Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Fri-YAY, High Note fam. It’s been a few weeks. Everybody hanging in there? Anybody watch anything interesting on television this week? Like maybe, Tuesday night? OH MY. That’s the review. Oh. My.

Welp. We all knew this day would come. The headline still provides some shock value, but in the theatre-of-the-absurd that has been the year 2020, it only makes sense that the President of the United States would test positive for COVID-19. Let’s hope the President and First Lady can navigate through the illness and make a full recovery in short order.

In what feels like a teachable moment, the market’s reaction to the situation was very fascinating. The President broke the news via Twitter (obviously) around 12am last night, which caused the overnight stock market to sell off. It moved down hard, but not to an extreme. After the immediate move, the index more or less held this level through the night. When day broke, we got word from Washington D.C.’s “odd couple,” Nancy Pelosi and Steven Mnuchin, that they are still optimistic that they can reach a deal on additional stimulus. The market immediately cut the overnight losses in half. By early Friday afternoon, stocks were positive for the day, before giving back a little to finish slightly down (but up for the week).

For those connecting-the-dots here you’ll notice that when you move the pen from one dot to the other it forms a question mark? How can news that the most powerful leader in the free world has COVID-19 not dramatically move the market? It’s worth stating again: who is or who is not the president really has very little direct effect on the market. Indirect effect, yes for sure but policy changes, tax law and foreign diplomacy take time to move the economy/market conditions. Who wins in November will certainly be important for tax planning and strategy, but the stock market will do its thing even as surreal as that appears.

UPDATE: After market close, the White House reported that President Trump will be receiving the experimental antibody therapeutic developed by Regeneron. Shortly after this announcement, the president was said to be headed to Walter Reed Hospital, “out of an abundance of caution.” We will be following this and all market news through the weekend. We have some topics below that grabbed our attention. Before that, we do have an update on the High Note Wealth team. Kristy is moving on from her position with us. She has been a wonderful part of our little family here for 3.5 years, so she will be missed. We will have more updates on the team in the weeks to come. If you have any service or appointment needs, feel free to call or email Shaun or Sarah as they are happy to help. We remain committed to providing the high level of service you all deserve. All the best. We look forward to talking to you soon.

<<< HIGH NOTE QUICK HITS >>>

Go Ahead, Fight the Fed, Let Us Know How That Goes

Stimulus, stimulus, stimulus, stimulus. That’s really what this is all about. The old saying “don’t fight the Fed” sounds about as trite as “eat your vegetables,” but there is something there. Remember these guys? Fed Chair Powell and Secretary Mnuchin are VERY committed to measures to keep the economy afloat through the pandemic. Both have been very vocal in the past week that Congress must pass additional stimulus that includes help to small business, the unemployed, and states. No bill yet (surprise, surprise!), but it is being worked on.

Not the Trend We Were Hoping For

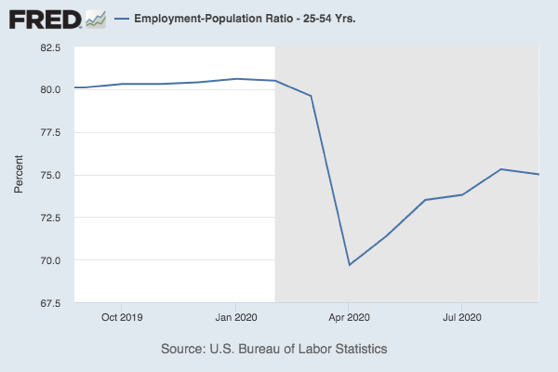

Speaking of stimulus to the unemployed, we did get a jobs report on Friday and it wasn’t great. Specifically, the re-employment of those laid off has slowed. Couple that with fresh layoffs at Disney and all the airlines reporting pending furloughs, and the uptrend in jobs seems to be in full reversal. What the assistance looks like once it gets through both houses is anyone’s guess, but consensus is that something needs to be done. If Congress doesn’t get something done, the market will let its feelings be known for a couple of days and that usually nudges them along.

Kneeeeeeeeeeee-Kooooooooooooo-lahhhhhhhhh

Every time I hear someone say Nikola I think back to the old Ricola commercials of the guys chanting Riiiiicolaaaaa from the mountain tops. I’m sure it’s just me, but now that I’ve mentioned it, give it a try. It’s fun.

On the topic of coughing, electric vehicle maker and tech darling du jour, Nikola, has had a really bad month. Back in June we wrote a little piece on the meteoric rise of the soon-to-be electric truck maker whose stock went from ~$10 to $80 in a month, all while they had yet to produce an actual truck. If you missed that, you can find it here. The party ended quickly last week with the stock returning to under $20 following a swirl of fraud rumors that led to founder and CEO, Trevor Milton, stepping down.

Whether what they are doing is fraudulent or misleading is hard to say. We think the takeaway here has a somewhat positive spin in regard to overall market health. In this stock market recovery, many naysayers have pointed to names like Nikola that have gone up on next to nothing – a sign of frothy markets. Seeing Nikola quickly fall out of favor is a good sign that investors are still digging into company dynamics and not just buying blindly. Rationality still exists! Here’s the most recent story.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.