to reorganize their debts and come out the other side as a continuing brand but that is not the case for many small businesses. For every larger known brand that we hear filing for bankruptcy there are countless small businesses that are folding with little notice. The Payment Protection Program (PPP) has been expanded and extended to assist. However, looking at the leisure sentiment above we can see that no amount of assistance can help if people are unwilling to be in public. Supporting small businesses has never been more important than it is now.

From the Desk of Shaun Westphal, CFP…

EXTREMELY (NOT) IMPORTANT

In recent weeks, most of you have likely received multiple requests via email, USPS or phone from Legg Mason “requiring” your response to an important operating initiative for sponsored funds. In summary, we hold a small position in the Western Asset Core Bond Fund which is owned by Legg Mason. Legg Mason is in the process of being acquired by Franklin Templeton. Nothing will change in the fund management (which has an excellent history) or fees, but the nature of the acquisition requires all of Legg Mason’s current management agreements to terminate. In turn, they need shareholder approval to implement new manager contracts after the acquisition and as you have all seen they are being very aggressive in attempting to generate shareholder interest in the upcoming meeting. We apologize if this feels like a nuisance; unfortunately, we can’t stop them from following regulations. Nothing needs to be done on your end. The meeting takes place on July 14th, so we should see the notices subside soon. As always, we are happy to discuss this and any other matters in greater detail.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.