Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

It’s Fri-Yay and that means it’s time to break down all things financial. Hopefully, everyone had a happy and productive week.

3386. That’s the number. That’s the all-time high the S&P 500 reached on February 19. Are we there yet? No. Are we super-duper close? Yes. During Wednesday’s trading session the index tickled the magic number while closing just short of it. This tease continued throughout Thursday and Friday’s trading sessions as well, ultimately finishing just under, but very close. I guess that means that our work here is done and we can finally take the helicopter to the Hamptons for the summer.

Not exactly. The meteoric recovery has led to a different wall of worry with underlying economic data still a bit stuck in the mud, so we will keep the helicopter grounded for now. The perceived fragility of the current market valuation is front and center to what we are tracking every day. It’s been a nice time to check in on exposures and take some gains here and there. The balancing act is considering the possibility of another significant virus flare-up and a vaccine getting cleared for mass production. We have a strategy for either outcome, so we will enjoy the market levels of today while being ready for whatever may happen tomorrow.

<<< HIGH NOTE QUICK HITS >>>

Tik Tok Hooray…ho…hey

- Microsoft is jumping into the social media fold to get their dance on. Or are they? For weeks now the administration has been speaking sternly about banning the American youth’s most popular app. There has been so much cyber saber rattling that a couple of prominent U.S. companies have been floated as potential buyers of the platform. Tik Tok has been a point of contention for many given their Chinese ownership and the idea of data being collected. India banned the app months ago for the same security concerns. How this all plays out will be very interesting to watch in the context of US-China relations. On the rumor alone, Microsoft stock moved up significantly.

Congress Gets Additional Stimulus Bill Passed

- NOPE. Not even close. And now they adjourned for summer vacation so we will keep checking???

COVID Cases Dropping

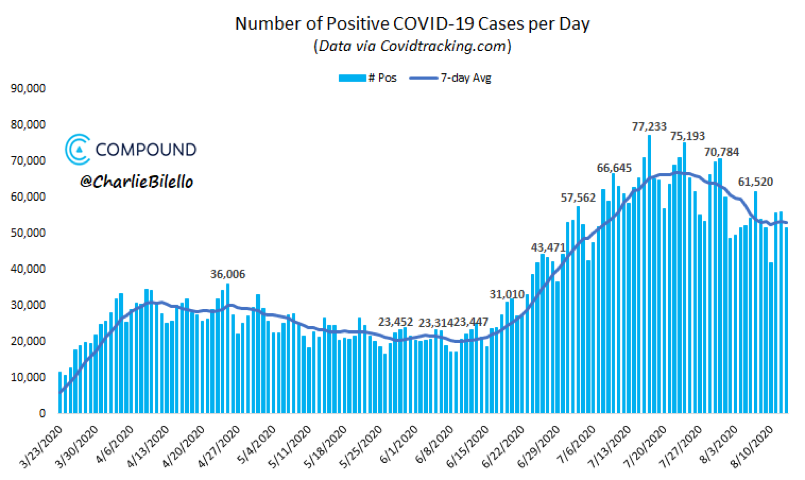

- It’s not exactly the sharp rollercoaster drop we are hoping for, but it is worth noting that COVID cases are in a downtrend. Can we continue in this direction or will the shrinking daylight of the fall send the trend back up? It is hard to say, but the latter seems more likely than the former. If that is the case, it’s certainly not a bullish situation for the economy, but the idea of another full lock-down has very little support.

Same Split, Different Day

- Sometimes the stories just write themselves. Just as we discussed with Apple announcing they were splitting their shares, Tesla did the same this week which lifted the stock 13% the next day. The price jump comes with no increased value creation, proving once again that the only thing rational about markets is talking about how irrational they are.

Be Kind, Rewind

- Those feeling nostalgic for the VCR movie revolution can take a trip out to Bend, Oregon and spend the night. The last standing Blockbuster in the world will be available for sleepovers via AirBNB soon. Not sure if you have to bring your own microwave to have popcorn for breakfast, but that feels like a small price to pay for a night strolling down memory lane. More here.

- The demise of Blockbuster is an important investing lesson. Once valued at over $5 Billion they eventually rolled the credits with the company in the hole almost $1 Billion. While the idea of streaming huge, high-def movie files feels obvious today, imagine telling someone in the year 2000 that that was where technology was headed. You would get strange looks. Without a doubt, there is something that we are doing today that will look antiquated twenty years from now. What that might be is difficult to know, but that doesn’t mean it isn’t fun to speculate. How about phones? With the work that is being done at Elon Musk’s Neuralink Co., we could be heading in a direction that would plant a chip in our brain that would eliminate the need for our shiny iPhones. The future can feel like a beautiful and terrifying place.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.