Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

As we approach the middle of July, we have an economy that is still trying to open. Whether it’s open or not sort of depends on the day of the week. Tuesday: definitely open. Wednesday: nope, not really open. Thursday: yeah, I think it could be open? Friday: no idea. Depending on the day of the week and the person answering the question, we really don’t know. Businesses are opening in some areas of the country while others are shutting back down. It’s the economic version of whack-a-mole.

The start/stop dynamic makes the directional data tough to analyze, but this was to be expected. The back-and-forth led to a somewhat quiet week in terms of the market news flow as we all watch and wait. Also, contributing to less dramatic headlines is that next week starts the beginning of second quarter earnings reports. The weeks prior to earnings tend to be a little more quiet than normal.

Utilizing the quiet week, we dug into a little research on the year. The recap, as you know, isn’t pretty, but we can’t hide from it, so getting it out can be cathartic. We had civil unrest with protests in every corner of the country, millions marching in the streets, increased tensions with Asia, a stock market meltdown in March, police brutality on TV for the world to see, thousands of Americans gone too soon, a communist power increasing control on a territory, an historic space launch, contentious presidential primaries and more. A crazy year for certain. But the year being described here isn’t 2020. It’s 1968.

Those that lived it or have spent time studying it, know that 1968 was a difficult year in America. All of the events above that have happened in 2020 also happened in 1968. Add to that the assassinations of Martin Luther King, Jr. and Robert F. Kennedy, the realization that the war in Vietnam was escalating and the sitting president announcing in March that he wasn’t going to seek re-election. Not a global pandemic, but big, big things.

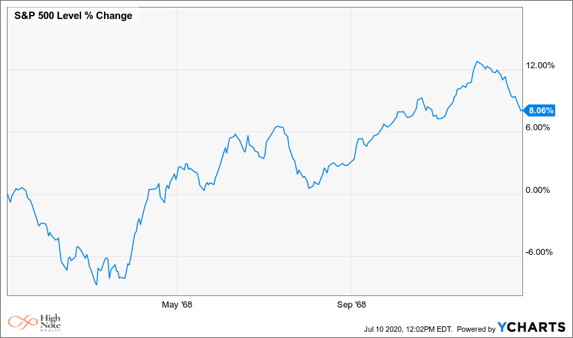

As some of the parallels began to take shape in doing the research, the question relevant to this note is, “how bad was the stock market with all of that going on”? The question is raised in no disrespect to the tragic events of that year, but rather in the interest of gaining further understanding of the relationship between what’s going on in the world and market performance. If you are still following along at this point you can probably guess with this build up…yes, the stock market had a really good year in 1968 finishing up over 8%. It did meltdown in March like 2020. Volatility was high like 2020 as well, but for the most part it shook off the news and strutted along.

Market years don’t repeat. Unfortunately, there isn’t a pattern and each one is different. It’s always interesting to look back to gain perspective on today.

A Brief Refresher on Events of 1968

January

- North Korea seizes USS Pueblo; 82 American soldiers imprisoned.

- North Vietnam launched the Tet Offensive which led to the realization that the war wasn’t slowing down and was only going to get harder.

February

- Memphis sanitation workers go on strike – re-igniting the civil rights movement.

March

- Eugene McCarthy challenges sitting President Lyndon Johnson in the New Hampshire primary and almost wins which causes Johnson to leave the race. The President, at the end of March, quit.

- Police open fire on segregation protesters at South Carolina State killing 3 and injuring 27.

- Students take over the administration building at Howard University in D.C.

April

- While in Memphis for the sanitation workers’ strike, Martin Luther King, Jr. is murdered. Civil unrest and riots ensue across 100 cities leaving 39 dead, 2,600 injured and 21,000 arrested.

- Students take over five buildings at Columbia University.

May

- Riots break out in Paris between 5,000 university students and the police.

- Antiwar activists start raiding Selective Service offices to burn files of potential war draftees.

June

- Robert F. Kennedy is murdered in Los Angeles on the day he won Democratic primary victories in California and South Dakota. Five months prior to election day the Democrats lost their leading candidate.

August

- The Soviet Union invades Czechoslovakia to suppress the Prague Spring.

- Disaster occurs at the Democratic National Convention in Chicago when police and National Guard go nuclear on antiwar demonstrators. TV broadcasters captured it all for the world to see.

September

- Student protesters and police clash in Mexico City leaving thousands dead and wounded.

October

- American track stars win gold and bronze medals in 200-meter dash. On the podium, they raised gloved fists in protest. The International Olympic Committee strips them of their medals.

November

- Richard Nixon wins the presidency in a close race with Hubert Humphrey.

December

- Apollo 8 becomes the first manned spacecraft to buzz the moon and return home safely.

S&P 500 Performance 1968

<<< High Note Quick Hits >>>

Walma-zon Plus Prime

- What kind of revenue do corporations and shareholders like? Recurring, the answer is recurring revenue. And how do we get recurring revenue? Subscriptions: we sell customers a subscription to _____________. Walmart entered the chat this week by taking a page out of Amazon and Netflix’s playbook launching their own subscription delivery service

called “Prime”called “Plus”. Yes, Walmart “Plus” is here to offer free delivery on goods and groceries for an annual fee of $98 (link here). We added Walmart to the portfolio of core holdings a while back as they offer a nice balance of stability with staple products but also a desire to innovate and grow. Time will tell if ruffling the feathers of the biggest gorilla in the Amazon is smart. For now, it seems that with the incredible expansion of at-home delivery the jungle is big enough for the both of them. And as shareholders we like the move.

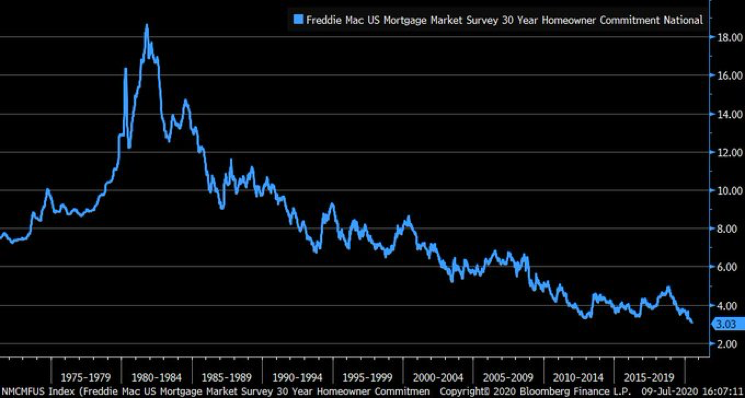

Buy, but What to Buy

- Everyone sing along, “mortgage rates at all time lows!” It feels like we could pencil this post in again for next week as rates give no indication of going anywhere but down. So everyone must being buy-buy-buying, right? Well, not exactly. As with most things, you have to read the fine print and a quick look at the details reveals that we have a disconnect. It’s hard to buy when the shelves are picked over and that is what we are seeing with the number of homes for sale down almost 30% year-over-year. As inventory slides in the starter-home market, we start to see a mismatch as mid-level and luxury homes climb. With many first-time homeowners staying put it slows down the entire chain. In the short-term, the lack of supply does stabilize prices but it’s doing it at low volume which is hard to sustain. That said, this is preferable to an oversupply of starter homes which quickly drives prices down.

30 Year Freddie Rate Wants to Test Sub-3%

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.