Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Friday! Nineteen years later and typing the date 9/11 still stops me in my tracks. Many things changed permanently on that tragic day. The year 2020 has that same feeling that things are changing before our eyes. In the investment world, change is simply an everyday occurrence and investors adapt on-the-fly. In the real world, it’s much harder and feels like it takes time to adapt. Ultimately, the human spirit is tremendously resilient, figuring out ways to make it work and move on.

As has been the overall trend the past couple of months, the investment world has adjusted and is moving on while the real world continues to survey the damage and find a path forward. Over time, one world will catch up or the other will slow down to come closer to being on the same page.

While history has many examples of the worlds keeping their polite social distance before meeting in full embrace, the time apart is never the same. It could be a long weekend or two years of traveling abroad. Knowing how long the split will last is worth all the money in the world, so safe to say that nobody has cracked that code.

As disciplined investors, it pays to take the situation as it comes, rather than trying to guess when the worlds might randomly reconnect on Facebook leading to a Zoom call that rekindles their friendship, and the next thing you know, they are old pals again and everything is synced up. It kind of just happens naturally over time. When they are apart, it can feel odd, strange and uncomfortable – all feelings that aren’t helpful in making sound investment decisions.

Having a plan helps. It might not chase away all the feelings, but does provide grounding. For anyone struggling with the feelings of the worlds being disconnected, this is a good reminder. Or if you need another reminder, that’s what we are here for.

We will get into a couple of things below, but for those catching the early flight, have a great weekend and all the best.

<<< HIGH NOTE QUICK HITS >>>

She’s Not Banking on History

And now finally, in 2020, we have the first female CEO of a major global bank. Citigroup named Jane Fraser the CEO-to-be this week which will put her in a category of one. She’s been at the bank fixing the messes made by her predecessors for the last 15 years, so it will be interesting to see if she simply can avoid making said messes and get the bank moving in a better direction. Female representation on Wall Street boards has substantially increased over the past five years, but this is an important and historic announcement. Here is the release.

Real Estate Cul-de-Sac

We haven’t checked in on mortgage rates in a couple of days, so are you wondering if they are up or down? “Down”, you say? Could be a lucky guess, but it’s correct. The 30-year mortgage rate made a new, new low this week touching 2.86%. We’re old enough to remember when 3% was a good rate.

Here is the fifty-year chart of mortgage rates. Taking a view from this perspective is stunning. The rollercoaster car hit the peak on track in 1982 and it’s been nothing but a downtrend for nearly forty years. As discussed, the mortgage supply is still quite tight as lenders aren’t exactly in a hurry to hold a bunch of these low-interest loans. If prices slip even a little, the wiggle room is non-existent.

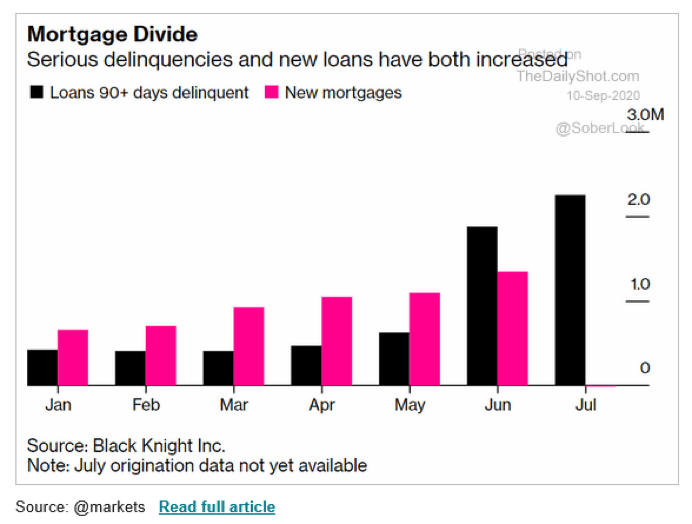

While on that topic, current loans that are now ninety plus days delinquent continue to rise. No surprise. If we think about the timeline, it’s now that the lag is over the data is rolling in. Many were able to make March payments as normal and scrape together April before then missing May, June and July, making August the first month of ninety-day delinquency. Hopefully, we see this start to plateau in October, as it’s not a good thing on all sorts of levels.

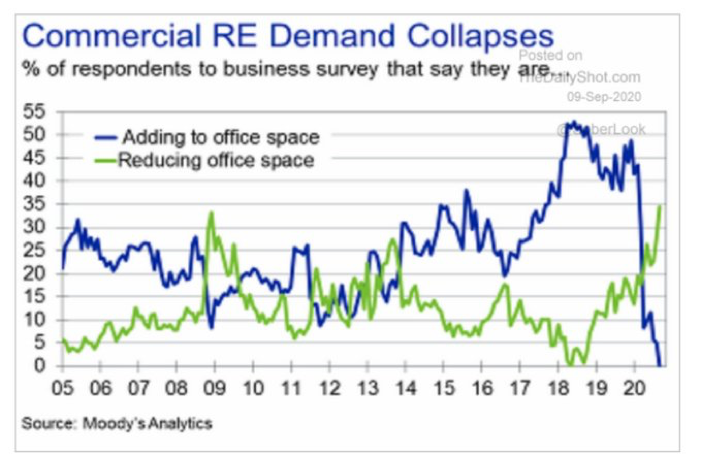

Channeling ‘Captain Obvious’ with this chart. We have the most recent survey data on business owner’s plans to increase/decrease their commercial office space. We would all expect the green line to be shooting up given the current pandemic. The level in relation to 2008-09 is probably more useful. The decision to add/reduce office space provides a little insight into how businesses see the path forward. The more this climbs it indicates that businesses see this lasting quite a stretch. It will be very interesting to see this chart react when a vaccine is through trial and approved.

How Can a Curve Be Sharp?

You’ve probably heard us blabber about this idea of a “risk curve”. Simply put, it is just a way to assign a risk level to an investment given it’s potential for return. Think of a stock that could double overnight or go to zero – very risky but the return is potentially supersized. This would be an investment that is “way out on the risk curve” whereas a CD at a bank is very much opposite. This article is in the weeds but nicely lays out a contributing factor to the market’s current price action. The short takeaway is that as interest rates are held low, investors start to take more risk. This isn’t a good or bad thing necessarily but very important to consider. This is why we always try to level set with how much risk we are taking relative to the requirements of a financial plan.

The danger for the plan-less is that the herd starts to move out on the risk curve plank, creating asset bubbles. Risk creeps in and at some point, the plank can’t hold everyone. Not a good spot to be.

Read more here and let us know if you have any questions.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.