Written by Michael Forrester – Founder, President, and CIO of High Note Wealth

Happy Fri-YAY, friends! Month six of 2021 is underway and all is well here and in the stock market, really, as it didn’t exactly “sell in May and go away,” as the old Wall Street adage implies. Sayings like that are fun because you get to sound smart while also rhyming. Unfortunately, the results of that adage hold up about as well as the “tails never fails” one when predicting a coin flip. One never knows, as the saying goes.

As discussed a couple of weeks ago, it is the summer of a potential taper tantrum (here, if you missed it). To taper or not to taper? That is the Fed’s question, not ours, so we cannot answer it for them, but we can follow the data to get a better feel for how they are leaning. And just as a refresher: super positive economic news…leads to taper…leads to toddler-like stock market tantrum. So, smiley-face economy causes sad-face stock market in this unique case. This leads one to a puzzled face which is an everyday occurrence in the wild and wonderful world of investing.

In the sea of metrics the Fed uses to determine such an answer, the more obvious markers like unemployment, labor participation rate, inflation, etc. play a pivotal role. This week we received the jobs report for May which was no smiley-face. It was strong with 559k new jobs created, but under the estimated 671k. That’s not a result that leads to tapering. Inflation data will be coming next. This will be an interesting one as inflation was having a “moment” a month ago, but that may have slowed as some commodity prices cooled off. If inflation comes in lower than expected, the taper tantrum nonsense talk can be put on the shelf until after the 4th of July.

Taper aside, unemployment continues to improve, particularly for the group that has been on the shelf longer than 27 weeks. A great deal of this is hospitality related, yes, but the trend is also positive for permanent position elimination. Ironic that on the day the jobs numbers were reported General Mills went ahead and announced they are cutting 20% of jobs at HQ. Not great, GIS. They have had their own specific challenges the last ten years, so we will file that under “their issue” and not a trend. During the lockdown, many of us mentioned how corporate America was going to learn how productive and efficient their workforce would be at home. That’s not to say it’s healthy for the workforce or the culture, but we wouldn’t be surprised to see more news of scaling down as companies reflect on recent history.

<<< HIGH NOTE QUICK HITS >>>

What’s My Age Again?

