Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Saturday! We’ve finally reached the week we have all been waiting for…Elon Musk’s debut as the host of Saturday Night Live. I’m kidding, obviously, but it is always interesting when the world of finance crosses over into the world of pop culture. No idea if the regulators of the Securities & Exchange Commission are regular watchers of the program, but safe to say they will be tuned in on Saturday night.

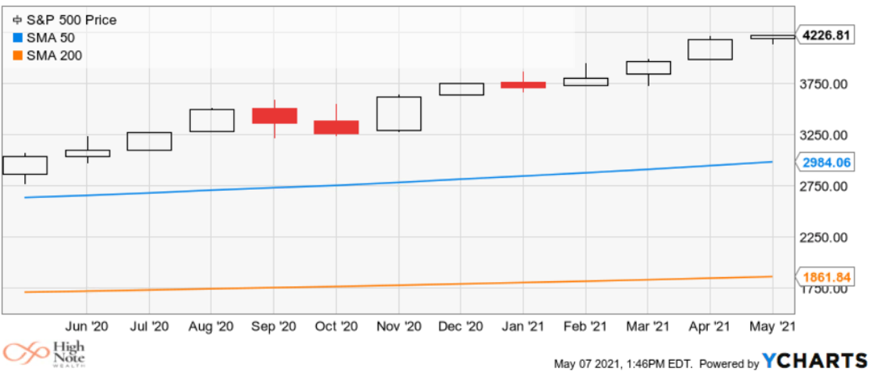

This week we are going look at some pictures. Charts, more specifically, which never tell the full story but are a nice way to ground us in what’s happening in high finance. With no additional updates on an infrastructure bill or tax changes from D.C., we will focus on market action and touch on some moves we have done and are considering. First up is the chart of the S&P500 for the last 12 months. This is a “candlestick” chart that shows the price increase/decrease daily. The red “candlesticks” are down days and the black are up days. Impressive, for sure, but the starting point is shortly after the market bottomed at the beginning of the pandemic.

Perspective is key, so look how different it looks when we go back to February of 2020. All of those “gains” made in the first third of the chart were essentially getting back to even.

Speaking of perspective, often times looking at charts that show the daily price change can be overwhelming and dramatic. We know that traders are buying and selling every day for a variety of reasons, so it doesn’t really speak to a longer-term trend. To change perspective, we like to look at charts that only show the monthly price change. Here is same chart as the first one above showing only the monthly change.

It’s the same thing as above, but we have fewer data points. What jumps out is that even in the positive run there were three full months of negative returns including as recently as January. Taking a gander from this view makes it look much more reasonable than frothy.

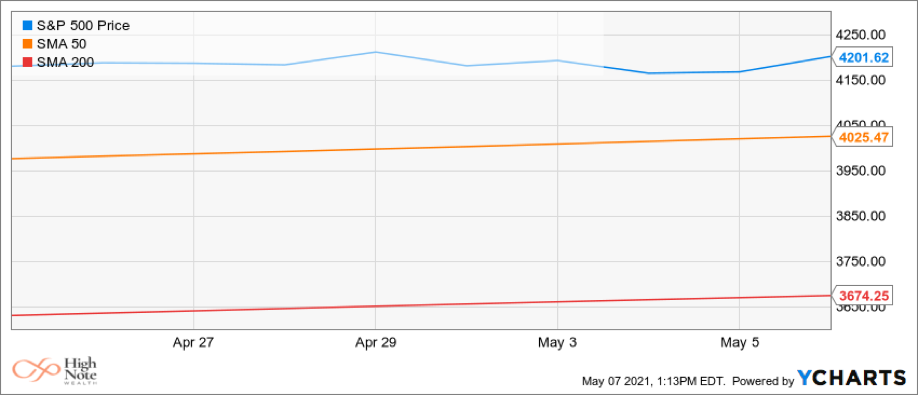

Speaking of reasonable, the past two weeks have been just that. Here’s the S&P 500 chart since April 24. If Musk’s SNL sketches are this boring, the ratings won’t be good.

