Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Fri-YAY, all. It’s that time again already for us to take a look back at what’s going on in the world of investing. President Biden was sworn in on Tuesday and stocks did well that day and into Wednesday, but overall, the week was a little ho-hum and that is fantastic. Call it a slight pause, call it a breather, or if it was 1990 we would say the market went out for a smoke break. However described, the phenomenon of inching up, pausing, inching up, pausing is a healthy thing.

Speaking of President Biden, we did get some executive actions and cabinet members approved, but nothing super exciting in relation to the investment world. The proposed stimulus package of $1.9T is still being touted, but inside reports are saying that it is getting some pushback from the House and Senate, so it’s impossible to know what can ultimately get passed.

Much discussion on the vaccine front this week as the new administration gets people in place and settles in. The stated goal is 100 million inoculated in 100 days which doesn’t seem like much of a stretch goal. That would mean less than 1/3 of the population is vaccinated by May Day? Hmmm. Let’s hope we can do better and there is some reason for hope, as many big businesses started jumping in this week to help and offer to incentivize workers to get it done. A skeptical thing to consider, but perhaps the private sector might be better at seeing this through. Just a thought.

We have a couple of fun takeaways from the week below. Until next time…all the best from the crew at High Note.

<<< HIGH NOTE QUICK HITS >>>

Small Business by the Numbers

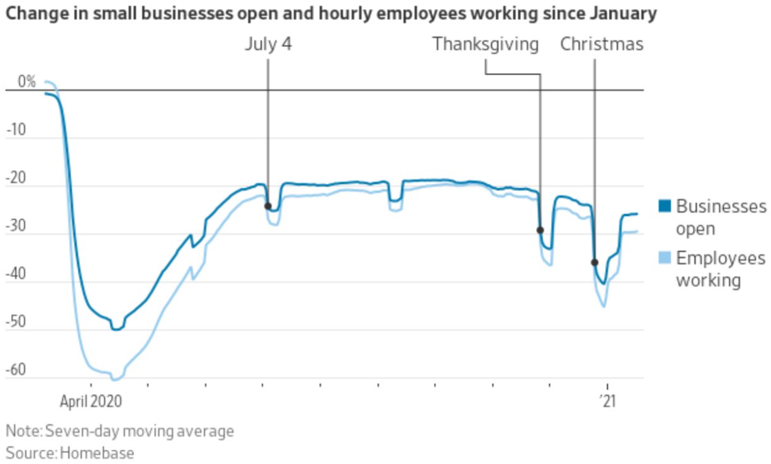

We have said in almost every entry written that small business is still hurting greatly. True, but how about some numbers to prove it? Roger. The data for small, privately-owned business is what the mathematicians would call “noisy.” As in, it’s tough to really know exactly what is happening with small business as a whole as there isn’t a great tracking system of exactly what’s open, what they are selling, etc. However, Homebase has been collecting as much information as possible while being a resource for business owners during the pandemic and here is their recent update. The trend is still concerning with approximately 25% of businesses still closed. Have they been reopened and closed? Are they never to be opened again? These sorts of details are not known, so those answers will come as we continue to move to full reopening. Safe to say that the 25% of small businesses still not open employ a lot of people.

Now Use it in a Sentence

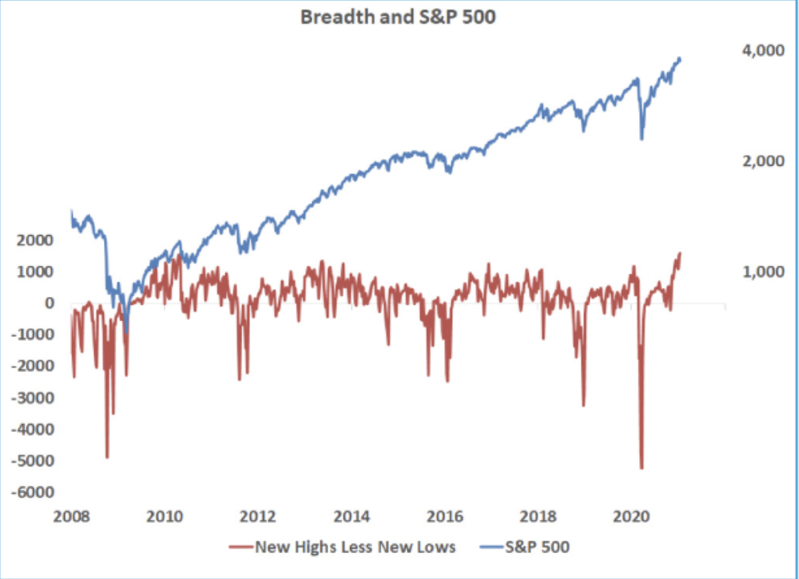

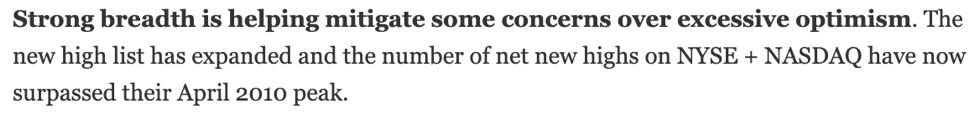

If you remember back a couple of weeks ago, we discussed the concept of “breadth.” Surely you remember a topic so riveting, but in the off chance you need a refresher, here was the post. The idea of more companies doing well is pretty straightforward and important in all market conditions, but it is extremely important when the indexes hit all time highs. For a rally to continue, breadth must play a role. This week the breadth surpassed the peak of April 2010 in the S&P 500, meaning the net number of stocks making new highs is at an all-time high. That’s a lot of “highs.” This doesn’t mean that this cannot quickly rollover or lose steam, but it does offset the fragility one assumes when the market is up.

Electric Avenue, Oslo Edition

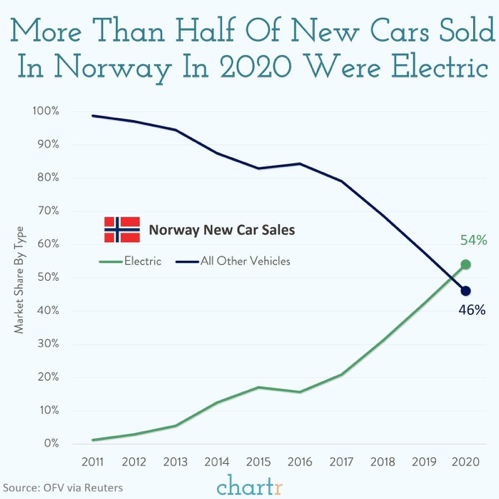

Well take a look at you, Norway, being a global trend setter. Total electric vehicles sold globally represented about 2.5% of the total number of cars sold. When the dust settles on 2020 maybe it’ll be up over 3%. A real number translates into a boatload of actual cars, but it doesn’t seem like much on a percentage basis. Norway is certainly carrying their share of the load as EVs surpassed combustion engine machines sold in 2020. The Scandinavian countries in general seem to lean electric, but good luck catching up to Norway, world.

P.S. Yes, this means the “addressable market” of electric vehicles is huge, but it does not mean there is an easy path to investing in it. All the major manufacturers are involved, so they can take losses to gain market share.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.