Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Fri-D’! Hoping everyone had a healthy and fulfilling week. A quick public service announcement: do not hesitate to let us know how we can make these updates more informative, more useful, or more interesting. We welcome ideas, topics or feedback of any kind (as long as you don’t leave a bad review on Yelp). We are always happy to dive deeper into topics or discuss basics. With that, let’s get to it.

Well, the longest recorded year in modern history continues to chug along. We are here to sort through all things financially relevant. Overall, it’s a strange time in the market with the election close and earnings starting to report for the quarter ending in September. A strange week within an overall strange year perhaps cancel each other out as the markets were relatively calm.

Still no stimulus package out of D.C., but we did get a bunch of blustering, blaming, name calling and grandstanding, so that’s great. The market moved down early in the week in what appeared to be the beginning of the no-stimulus-rebellion that we discussed last week. That didn’t hold long as positive days undid the selling to get us basically flat for the week. A package of some kind isn’t out of the question, but every hour we get closer to election day it is less likely.

The major banks did start the earnings season with results that were positively solid, but not exciting. The banks remain in robust positions of cash while allocating dollars to loan-loss reserves – good things for the overall economic health. The next couple of weeks will be full of earnings reports which we will follow closely. Not to spoil the ending, but there’s a really good chance that we learn online shopping continues to boom with record numbers, real estate vacancies pile up and the service industry businesses like airlines, restaurants, hotels, cruises, etc. continue to light cash on fire. More on all of this next week.

<<< HIGH NOTE QUICK HITS >>>

The Good and the Bad in Two Charts

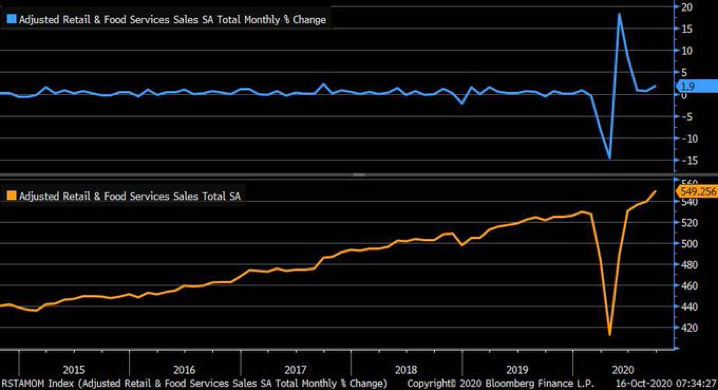

September economic data entered the chat this week which helps make sense of where we are in the recovery. Retail sales shows the v-shaped recovery in full effect, which is nice to see. However, industrial production was more like industrial proYUCKtion by reporting numbers that turned their nice v-shape into more of a standard deviation symbol. Hopefully this was just an off month. We need all aspects of the economy to pull us out of this long-term.

Retail Sales – perfect v-shaped recovery

Industrial ProYUCKtion – turning down

The Magic Castle Will be Televised

Disney announced this week that they are consolidating their media business to focus on the streaming service, Disney +. Many analysts and investors have been calling (begging) for such a move and it seems like they have gotten the message. The park business is partially open, but the road to full recovery looks treacherous. This could unlock some value going forward. Disney is not a current position that we hold, but it’s on the “want list” for a price that makes sense. Story can be found here.

Holla at Your Boy

Citywire Magazine published an article this week on High Note Wealth in their weekly, “My Model Portfolio” series. Nothing terribly exciting, but the portfolio graphics sure look cool. The article is on page 30 and link is here.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.