Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Fri-YAY! Here we sit the day before our first COVID Halloween and five days before the most important election in the history of elections since the last election…or something like that. Anyway, lots going on at the intersection of politics and finance that we are here to carve up like one of those fancy jack-o-lanterns you see sitting on the news desk. Let’s assume our pontification positions as we survey the current financial landscape.

Could be wrong here, but what makes a temper tantrum a TEMPER TANTRUM is the timing, right? Say, for example, Little Michael throws a fit in the car, it’s unpleasant but doesn’t quite hit as hard as when sitting in the second row of Sunday service with a packed congregation (not saying this ever happened, but if so it was most certainly the result of egging on by an older sister). Well, it seems that Little Michael and the market both know how to time their tantrum efforts to maximize reactions.

As readers know, we have been writing since August that we expect the market to drop their little body on the floor and scream at the top of their lungs if there is no stimulus deal from D.C. If this were done a month ago, there would have been time to potentially get a deal done, but the market is shrewd, like Little Michael, knowing that waiting until the week before the election is much more inconvenient and therefore maximizes the kicking and screaming.

Knowing the parents were comfortably seated in their Sunday best, the market started misbehaving on Monday, cooled down on Tuesday, then continued its antics to end the week. By the time mom got a red and writhing Little Michael to the back to the church, the S&P 500 had pulled back about 6%.

There are a few other factors in play – COVID case increase in the U.S. and new lockdowns in Europe – but the tantrum is a clear statement to the lawmakers that they need to get a stimulus deal done and sooner rather than later.

On a positive note, we had earnings reported by the tech giants this week and the numbers were very strong. Even with high expectations, the numbers surpassed estimates across the board for Amazon, Apple, Google and Facebook. Additionally, GDP and unemployment reports were better than expected. A great sign for fundamentals, however, we all know that once a Little Michael is in melt-down mode there is very little in the moment that will get him to calm down (again, hypothetically).

The takeaway here is that this was to be expected and even with a rough week, the market has fully recovered from the disaster that was March. We are still in the driver’s seat in a higher-than-normal cash position and using it as an opportunity to get some cash to work while we watch and wait. For the next couple of weeks, we expect increased volatility as the details from the election sort themselves out and we learn more about the next stimulus deal. Times like these can feel uncomfortable and make for interesting conversations, but in the grand scheme of a financial plan they are very muted.

If market volatility continues, expect our communication to increase just so everyone knows what we are seeing and how we are adjusting. The uneasiness of next week has been so played up at this point that maybe it will come and go with less drama than expected. Regardless, we are sitting firmly in our chairs, buckled in and ready to address anything that comes our way.

Hopefully everyone can unplug and have an enjoyable weekend. If there is anything that we can help with, do not hesitate to reach out.

<<< HIGH NOTE QUICK HITS >>>

Bathtub Regeneron Anyone

It seems like “controlling” the COVID virus is “so last year” at this point which makes therapeutics even more important in helping to reduce mortality and getting those infected recovered quickly to protect our medical system. There was good news this week with the effectiveness of Regeneron’s COVID antibody drug showing reduced medical visits by 57%. The bad news is that there is currently only 50k doses available which isn’t close to enough with cases spiking. I know they are working on ramping up production around the clock, but that could take a while so maybe it’s time for bathtub chemists to start helping the cause? Here’s the article on the trial results.

Ride the Wave

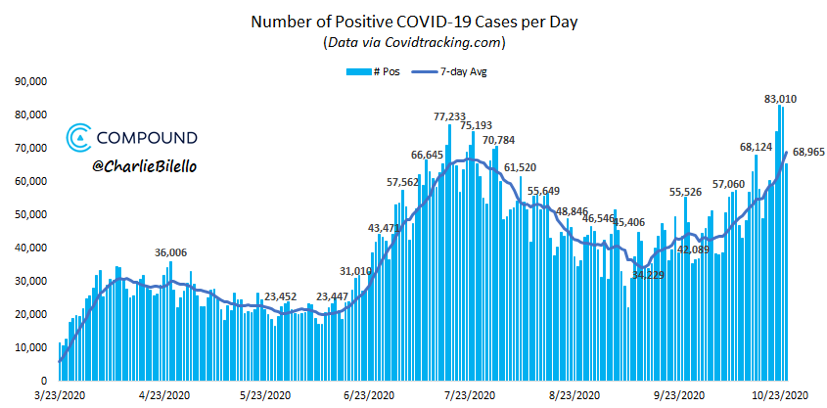

The debate among those smarter than us is whether you can have a second wave of COVID outbreak without officially ending the first wave. Leaving that discussion for others, the chart does look like a third wave is well underway. The seven-day average of daily cases has now surpassed the peak in late July. As the infection momentum builds, things like the Regeneron therapeutics above are critical.

Black Gold Trap Door

Have we talked about a “value trap?” It’s probably been mentioned, but it’s worth a revisit here, particularly with what is going on with Big Oil. In the lexicon of poker, there is a saying that is along the lines of, “if you can’t spot the sucker at the table then you are the sucker.” We have a similar dynamic in the world of stocks known as value trap.

From time to time, a stock will appear to be undervalued based on some valuation metric like price-to-earnings making it appear to be a safe, screaming-deal that you can’t wait to buy. When you are done analyzing the stock, you look around the table and don’t see your opponents buying the stock. “Huh, that’s puzzling,” you think, but knowing they are suckers, you think you’ve found something they haven’t because you are “good enough, smart enough and doggone it, people like you” (or something like that). So, you buy it. And then nothing. No upside. No other buyers. The stock goes down and you realize you were the sucker.

Simply put, it’s the old “when things look too good to be true, they often are” of investing. A perfect example has been Wells Fargo this year. After the initial market meltdown of March, the stock sat right around $25 per share, but boasted a 7-8% dividend. In the world of dividends, that’s huge (if you bought it at $25 a share, you could get a 7-8% return and the stock price wouldn’t even have to move up!). The price had come down with the correction and we were told by management the dividend was “safe.” Well, typically when corporations go out of their way to tell us the dividend is “safe,” it is more likely that it is, in fact, “unsafe”, than if they just said nothing at all. And sure enough the dividend was cut to 1% and the stock is trading around $20. A classic value trap.

That brings us to Big Oil. We know it has been a bad year for domestic oil producers, refiners, etc. With the recent pull back this week many of the stocks are now trading lower than they were at the bottoms of March. We avoided the urge to add any of these stocks while many were saying they would rebound and were recommending them to investors. It felt like a value trap then and it still does today. Exxon is currently paying a dividend in the 11% range. This week they chose not to increase the dividend for the first time in 38 years. And management just told us that the dividend is safe. It very well might be, but we’d rather not find out.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.