Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Fri-Yay! March always feels like it offers so much potential as the bridge to spring. Last March, not so much. March 2020’s “potential” was more about the potential for a complete and total disaster. It was one year ago this week that the NBA officially halted their season and things got very “real” in the media. The next day the Wall Street Journal headline read, “Dow’s 11-Year Bull Market Ends.” What a difference a year makes.

As we sit in March this year, there is even more reason for optimism. Perhaps it’s a reluctant optimism given the disruption of the past twelve months, but that is understandable. The economy took some dings and dents, but it’s moving along. States are opening up, live events are on the horizon, and herd immunity is a real possibility. Here’s to a better March.

The stock and bond markets have been business-as-usual the past couple of weeks. As card carrying market participants, we are required to worry about something and the worry du jour is inflation and interest rates. If we made a list of potential worries and ranked them, inflation and interest rates would be way down the list. It gives the financial media something to discuss and that’s about it at the moment. We see it as more of an opportunity to achieve some decent returns in bonds that have been anemic for the past year. Every little tick helps.

<<< HIGH NOTE QUICK HITS >>>

Pigs Do Fly as Congress Passes Stimulus

$1.9 Tra-tra-tra-trillion. It’s easy to lose sight of how much funny money this is when the numbers get so big. For context, $1.9T is approximately the yearly GDP of Italy. And it’s more than the yearly GDP of countries like Brazil, Canada, Mexico, Russia, South Korea, and Australia.

Okay so we know it’s big number, but what do we get?! Like all bills from D.C. there are more layers to it than a bag of onions, so it’s still a little unclear. The quick version is

more direct stimulus, an extension of additional unemployment benefits, housing relief, and additional allocations to vaccines, state governments and schools.

Ignoring any long-term ramifications, in the short term this should be bullish for stocks and the economy. Perhaps, bullish is an overstatement. Let’s call it “positively neutral?” As in, given the delay in getting it passed, it doesn’t feel like an impetus for stock upside, but it should keep the train on the tracks. It feels like we are paying off the credit card balance we ran up the last couple of months. Here is a full break down from [checks notes]… The Committee for a Responsible Federal Budget.

Destination Vax-Nation

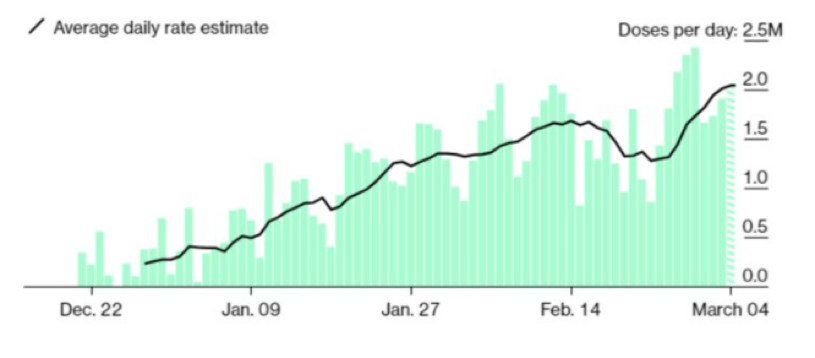

In addressing the country, President Biden announced that he will require states to open up vaccines to all adults by May 1st. White House guidance from suppliers is that there will be enough production for all adults by the end of May. Whether these deadlines are met or not, cocktail napkin math points to herd immunity in the middle of May. Amazing.

As of Friday, 25% of the U.S. population has received at least one leg of the vaccine. At a rate of 2 million doses a day, it adds up quickly.

What Covid Fighters Really Need From Their Advisors

Katherine published an article with Barron’s about how financial advisors can support frontline healthcare workers through these challenging times. It was also featured as the lead story in the Wall Street Journal’s daily newsletter – check it out!

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.