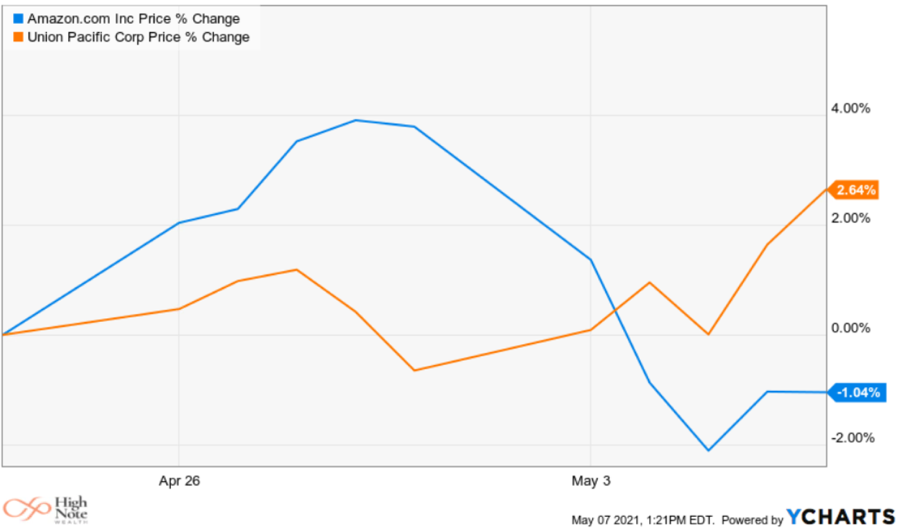

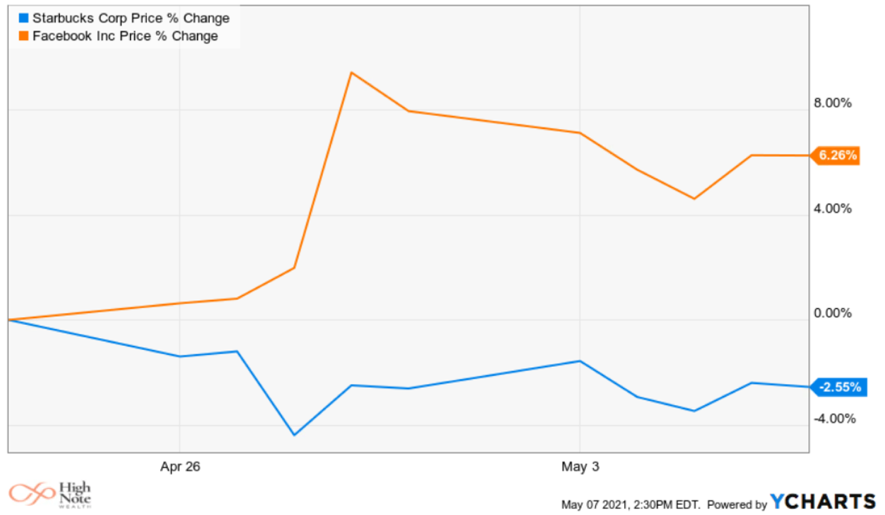

With 500 companies in the S&P 500 index we know that they aren’t moving in lockstep. Here is a chart of two of our holdings over the past two weeks. Amazon went backwards, but Union Pacific had a nice run. This would neatly fit the story of the economic reopening with technology not performing well and industrial-type stocks making returns.

But then how in the h*#^ does this fit? Two more of our portfolio holdings in the chart below. Starbucks, which should certainly be a re-opening play given that they are literally reopening, and tech staple Facebook which should be down given the narrative but it’s opposite day.

The lesson here is that it’s never as simple as 1+1=2 and that’s okay. There are always opportunities to own good things at fair prices if we block out the noise.