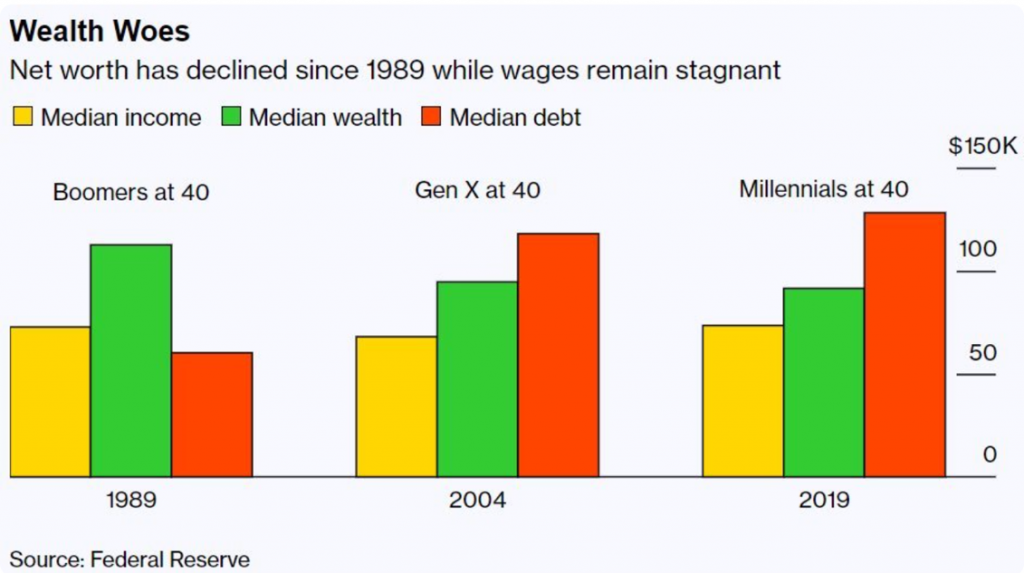

The stacking up of generations is interesting in comparative American history. We all have stories and anecdotes with a few stereotypes sprinkled in here and there to really get the juices flowing. We will skip all that and go straight to the numbers. Yes, the numbers have certain limitations, but those of us who have ever gotten mixed up in generation conversations on Twitter know the numbers are much more pleasant and won’t call you names. This chart from the Federal Reserve provides income, wealth, and debt numbers over time by generation. The study is more a commentary on wage growth (or lack thereof) over the last 30 years than “who had it better.” The median wealth may be a little misleading as the transfer from boomer to millennials is just starting. That will increase wealth, but not income earned from occupations. Being medians only, it would be fun to see the wage growth of certain brackets – as in, what has the wage growth been for the top 10% earners? When the Fed looks at this sort of thing they are really concerned about the median as a way to move the entire economy forward and this is one of their go-to charts to prove we haven’t seen wage growth inflation in years.

Leaving on a Jet Plane

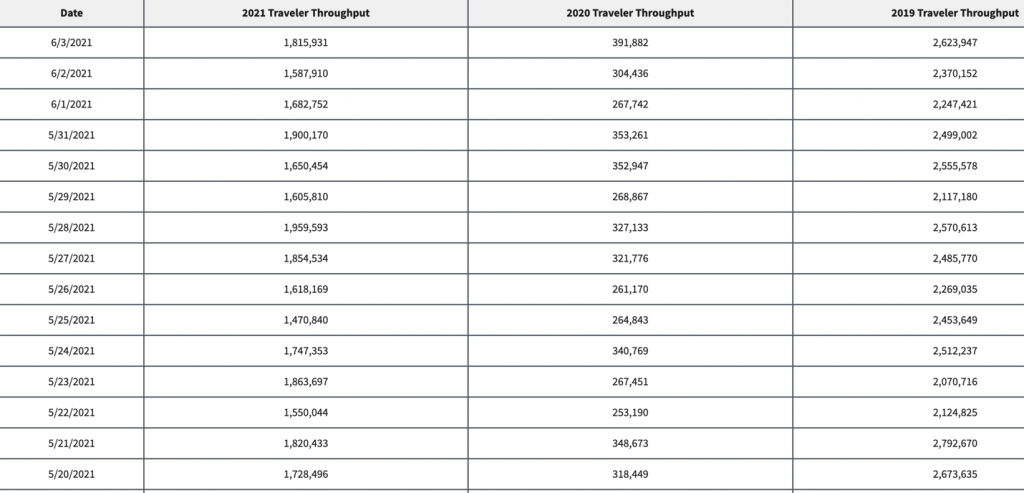

In 2019, TSA checked in over 2M daily traveling passengers on the reg. That mark hasn’t been achieved since March 7, 2020, but…we are getting close. The Friday before Memorial Day weekend saw the 2021 peak number of 1.959M which is still down from the 2.570M travelers on the same day in 2019. The working theory is that almost all the domestic vacation/leisure travel is back to normal with the difference being the lack of international and business passengers. Check out the table below of daily passengers to see the stark comparison of 2021 vs. 2020.

As for the airlines, they are happy to see the numbers up, but the nature of their travel routes very much influence their bottom lines. Business and

international travel tends to be much more profitable than domestic flights.

Whether that all comes back is very much open to debate which is why we still see stocks like Delta down from February 2020 levels. Rough estimates are that business travel accounts for 12-15% of seats, but 75-80% of revenue – YIKES. If business travel is indeed permanently changed, the stocks could be overvalued if they are down 20% from peak.

High Note Wealth LLC is registered as an investment adviser with the Securities and Exchange Commission (SEC). High Note Wealth LLC only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.