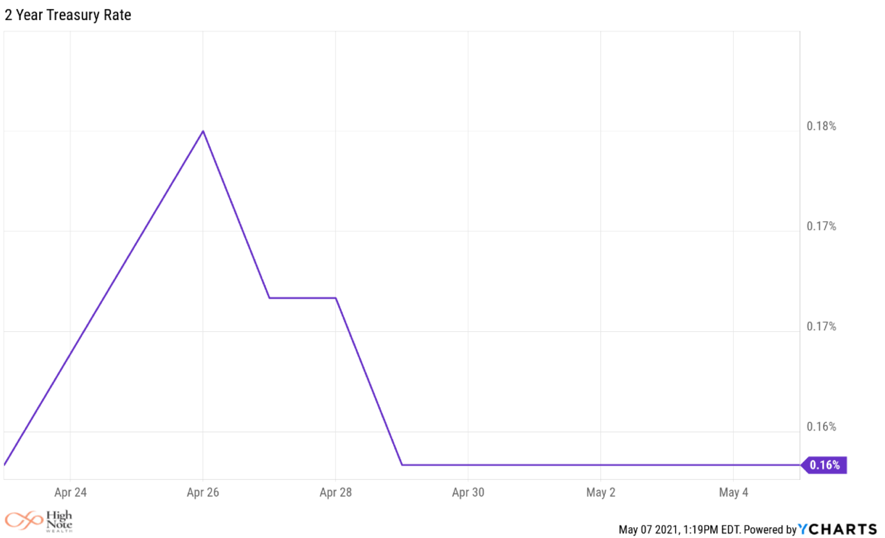

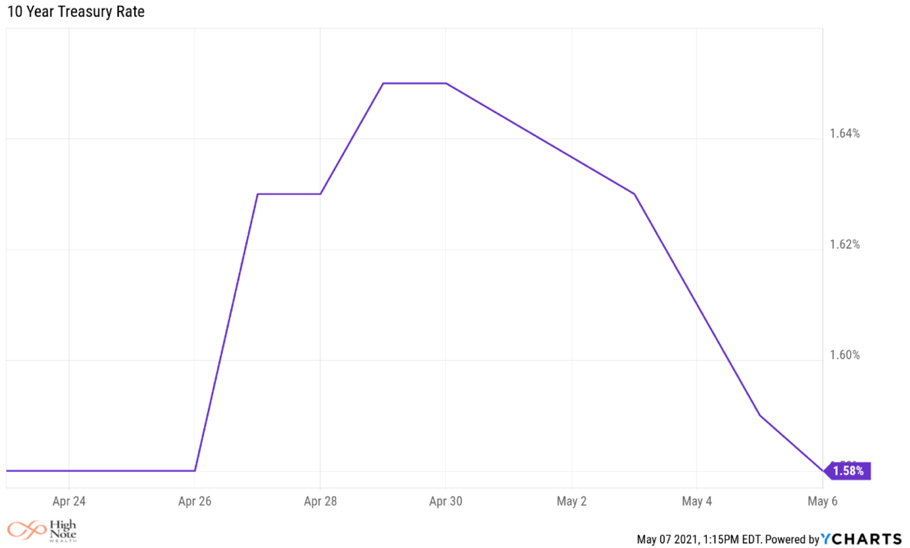

Okay, just a couple of more (for those who have made it this far). We are old enough to remember two weeks ago when rates were climbing and heading to the moon. Or not. Here’s the 2-year treasury rate action.

But what about the 10-year, you say? Same.

Treasury rates have more or less re-bottomed (that can’t be a word, but you get the point). With this movement, we are in the process of making some portfolio adjustments. Given it’s still underway, we will hold off specifics, but the idea is that we want some holdings in our bond portfolio that will benefit if rates rise. We already have holdings that will benefit if inflation increases (or the Fed actually admits it’s happening). The combination of this positioning provides upside, for sure, but more importantly protects against the decreases in bond prices that occur if rates move back up.

<<< HIGH NOTE QUICK HITS >>>

So HOTT It’s Coldbase

2021’s hottest initial public offering (IPO) is a giant whoops at the moment. Cryptocurrency trading platform, Coinbase, went public to great fanfare in the middle of April. Some saw it as a way to play crypto or Bitcoin without owning the actual thing. Others saw it as a business that has millions of users that could be capitalized for advertising. Well, neither of those ideas seem to be working at the moment as the stock has tanked since hitting the street, while the price of crypto has increased. We’ve said it before and it’s worth saying again, in times where things look frothy it’s nice to see things not working (especially when we don’t own them) as it shows there are rational decisions being made in the marketplace. This isn’t to say that Coinbase won’t be a long-term growth story, but the market is telling us that the valuation was just too high at IPO.

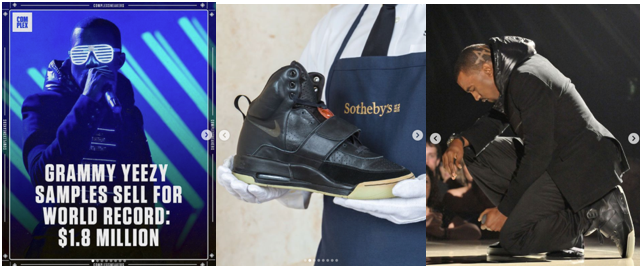

Oh Pleezy These Yeezys

Record prices in non-traditional assets continue as Sotheby’s auctioned Kanye West’s prototype Yeezy 1s for a cool $1.8M last week. The euphoria we are witnessing is historic and, in a way, almost makes the stock market feel fairly valued. Clearly there is money flying all over the place and we know that usually doesn’t last indefinitely. That said, if we think about all of the money that wasn’t spent in 2020 on travel, dining out, entertainment and a variety of other things it makes sense that there seems to be an endless supply.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.